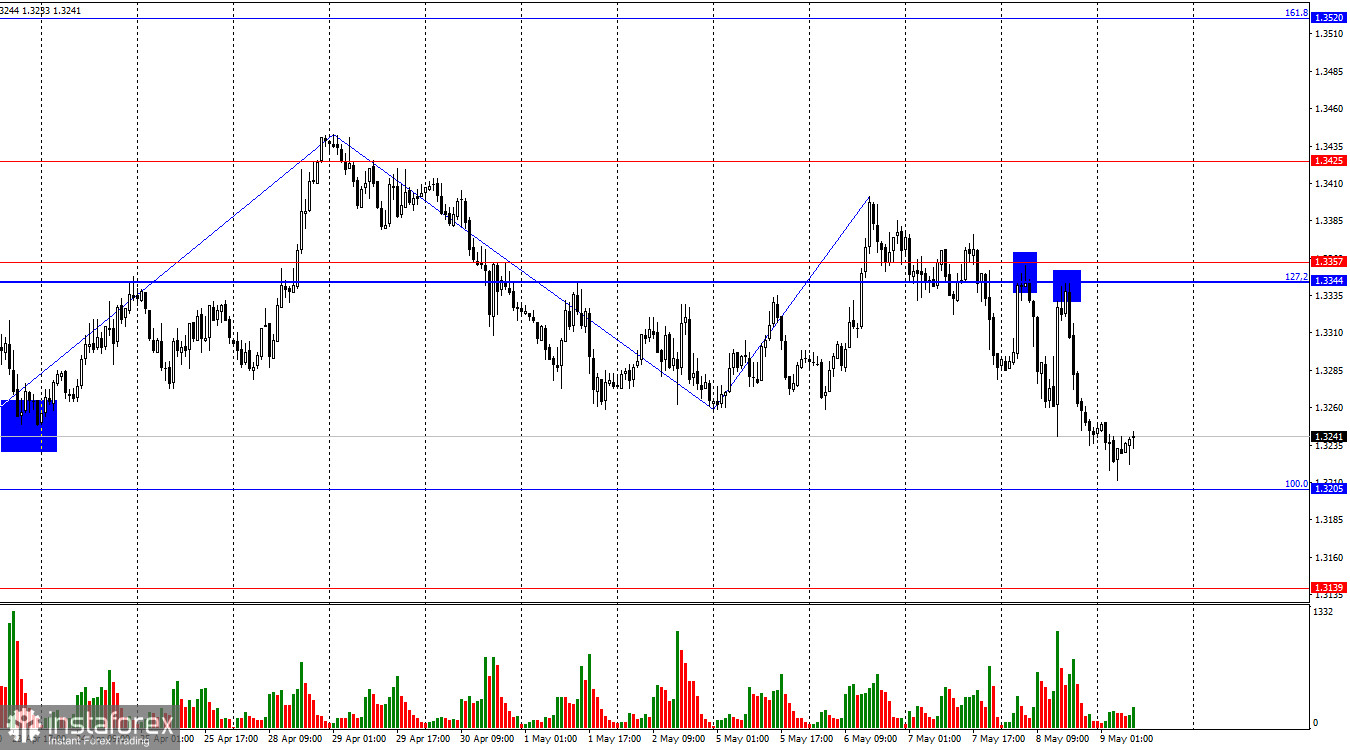

On the hourly chart, the GBP/USD pair on Thursday formed two bounces from the 127.2% Fibonacci retracement level at 1.3344, turned in favor of the US dollar, and dropped to the 100.0% Fibonacci level at 1.3205. There was no rebound from this level—just a few points short. Thus, no buy signal was generated. A consolidation below 1.3205 would suggest the pair could continue declining toward 1.3139 and 1.3085.

The wave pattern remains simple and clear. The most recent completed upward wave did not break the previous high, while the last downward wave did break the previous low. This means the bullish trend is transitioning into a bearish one. So far, the pound's decline is too mild to call it a trend, but over the past three months, such drops have only occurred on rare occasions. Bulls will have a hard time lifting the price above 1.3425 without new announcements from Donald Trump about increased or new import tariffs.

