The euro and the pound posted significant gains during today's Asian trading session, and there were objective reasons for this.

The sharp weakening of the U.S. dollar during the Asian session was directly linked to speculation that Jerome Powell could be dismissed from his role as Chair of the Federal Reserve. This is reportedly what U.S. President Donald Trump is pushing for, clearly dissatisfied with Powell's leadership.

Such rumors have triggered panic in the currency markets, as Powell's resignation—especially under presidential pressure—would undermine confidence in the Fed's independence. Traders fear that political interference in monetary policy could lead to reckless decisions aimed at short-term gains rather than long-term economic stability. This has weakened the dollar against several major currencies. Concerns are further intensified by Trump's recent criticism of Powell for not acting to lower interest rates, which, according to the President, is holding back economic growth.

The dollar's weakness is also tied to the ongoing uncertainty over the direction of U.S. trade policy. The prolonged trade negotiations with China and the threat of new tariffs continue to weigh on the greenback.

Given that no data is scheduled for release today from the UK or the eurozone, there is even less reason to sell the British pound or the euro in the current market environment. Without fresh economic data from the United Kingdom and the EU, traders lack solid grounds for decision-making. In this context, with the market deprived of key inputs, speculation on the pound and the euro becomes less justified and more risky. However, it's important to remember that this lack of data is only a temporary factor. As soon as new economic figures are released, the market will respond immediately, and risk assets may once again come under pressure.

The Mean Reversion strategy is preferred if the data matches economists' expectations. If the data significantly exceeds or falls short of expectations, the Momentum strategy is the most effective approach.

Momentum Strategy (Breakout):

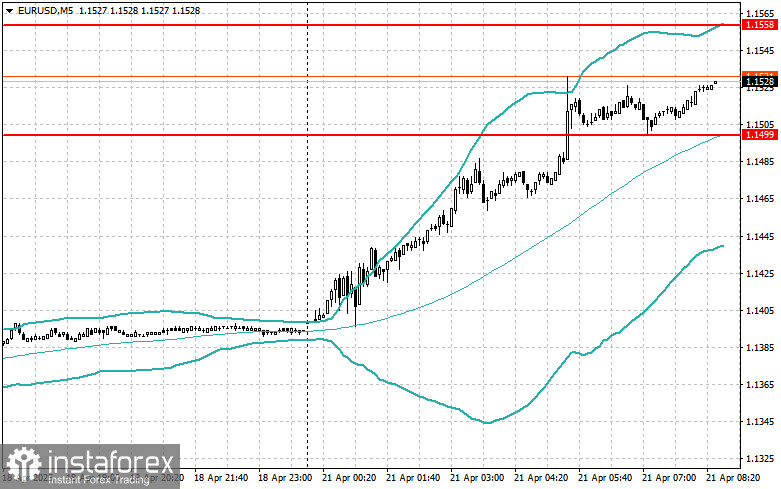

EUR/USD

Buying on a breakout of 1.1535 may lead to a rise toward 1.1580 and 1.1652.

Selling on a breakout of 1.1480 may lead to a decline toward 1.1465 and 1.1400.

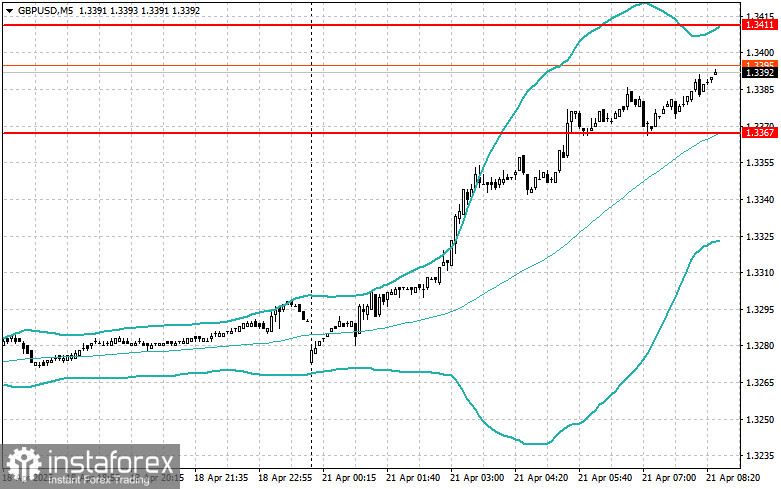

GBP/USD

Buying on a breakout of 1.3420 may lead to a rise toward 1.3465 and 1.3510.

Selling on a breakout of 1.3380 may lead to a decline toward 1.3335 and 1.3285.

USD/JPY

Buying on a breakout of 140.80 may lead to a rise toward 141.35 and 141.85.

Selling on a breakout of 140.40 may lead to a drop toward 140.00 and 139.80.

Mean Reversion Strategy (Pullbacks):

EUR/USD

Look for selling opportunities after a failed breakout above 1.1558 and a return below this level.

Look for buying opportunities after a failed breakout below 1.1499 and a return above this level.

GBP/USD

Look for selling opportunities after a failed breakout above 1.3411 and a return below this level.

Look for buying opportunities after a failed breakout below 1.3367 and a return above this level.

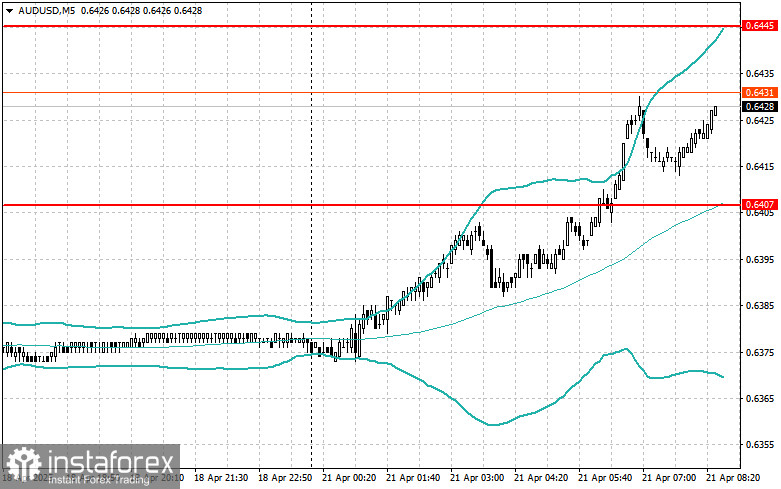

AUD/USD

Look for selling opportunities after a failed breakout above 0.6445 and a return below this level.

Look for buying opportunities after a failed breakout below 0.6407 and a return above this level.

USD/CAD

Look for selling opportunities after a failed breakout above 1.3805 and a return below this level.

Look for buying opportunities after a failed breakout below 1.3780 and a return above this level.