Gold has resumed its upward movement as investors analyzed trade-related comments from U.S. Treasury Secretary Scott Bessent while awaiting the Federal Reserve's decision on interest rates.

Bessent recently stated that several attractive offers were made to the United States during negotiations with trade partners, reiterating that some deals might be announced as soon as this week. However, no specific details followed, causing investors and traders to question the credibility of these developments. While the U.S. Treasury Secretary mentioned the possibility of a significant reduction in tariffs on U.S. goods, he also clarified that no major concessions would be made for trade partners.

This position slightly softens the rhetoric regarding the domestic market but dampens hopes for a quick recovery of global trade relations and the resolution of ongoing conflicts. In the context of growing economic instability caused by the pandemic and geopolitical factors, protectionist measures—even in a milder form—are likely to worsen the situation. Restricting access to the U.S. market, even with some tariff reductions, will pressure partner economies, forcing them to seek alternative development paths and strengthen their domestic markets. In the long term, such an approach could lead to the fragmentation of the global economy, a decline in international trade volumes, and slower economic growth.

Nevertheless, according to Bessent, the latest GDP data do not suggest an impending recession. He emphasized the resilience of consumer spending, which remains the key driver of economic growth. However, recent U.S. trade balance figures tell a different story. A sharp 14% month-over-month increase in imports indicates a slowdown in economic growth, which will likely continue in the near term.

Bessent also noted the importance of closely monitoring the global economic situation. Geopolitical tensions, supply chain disruptions, and the energy crisis in Europe could negatively affect U.S. economic growth. Therefore, although the current indicators appear encouraging, vigilance is necessary to remain prepared for potential challenges.

As for gold prices, they rebounded due to fears that trade tensions may further slow the global economy. Added to this is the Federal Reserve, which is expected to maintain a wait-and-see approach today to assess how the trade policies implemented last month impact the economy before making any changes to U.S. interest rates. The Fed is expected to keep rates unchanged at this meeting, despite repeated criticism from President Trump toward Fed Chair Jerome Powell for not cutting rates.

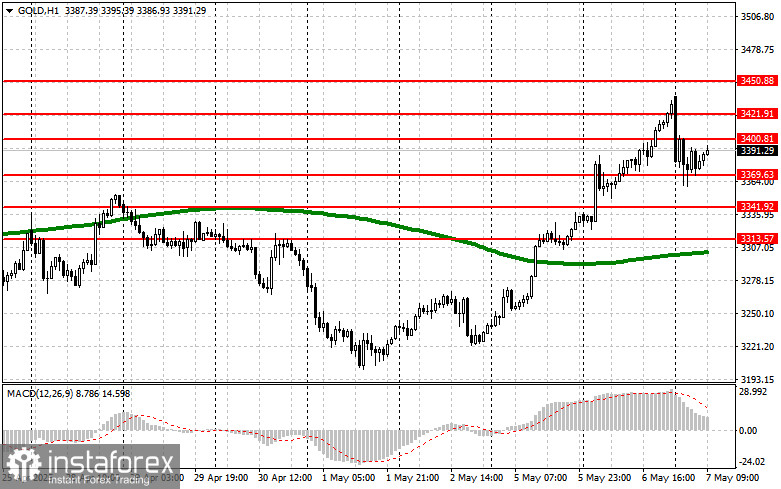

From a technical standpoint, buyers need to overcome the nearest resistance at $3400 to aim for $3421, above which it will be challenging to gain a foothold. The most distant target stands at the $3450 area. Bears will attempt to regain control of $3369 in case of a decline. If they succeed, a breakout of this range would deal a serious blow to the bulls and push gold toward a low of $3341, with the prospect of reaching $3313.