Gold prices have recently seen a notable correction amid market expectations of the start of real negotiations between the U.S. and China on tariffs and overall trade. Treasury Secretary S. Bessent's statement, noting that the current tariff war between Beijing and Washington is unproductive, suggests that negotiations are already taking place behind the scenes and that an agreement may be reached in the near future.

From a technical perspective, the price of the "yellow metal" has shown a local reversal downward, and a likely stream of positive, calming news for the markets may reduce demand for safe-haven assets—gold being a primary example.

Technical outlook and trading idea:

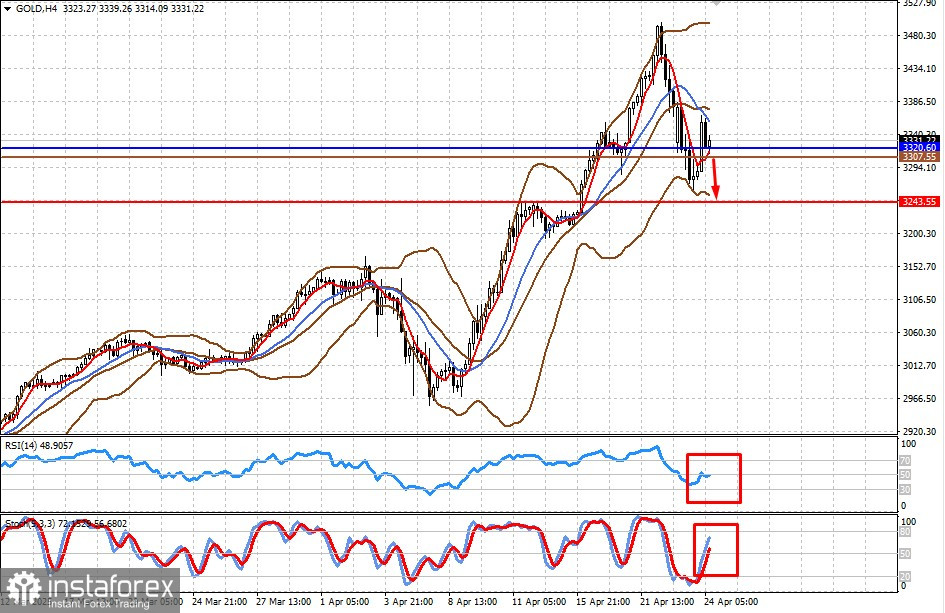

- The price is below the midline of the Bollinger Bands, above the 5-day SMA, but below the 14-day SMA.

- RSI is below the 50% mark.

- Stochastics are still rising for now.

I believe that the price of gold may fall to 3243.55 after breaking below 3320.60. The entry point can be considered at the 3307.55 level.