The news flow on Wednesday did all it could, and on Thursday, bears got lucky for a second day in a row. As expected, the Bank of England lowered its interest rate, but that didn't make the decision any less significant or less "hawkish." A rate cut is a rate cut, and the pound should respond by falling—which it did. Two central banks effectively supported the dollar, though the gains were modest. It's hard to predict how long this climb will continue with Trump's unpredictable policies. In my view, the pound has no new reasons to rally, while the dollar has few reasons to rise at all. So even though the current chart looks like the beginning of a bearish trend, I wouldn't expect a strong drop in the near future. Powell calmed markets, and Bailey signaled readiness to ease monetary policy moderately. The situation now favors the dollar, but Trump could easily chase the bears off the market with a single announcement.

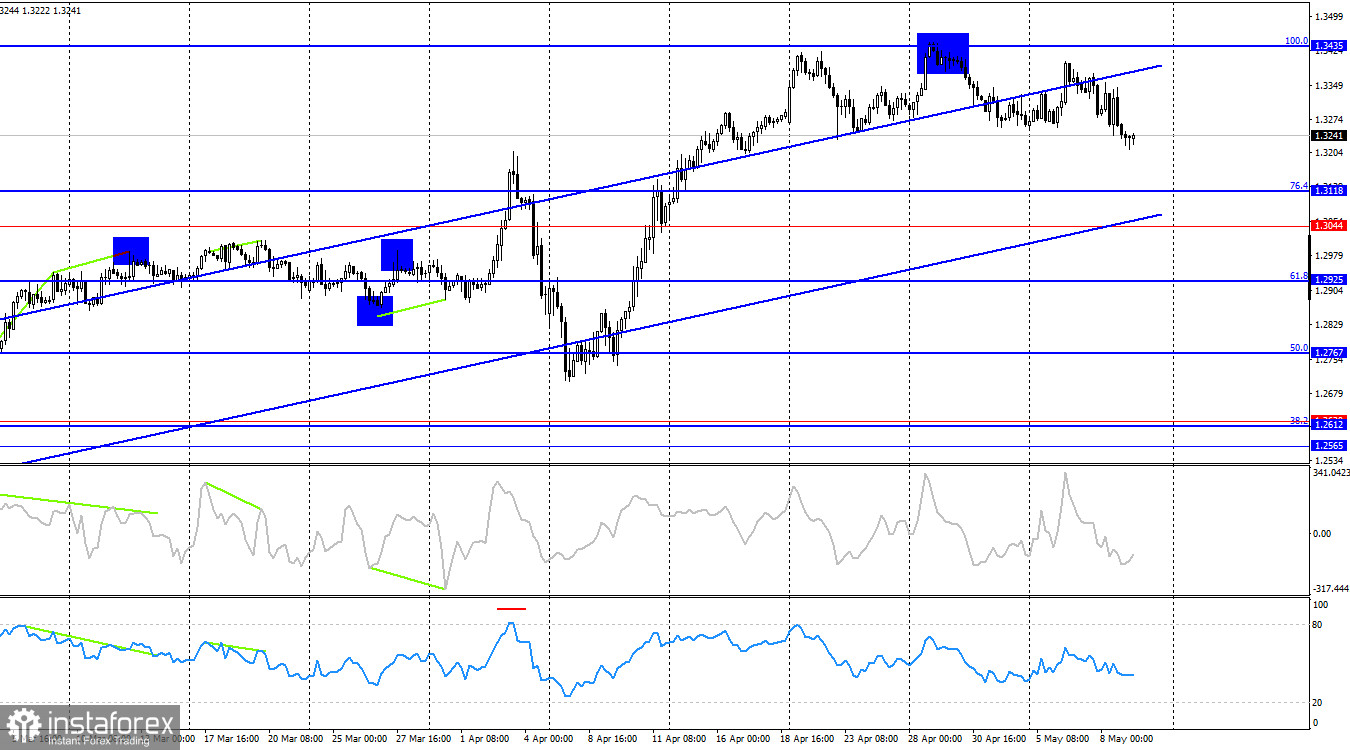

On the 4-hour chart, the pair rebounded from the 100.0% Fibonacci level at 1.3435, turned in favor of the dollar, and continues to fall toward the 76.4% corrective level at 1.3118. No emerging divergences are noted on any indicator. The ascending trend channel still suggests a bullish trend. The background remains unfavorable for bears, so I'm not expecting a deep drop just yet.

