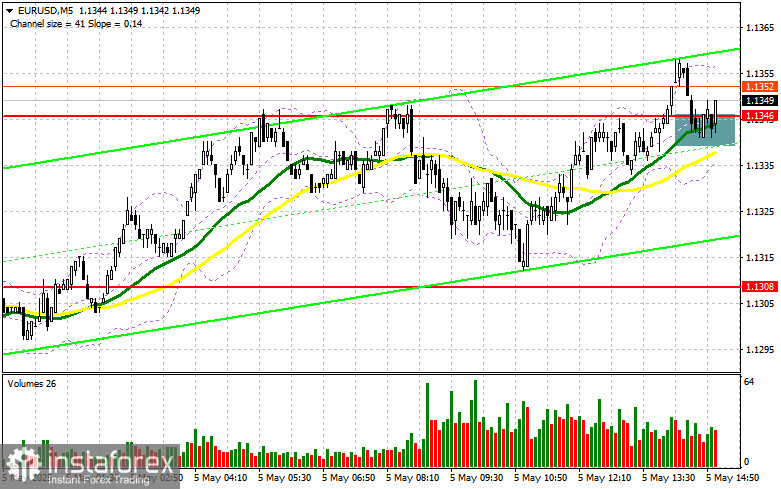

In my morning forecast, I focused on the 1.1346 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and see what happened. A breakout and retest of 1.1346 led to an entry point for buying the euro, but so far, a major rally has not materialized. The technical picture has not been revised for the second half of the day.

To open long positions on EURUSD:

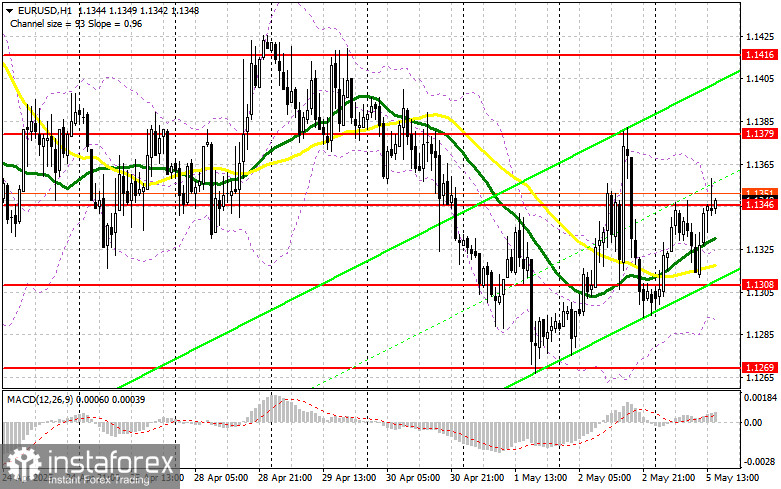

The second half of the day could pose a challenge for the U.S. dollar due to the expectation of rather weak fundamental data. All traders' attention will be focused on the PMI for the services sector, the composite PMI, and the ISM services index for April. A drop below the 50-point threshold may be a turning point for the economy. If the pair declines, I plan to act from the 1.1308 support formed at the end of last week. A false breakout there will be a signal to buy EUR/USD with the aim of a recovery toward 1.1346, where trading is currently concentrated, leaving room to activate the morning entry point. A breakout and retest of this range will confirm the correct entry point with a move toward 1.1379. The most distant target will be the 1.1416 level, where I will take profit. If EUR/USD falls and there is no activity around 1.1308, pressure on the pair may increase significantly, potentially leading to a move toward 1.1269. Only after forming a false breakout there will I act to buy the euro. I plan to open long positions on a rebound from 1.1219 aiming for an intraday upward correction of 30–35 points.

To open short positions on EURUSD:

If the euro rises after U.S. data, which is also likely, bears will need to assert themselves around 1.1346. Only a false breakout there will justify short positions aiming for a drop to the 1.1308 support, where the moving averages are located in favor of the bulls. A breakout and consolidation below this range would be a suitable selling scenario with a move toward 1.1269. The furthest target will be 1.1219, where I will take profit. Testing this level would break the bullish market. If EUR/USD rises in the second half of the day and bears fail to act near 1.1346, buyers could push the pair to 1.1379. I will only sell there after a failed consolidation. I plan to open short positions on a rebound from 1.1416, aiming for a downward correction of 30–35 points.

Indicator signals:

Moving averages Trading is taking place around the 30- and 50-day moving averages, indicating market uncertainty.

Note: The moving average periods and prices are based on the author's analysis of the hourly (H1) chart and differ from the standard definitions on the daily (D1) chart.

Bollinger Bands In case of a decline, the lower boundary of the indicator around 1.1275 will act as support.

Indicator descriptions

- Moving average – determines the current trend by smoothing volatility and noise. Period – 50 (yellow on the chart)

- Moving average – determines the current trend by smoothing volatility and noise. Period – 30 (green on the chart)

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12, Slow EMA – period 26, SMA – period 9

- Bollinger Bands – period 20

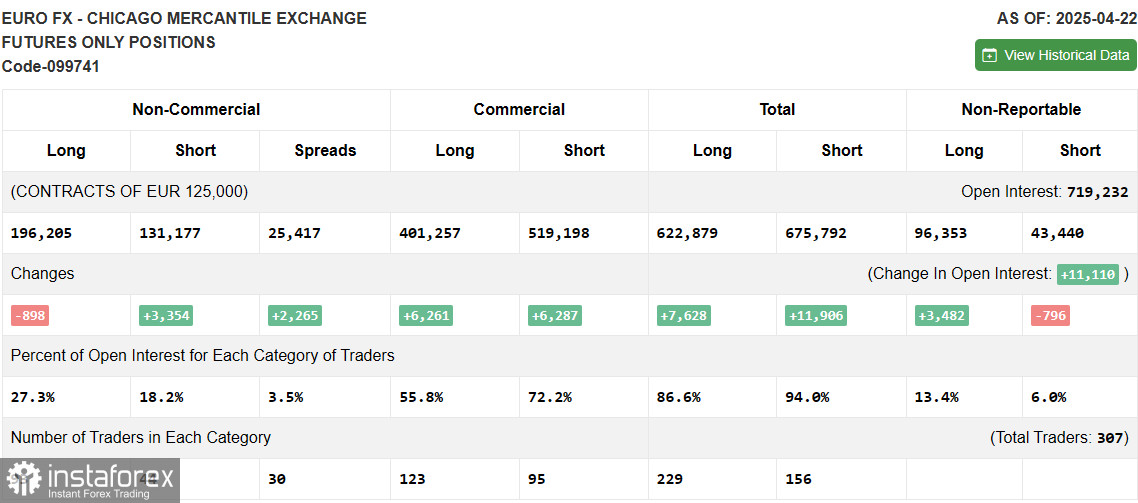

- Non-commercial traders – speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain criteria

- Long non-commercial positions – total long open positions held by non-commercial traders

- Short non-commercial positions – total short open positions held by non-commercial tradersTotal non-commercial net position – the difference between short and long positions held by non-commercial traders.