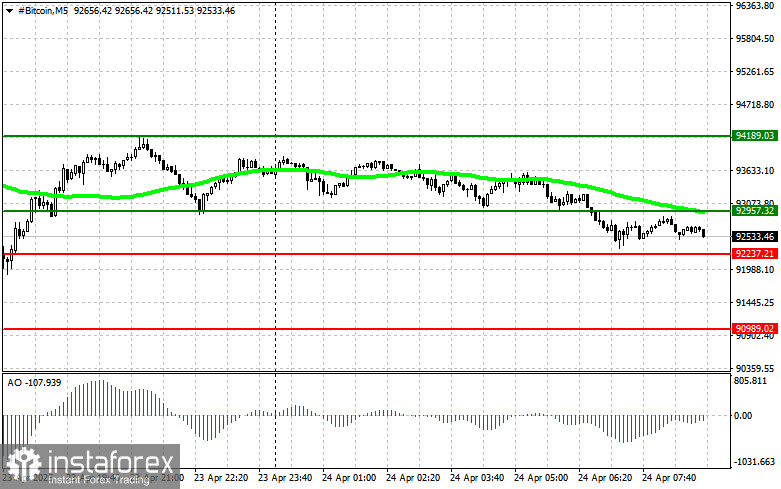

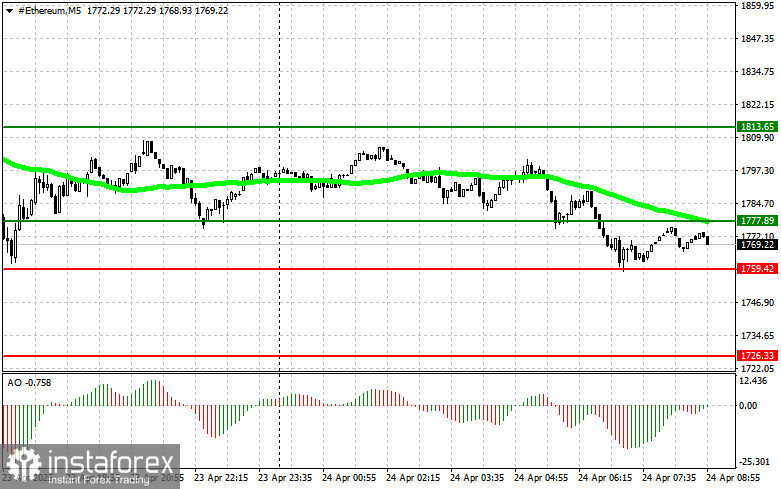

Bitcoin failed to hold above the $94,000 level and corrected to the $92,500 area, where it appears more comfortable. Ethereum also pulled back to around $1,769 after briefly climbing above $1,830.

Meanwhile, following Bitcoin's rise above $94,000 yesterday, the Fear and Greed Index jumped to 72 points, indicating a state of "greed." Bitcoin also surpassed both silver and Amazon in terms of market capitalization. This rally reinforced its position as the dominant force in the cryptocurrency market and renewed interest from traditional financial institutions and retail investors.

Bitcoin's impact on the global economy is becoming increasingly clear, especially considering its market capitalization. By exceeding Amazon in value and overtaking silver, Bitcoin is proving its ability to compete with traditional assets. The key question is whether it can sustain this momentum and continue its ascent or whether a correction is inevitable. Time will tell, but one thing is certain: Bitcoin has permanently reshaped the financial landscape.

As for the intraday strategy in the crypto market, I'll continue focusing on major pullbacks in Bitcoin and Ethereum as opportunities to trade within the framework of a still-intact medium-term bullish trend.

Below are the short-term trading strategies and conditions:

Bitcoin

Buy Scenario

Scenario 1: I plan to buy Bitcoin today at the entry point of around $92,900, targeting growth toward $94,200. I will exit the long position at nearly $94,200 and open a sell position on the rebound. Before buying on the breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario 2: Buy Bitcoin from the lower boundary of $92,200 if there is no market reaction to its breakout, with a return toward $92,900 and $94,200.

Sell Scenario

Scenario 1: I plan to sell Bitcoin today at the entry point of around $92,200, targeting a drop toward $90,800. I will exit the short position at nearly $90,800 and immediately buy on the rebound. Before selling on the breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario 2: Sell Bitcoin from the upper boundary of $92,900 if there is no market reaction to its breakout, with a return toward $92,200 and $90,900.

Ethereum

Buy Scenario

Scenario 1: I plan to buy Ethereum today at the entry point of around $1,777, targeting growth toward $1,813. I will exit the long position at nearly $1,813 and sell immediately on the rebound. Before buying on the breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario 2: Buy Ethereum from the lower boundary of $1,759 if there is no market reaction to its breakout, with a return toward $1,777 and $1,813.

Sell Scenario

Scenario 1: I plan to sell Ethereum today at the entry point of around $1,759, targeting a drop toward $1,726. I will exit the short position at nearly $1,726 and immediately buy on the rebound. Before selling on the breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario 2: Sell Ethereum from the upper boundary of $1,777 if there is no market reaction to its breakout, with a return toward $1,759 and $1,726.