The euro and the pound remained within their sideways channels, where they could spend the entire day. There are no particular reasons for the growth of risk assets, but there are also no reasons to get rid of them.

Good Friday data showing a rise in the University of Michigan Consumer Sentiment Index limited the euro and pound's upside potential but did not significantly strengthen the US dollar. Investors continue to weigh the prospects of further hawkish monetary policy by the Federal Reserve and assess the resilience of the European economy amid the trade crisis and the risk of rising inflation.

Across the European continent, the situation is mixed. Germany, the locomotive of the European economy, is showing signs of slowing down, while Southern European countries, particularly Spain and Italy, continue to demonstrate relatively stable growth. This creates additional uncertainty for the European Central Bank, which is planning to continue lowering interest rates, thus limiting the euro's upside potential.

Today, apart from Spain's unemployment rate, there are no other significant data. And perhaps that's for the best. The information noise we are bombarded with daily by economic commentators often prevents us from seeing the bigger picture. The dry numbers from Spain are unlikely to impact the euro strongly, so there's no need to focus heavily on this indicator.

It is also unlikely that we will see significant volatility in the pound today, but hopes for positive retail sales data from the CBI could strengthen buyers' positions. Recently, there has been a steady improvement in consumer confidence in the country, signaling a strengthening of economic sentiment, and lower interest rates will continue to stimulate the economy by supporting consumer demand. Overall, the short-term prospects for the pound sterling appear relatively positive, especially if retail sales data meet forecasts.

If the data matches economists' expectations, acting based on the Mean Reversion strategy is better. If the data turns out to be much higher or lower than economists' expectations, it's best to use the Momentum strategy.

Momentum Strategy (Breakout):

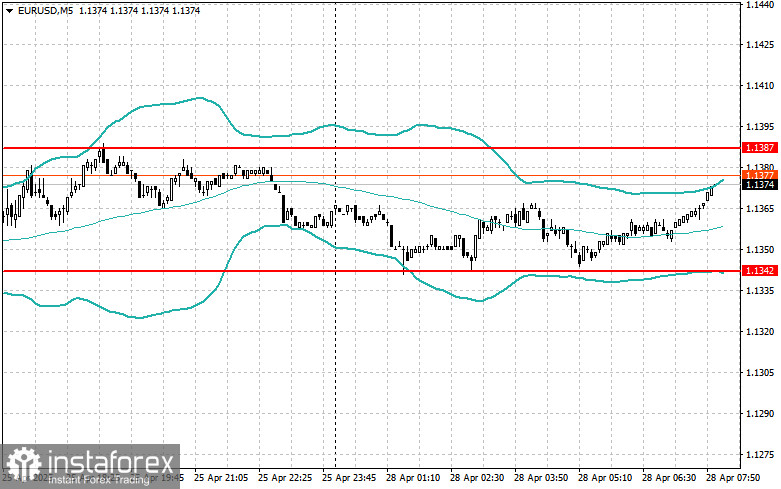

EUR/USD

Buying on a breakout above 1.1391 could lead to growth toward 1.1435 and 1.1487;

Selling on a breakout below 1.1315 could lead to a decline toward 1.1267 and 1.1217;

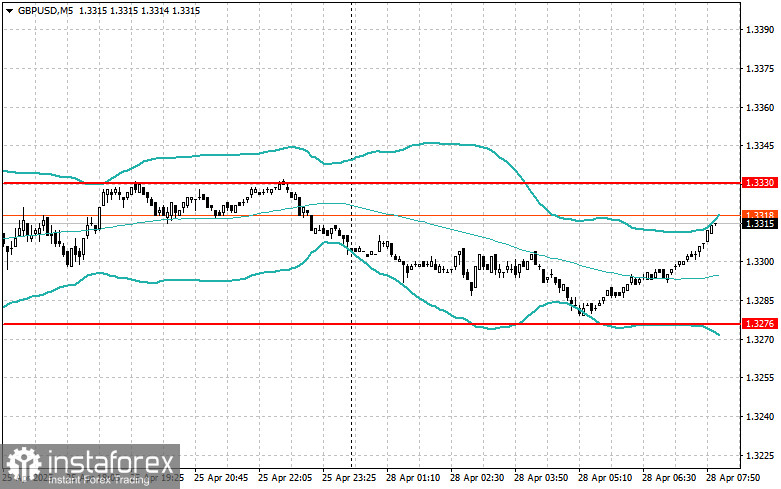

GBP/USD

Buying on a breakout above 1.3342 could lead to growth toward 1.3379 and 1.3416;

Selling on a breakout below 1.3282 could lead to a decline toward 1.3247 and 1.3205;

USD/JPY

Buying on a breakout above 143.77 could lead to growth toward 144.17 and 144.51;

Selling on a breakout below 143.29 could lead to a sell-off toward 142.86 and 142.34.

Mean Reversion Strategy (Pullbacks):

EUR/USD

I will look for selling opportunities after a failed breakout above 1.1387, returning below this level;

I will look for buying opportunities after a failed breakout below 1.1342, returning back to this level.

GBP/USD

I will look for selling opportunities after a failed breakout above 1.3330, returning below this level;

I will look for buying opportunities after a failed breakout below 1.3276, returning back to this level.

AUD/USD

I will look for selling opportunities after a failed breakout above 0.6417, returning below this level;

I will look for buying opportunities after a failed breakout below 0.6375, returning back to this level.

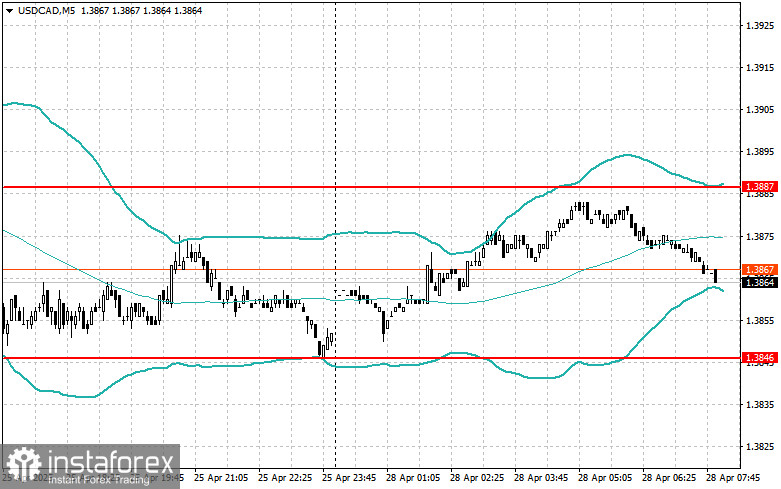

USD/CAD

I will look for selling opportunities after a failed breakout above 1.3884, returning below this level;

I will look for buying opportunities after a failed breakout below 1.3850, returning back to this level.