Bitcoin and Ethereum, having spent the entire weekend moving sideways within a range, surged sharply during today's Asian session.

The rally was triggered by rumors that U.S. Federal Reserve Chair Jerome Powell may be removed from office—an event that would further intensify the turmoil currently shaking the U.S. economy. This sparked a strong sell-off in the dollar, further undermining investor confidence in the greenback. And if even the U.S. dollar is falling, why not consider Bitcoin—often referred to as digital gold—as an alternative safe-haven asset?

According to recent data, active and key market participants—wallets holding between 10 and 10,000 BTC—continue to accumulate Bitcoin actively. The total BTC balance on these wallets has returned to record levels, signaling strong demand.

This trend also reflects large investors' confidence in Bitcoin's long-term potential. They view the current volatility as an opportunity to expand their positions rather than a signal to sell.

Accumulation of BTC by major players is traditionally considered a bullish signal, as it reduces the available supply on the market and creates upward price potential. Moreover, interest in Bitcoin isn't limited to retail investors—institutions are also getting involved. Many companies and funds add BTC to their investment portfolios to diversify and hedge against inflation. This signals the growing recognition of Bitcoin as a legitimate asset class.

As for the intraday strategy, I will focus on buying into major dips in Bitcoin and Ethereum in anticipation of continuing the medium-term bull market, which is still in play.

For short-term trading, the following scenarios apply:

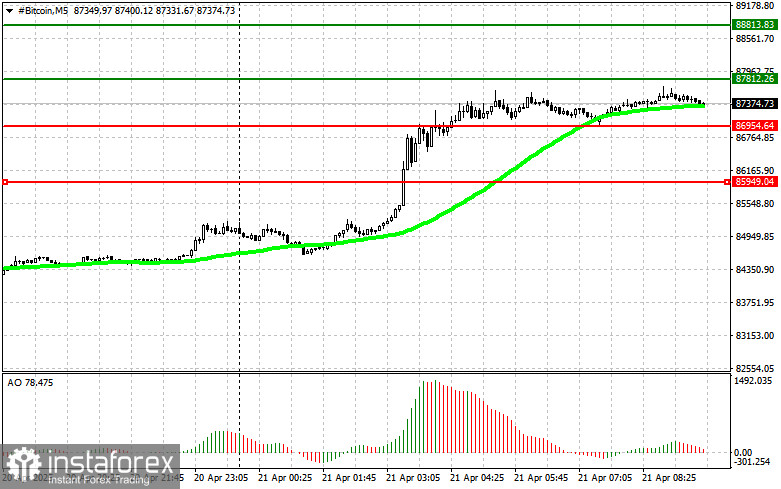

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today if it reaches the entry point around $87,800, targeting a rise to $88,800. I will exit long positions at $88,800 and immediately sell on a pullback. Before buying a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario #2: Buying is also possible from the lower boundary at $86,900 if there is no market reaction to a breakout below, with a rebound expected back toward $87,800 and $88,800.

Sell Scenario

Scenario #1: I will sell Bitcoin today if it reaches the entry point around $86,900, targeting a decline to $85,900. I will exit short positions at $85,900 and immediately buy on a pullback. Before breakout selling, ensure the 50-day moving average is above the current price, and the Awesome Oscillator is below zero.

Scenario #2: Selling is also possible from the upper boundary at $87,800 if there is no market reaction to a breakout above, with a move expected down to $86,900 and $85,900.

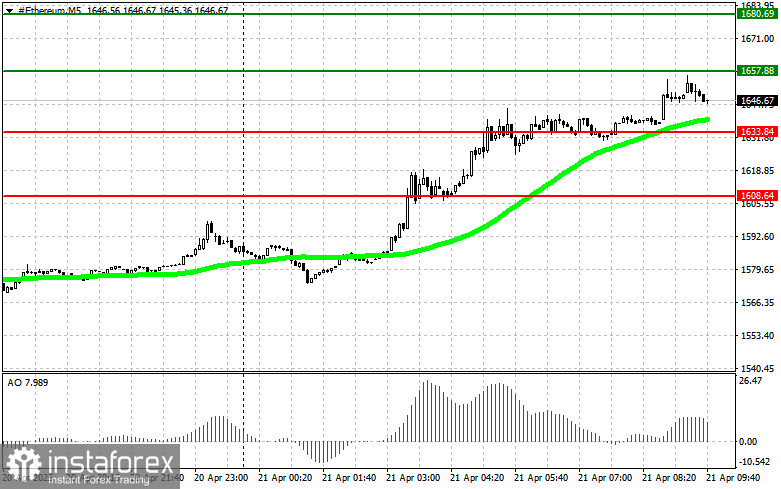

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today if it reaches the entry point around $1657, targeting a rise to $1680. I will exit long positions at $1680 and sell immediately on a pullback. Before buying a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario #2: Buying is also possible from the lower boundary at $1633 if there is no market reaction to a breakout below, with a rebound expected back toward $1657 and $1680.

Sell Scenario

Scenario #1: I will sell Ethereum today if it reaches the entry point around $1633, targeting a decline to $1606. I will exit short positions at $1606 and buy immediately on a pullback. Before breakout selling, ensure the 50-day moving average is above the current price, and the Awesome Oscillator is below zero.

Scenario #2: Selling is also possible from the upper boundary at $1657 if there is no market reaction to a breakout above, with a move expected down to $1633 and $1606.