Trade Review and Tips for Trading the Euro

The designated levels were not tested in the first half of the day.

In the absence of important fundamental statistics, EUR/USD volatility left much to be desired. Now, during the U.S. session, traders' attention will focus on the released data on the services PMI, the composite PMI, and the ISM services index for April of this year. These indicators serve as key barometers of the economic situation, providing insight into current business activity and potential threats of an economic downturn. It is expected that weakening PMI figures will indicate a slowdown in services sector growth, which could negatively impact the overall economic dynamics. Market reaction will depend on the degree of divergence between the actual data and expectations.

Given U.S. trade tariffs and anticipated labor market problems, a slowdown in services sector activity is unlikely to be seen as a temporary phenomenon, so the market's response to weak data could be quite strong. Therefore, the publication of PMI figures will be a significant event for financial markets, potentially triggering sharp price swings and influencing investor sentiment.

Regarding intraday strategy, I will rely mainly on the implementation of Scenarios #1 and #2.

Buy Signal

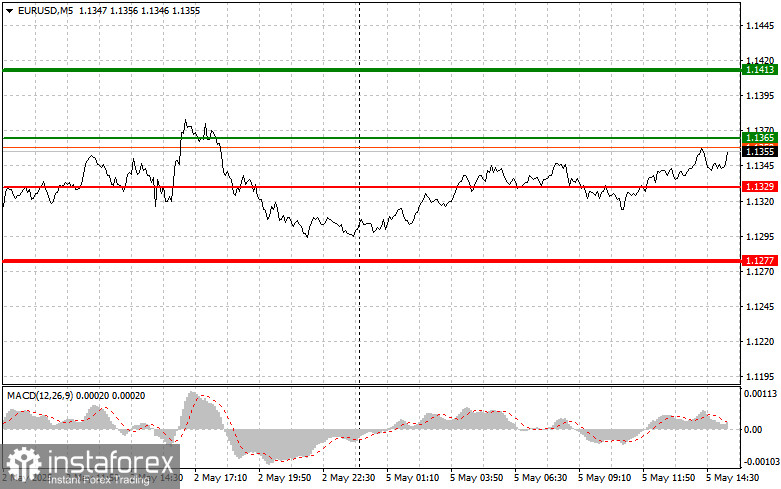

Scenario #1: Today, euro purchases are possible at the price level of 1.1365 (green line on the chart), targeting a rise to 1.1413. At 1.1413, I plan to exit the market and sell the euro in the opposite direction, expecting a 30–35 point pullback. A euro rise can be expected in line with the trend and after weak data. Important! Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1329 price level when the MACD indicator is in the oversold zone. This would limit the pair's downward potential and lead to a reversal upward. A rise toward the opposite levels of 1.1365 and 1.1413 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1329 (red line on the chart). The target is 1.1277, where I will exit the market and immediately buy in the opposite direction (expecting a 20–25 point move back from the level). Pressure on the pair may return if U.S. statistics are strong. Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1365 price level when the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a reversal downward. A decline to the opposite levels of 1.1329 and 1.1277 can be expected.

What's on the chart:

- Thin green line – entry price at which the instrument can be bought

- Thick green line – anticipated price for placing Take Profit or manually fixing profits, as further growth above this level is unlikely

- Thin red line – entry price at which the instrument can be sold

- Thick red line – anticipated price for placing Take Profit or manually fixing profits, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones

Important: Beginner traders on the Forex market must be very cautious when making market entry decisions. Before important fundamental reports are released, it is best to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, like the one I've presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.