Time is not on Donald Trump's side, nor the side of the US stock market. The longer the uncertainty surrounding White House policy drags on, the more likely it becomes that negative tariff news will impact the American economy. What is bad for the economy is bad for the S&P 500. No surprise then that JP Morgan has revised its year-end forecast for the broad equity index down from 6,500 to 5,200. For now, however, investors are staying on the sidelines.

They are spooked by the mixed messages coming from the White House. One moment, Trump is granting tariff exemptions for electronics and hinting at relief for the auto industry. Next, his administration launches an investigation that could result in tariffs on pharmaceutical and semiconductor imports.

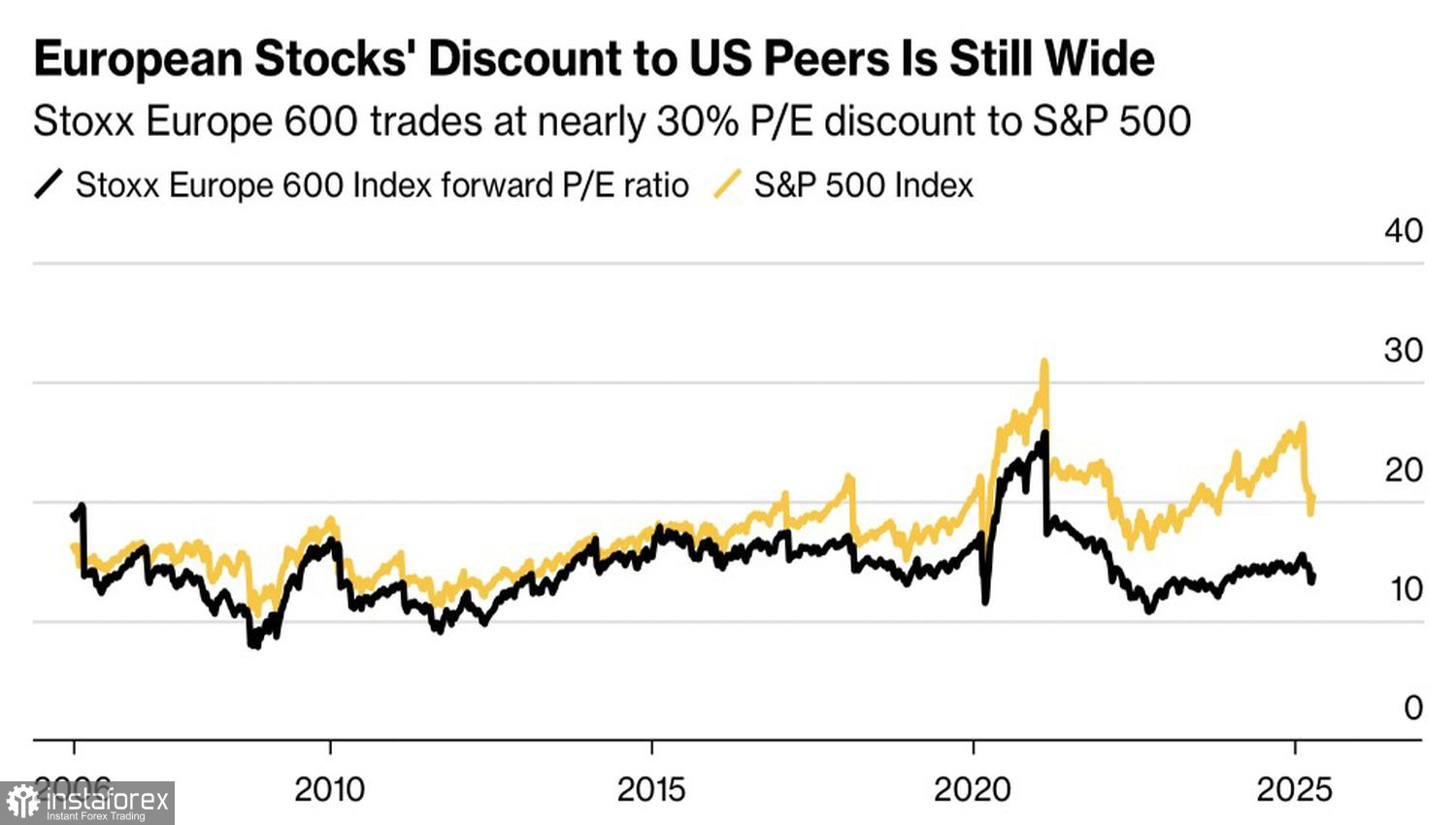

P/E dynamics on US and European stocks

At one point, the president calls on China to resume negotiations. At another, a Wall Street Journal insider claims that America's real goal in negotiating tariff rollbacks with other countries is to isolate Beijing. The contradictions are so numerous that the S&P 500 has stalled, while capital continues to rotate into still-undervalued European equities.

