Markets remain tense. The U.S. Dollar Index and the cryptocurrency market are stagnating, caught between opposing forces. Investors are tensely awaiting the outcome of the Federal Reserve's monetary policy meeting.

Donald Trump's presidency has left financial markets completely disoriented. His attempts to solve America's core issues with blunt-force tactics appear to have failed, and constant maneuvering on the geopolitical stage has only increased market volatility. No trade deal has been reached with China, efforts to resolve the Ukraine conflict have consistently failed, and the domestic economy remains in a precarious state. Meanwhile, the president has launched a new high-profile campaign—this time targeting Hollywood—perhaps hoping to score political points at home.

Monday's non-manufacturing sector data came in above expectations but still hovered dangerously close to the critical threshold, reflecting continued weakness in the U.S. economy. The ISM Non-Manufacturing Index rose to 51.6 in April from 50.8 in March (versus a forecast of 50.2), which was a pleasant surprise. However, like other non-manufacturing indicators, it remains just above the 50-point level that separates expansion from contraction.

Against this backdrop, investors desperately seek clarity on where the markets might head next.

They continue to speculate on what the Fed will decide. While the consensus forecast suggests the key interest rate will remain unchanged at 4.5%, there is a real risk of an unexpected rate cut. Such a move would support the economy by boosting business activity and would align with the intentions of the 47th U.S. president.

As a result, market activity has become notably stagnant. Major forex pairs are at a standstill. The same goes for cryptocurrencies. Stock index growth has slowed. The only segments showing strong momentum are commodities and raw materials. Gold prices are rebounding, as are oil prices, which are climbing due to heightened geopolitical tensions in the Middle East, where Israel launched airstrikes on the port of Hodeidah in Yemen and a cement factory in retaliation for missile attacks carried out by Iran-backed Houthis.

What to Expect in the Markets Today

I believe only safe-haven assets, particularly gold and oil (due to Middle East tensions), will be in demand. All other markets—forex, equities, and crypto—will likely consolidate until the Fed's policy decision is announced.

Day's Forecast

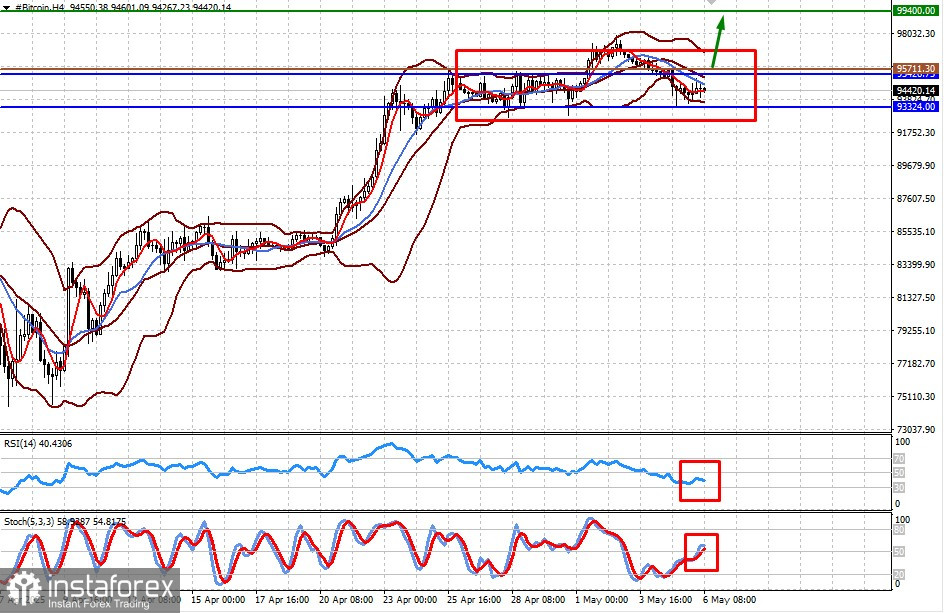

Bitcoin

The token is consolidating within the range of 93,324.00–95,426.75. If the Fed unexpectedly cuts interest rates tomorrow, Bitcoin could sharply rise toward the 99,400.00 level. A potential entry point for buyers would be around 95,711.30.

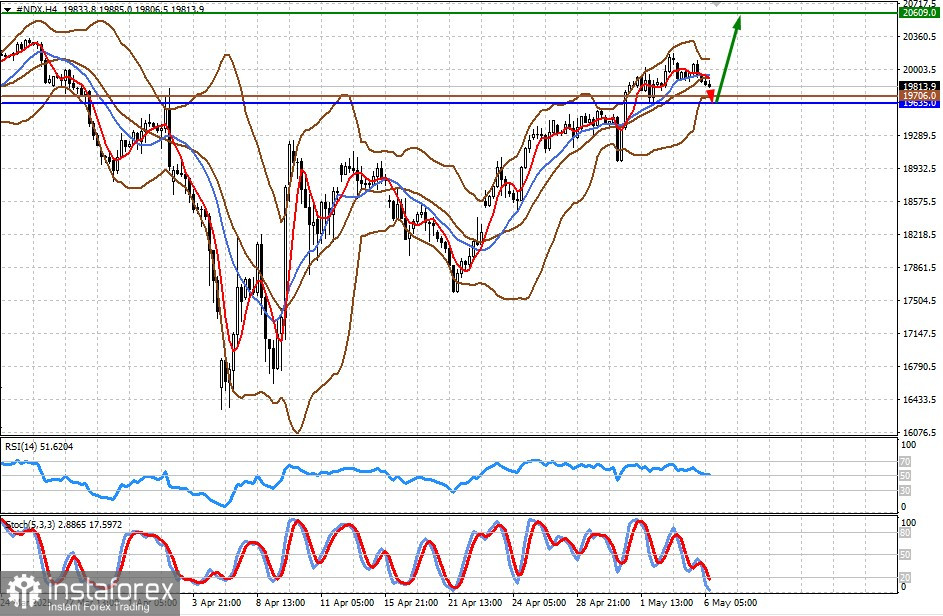

#NDX (NASDAQ 100 Futures CFD)

The contract has paused its upward movement in anticipation of the Fed's decision. It may correct downward to 19,635.00, bounce from that level, and—if the Fed does cut rates—resume growth toward 20,609.00. A potential buying opportunity on the dip lies near 19,706.00.