Following the previous regular session, US stock indices closed higher. The S&P 500 gained 1.67%, the Nasdaq 100 rose by 2.50%, and the Dow Jones Industrial Average increased by 1.07%.

However, pressure returned to the market during the Asian session. Asian indices broke their five-day winning streak after the brief global rally in risk assets faded amid mixed signals from the Trump administration about its plans for tariffs on China.

Treasury Secretary Scott Bessent yesterday cast doubt on a timely resolution to the US-China trade war. As a result, Hong Kong stocks fell by 1.1% for the first time in four days. Gold jumped 1.4% amid increased demand for safe-haven assets. European stock index futures dropped 0.1%.

The global advance in equities on Wednesday, following sharp swings earlier this month, was supported by signs that President Donald Trump was reconsidering the most aggressive elements of his stance on trade and the Federal Reserve. However, it is clear that investors find it difficult to predict where markets will go next, given the flurry of headlines from various administration officials and Trump's frequent tariff disputes.

Trump indicated that the US is aiming for a fair deal with China, adding Wednesday evening that the country could introduce a new tariff rate within the next two to three weeks. The administration is also considering reducing certain tariffs targeting the automotive industry, which automaker executives have warned would severely impact profits and jobs.

In an interview, Bessent also said that Trump had not offered to remove US tariffs on China unilaterally. When asked whether the president's proposal to de-escalate was one-sided, he replied, "Absolutely not." The Treasury Secretary stated that the administration is weighing many factors regarding China beyond tariffs, including non-tariff barriers and state subsidies. He also said that the strongest relationships between Washington and Beijing are at the top level, and there are no timelines for engagement. A complete rebalancing of trade could take two to three years.

In the commodity market, oil declined as investors assessed the prospects of increased OPEC+ supply and the impact of ongoing trade tensions between the US and China.

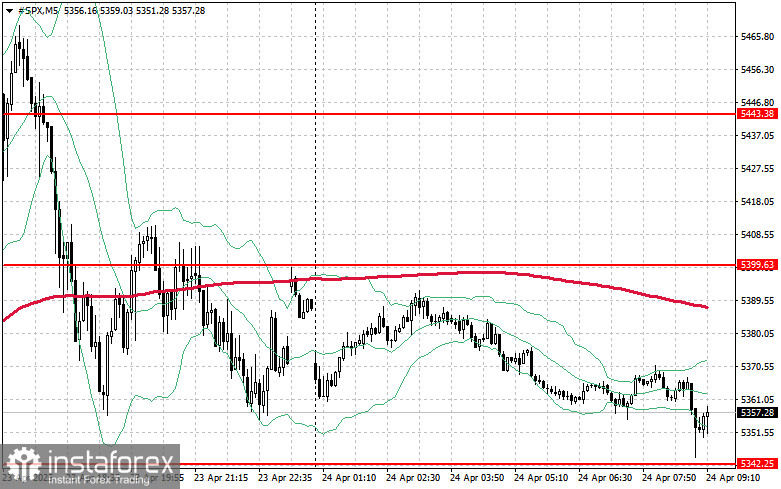

Technical Outlook for the S&P 500:

Today, the main task for buyers is to overcome the immediate resistance at $5,399. This would help continue the upward move and open the way to a new level at $5,443. An equally important objective for the bulls is to regain control above $5,483, which would further strengthen buyers' positions. If the index moves lower amid weakening risk appetite, buyers will need to show up around $5,342. A break below that would quickly push the instrument back to $5,305 and open the way to $5,269.