Meanwhile, surveys from Bank of America suggest that the broad market index could resume its downward path. About 82% of respondents, managing a combined $386 billion, believe the global economy will weaken. However, their average cash allocation is just 4.8%, compared to the 6%+ typically seen when fear dominates the market. When fund managers are strongly bearish on macro conditions but not fully bearish on the S&P 500's outlook, it signals that the market's downside potential hasn't yet been exhausted.

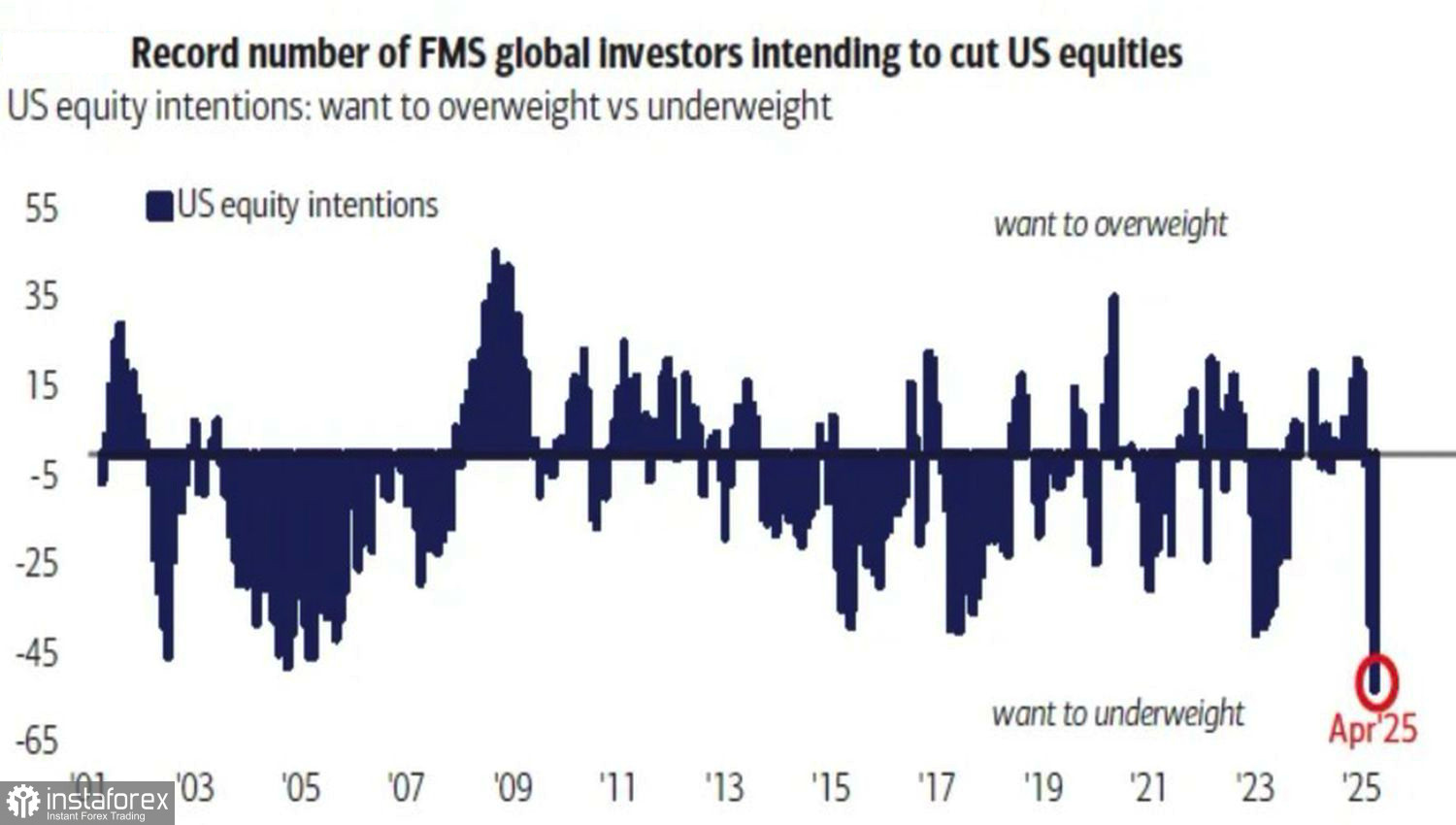

Share of investors planning to divest from US equities

In April, Bank of America respondents reported an underweight position in US equities of 3%, down sharply from a 17% overweight in February, the largest two-month drop on record. A record number of asset managers now plan to divest from US stocks in the near future.

