Bitcoin and Ethereum dropped in value toward the end of Thursday's U.S. session but recovered during today's Asian trading hours.

It has become common practice that the crypto market declined with the U.S. stock market following news that Trump raised tariffs on China to 145%, adding more confusion and heightening investor anxiety. However, given how quickly Bitcoin rebounded today, there's reason to anticipate another attempt to push BTC toward the $85,000 level by the end of the week.

Meanwhile, lawmakers in North Carolina introduced a bill that would allow the use of digital assets for tax payments and other economic transactions. This is another legislative initiative by a U.S. state concerning cryptocurrencies. "Digital assets are recognized as a legitimate medium of exchange in North Carolina," the bill states. "A transaction shall not be denied legal effect or enforceability solely because it involves a digital asset."

The Digital Asset Freedom Act outlines the criteria digital assets must meet to be eligible. To ensure liquidity and market depth, the digital asset must have a market capitalization of at least $750 billion and a daily trading volume of at least $10 billion. Many crypto assets meet these thresholds. The bill also states that qualifying digital assets must have a minimum of 10 years of trading history on public markets and must demonstrate security and resistance to censorship.

As for intraday crypto trading, I will continue to rely on deep pullbacks in Bitcoin and Ethereum as opportunities to enter, anticipating the continuation of the intact medium-term bull market.

As for short-term trading, the strategy and conditions are described below.

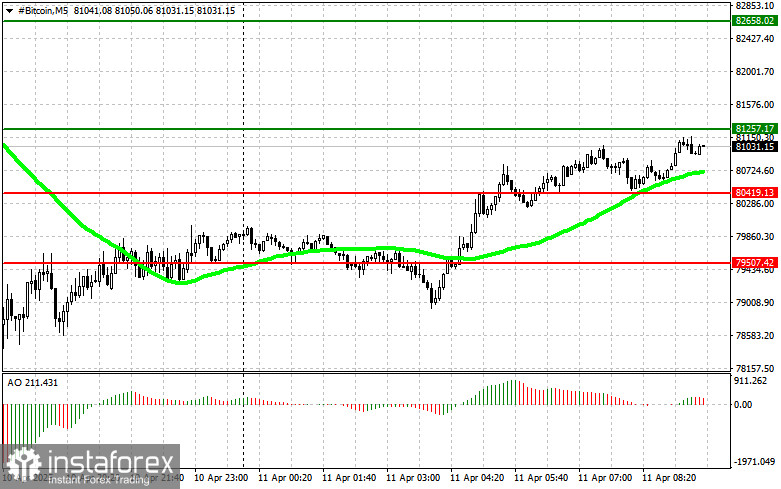

Bitcoin

Scenario 1: Buy BTC at the entry level of $81,250, targeting a rise to $82,600. Exit long positions near $82,600 and consider shorting on a bounce. Before initiating a breakout trade, confirm that the 50-day moving average is below the current price and that the Awesome Oscillator is in positive territory.

Scenario 2: If the market does not react to a downside breakout, buy from the lower boundary at $80,400, targeting $81,250 and $82,600.

Sell Scenario

Scenario 1: Sell BTC at the entry level of $80,400, targeting a decline to $79,500. Exit short positions at $79,500 and consider buying on a bounce. Confirm that the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory before selling on a breakout.

Scenario 2: Sell from the upper boundary at $81,250 if there's no market reaction to a breakout, targeting $80,400 and $79,500.

Ethereum

Scenario 1: Buy ETH at the entry level of $1,566, targeting a rise to $1,628. Exit long positions at $1,628 and consider shorting on a bounce. Confirm that the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario 2: Buy from the lower boundary at $1,537 if there is no reaction to a downside breakout, targeting $1,566 and $1,628.

Sell Scenario

Scenario 1: Sell ETH at the entry level of $1,537, targeting a decline to $1,490. Exit short positions at $1,490 and consider buying on a bounce. Confirm that the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario 2: Sell from the upper boundary at $1,566 if there's no market reaction to a breakout, targeting $1,537 and $1,490.