Analysis of Macroeconomic Reports:

A few macroeconomic events are scheduled for Wednesday, but some important reports will be released. However, the current key issue is not the reports' significance but how the market will react to them — and whether it will pay any attention. It's no secret that over the past two months, the market has been trading purely based on "Trump news," any announcement related to the escalation of the trade war triggers another sell-off of the U.S. dollar. Thus, today's reports may lead to a slight dollar rebound, but they are unlikely to change the overall trend. Today's most important data includes U.S. retail sales and the UK inflation report.

Analysis of Fundamental Events:

There's still little point in discussing fundamental topics other than Trump's trade war. The dollar's decline could continue indefinitely. We recommend that traders closely monitor statements from key leaders of major countries and alliances regarding tariffs. In the Eurozone, for example, officials have stated that they've achieved "modest progress" in negotiations with the Trump administration. However, "modest progress" is not enough to support the dollar. Meanwhile, Trump has announced his intention to impose tariffs on semiconductors, which affects many countries globally. The trade standoff with China remains unresolved and continues to be the market's top priority.

General Conclusions:

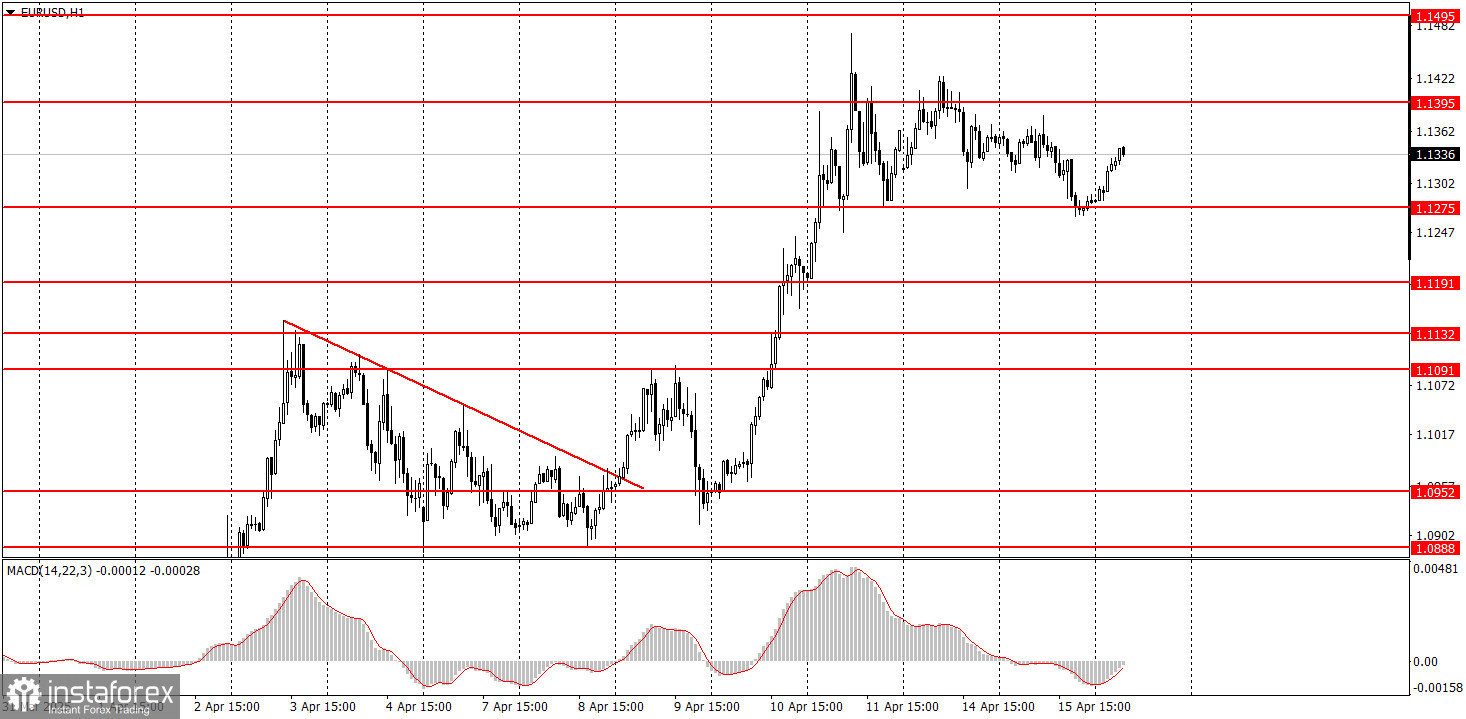

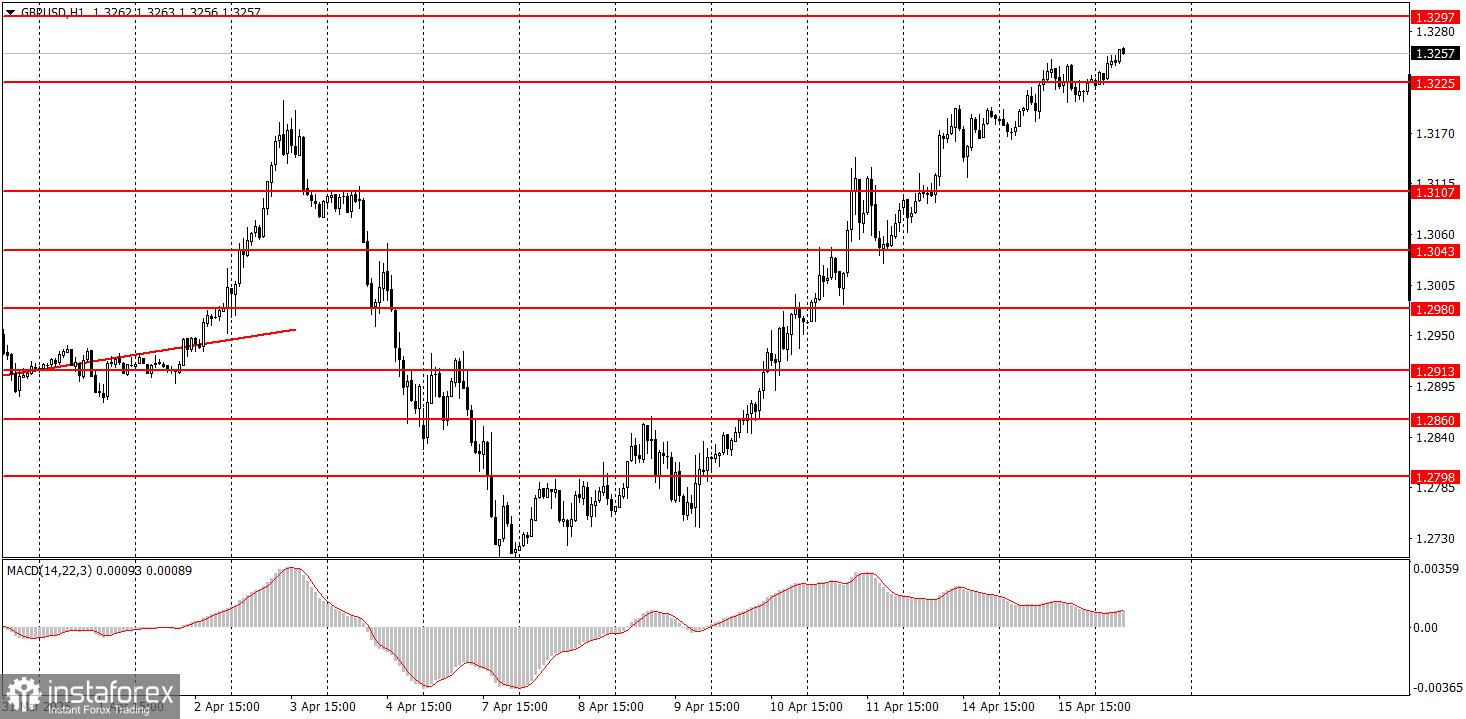

On the third trading day of the new week, both currency pairs could move in either direction. The British pound is rising steadily while the euro remains flat. Macroeconomic releases scheduled for today could affect currency movements, but the market's reaction to them is unpredictable. Technical levels are also not being respected consistently and are often ignored altogether.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.