That is hardly surprising, given the unpredictable consequences of the trade war. China, aware it cannot win outright, is turning to unconventional tactics, offloading US Treasuries and obstructing American companies. The ban on Boeing aircraft purchases, for instance, sent the company's shares tumbling. The trade skirmish is already impacting US exporters, who collectively account for about 11% of GDP. The economy is clearly cooling and a recession may be closer than it seems.

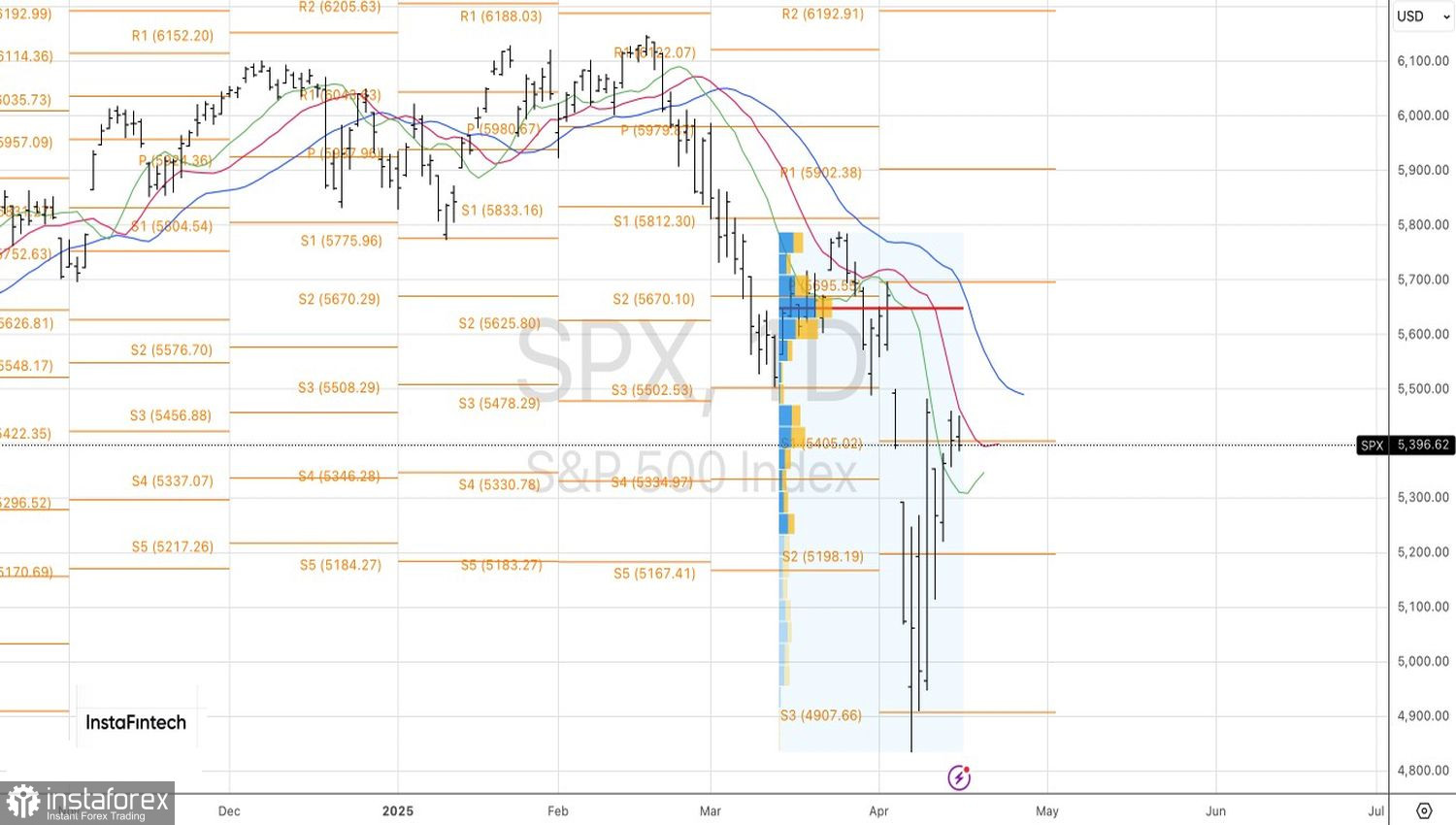

On the daily chart, the S&P 500 is currently testing the key pivot level at 5,400. If bulls fail to keep prices above it, it will signal weakness and may trigger a wave of selling in the broader index, long before any resistance tests at 5,500 or 5,600 even come into play.