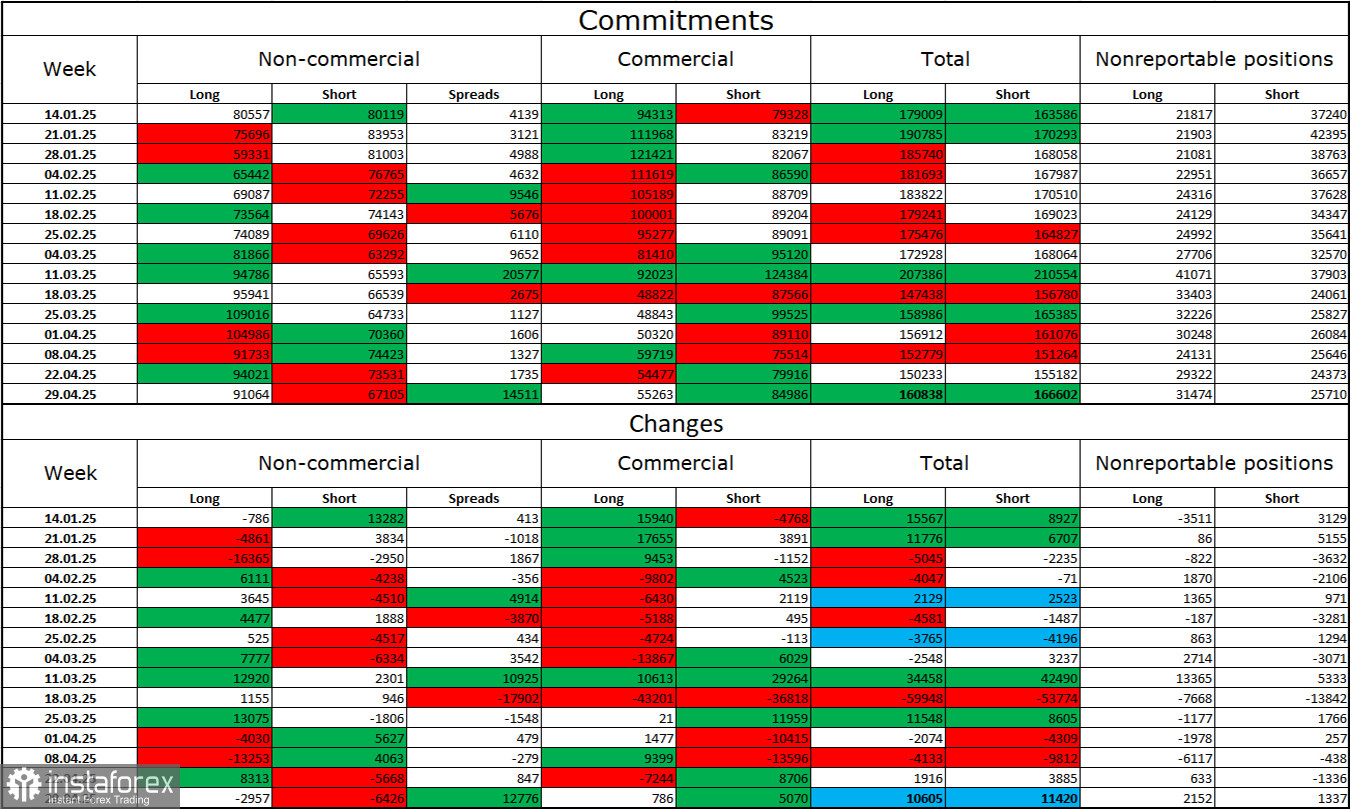

Commitments of Traders (COT) Report

Sentiment among the "Non-commercial" trader category became more bullish in the latest reporting week. Long contracts held by speculators fell by 2,957, and short positions dropped by 6,426. Bears lost their advantage in the market. The gap between long and short positions now stands at 24,000 in favor of the bulls: 91,000 versus 67,000.

In my opinion, the pound still has downward potential, but recent developments could cause a long-term market reversal. Over the last three months, long positions rose from 80,000 to 91,000, while short positions declined from 80,000 to 67,000. Notably, over the last 14 weeks—coinciding with "14 weeks of Trump's presidency"—long positions grew from 59,000 to 91,000, and short positions fell from 81,000 to 67,000.

Economic Calendar (May 10):

- UK – BoE Governor Andrew Bailey speaks (08:40 UTC)

Friday's calendar includes just one event, but it could be significant enough to influence market sentiment in the first half of the day.

GBP/USD Forecast and Trader Tips:

Sales were viable after an hourly close below the 1.3344–1.3357 zone and after two bounces from the same area, with targets at 1.3265 and 1.3205. The second target was nearly reached. Buying opportunities may arise on a rebound from 1.3205 on the hourly chart, with a target at 1.3344.

Fibonacci grids are drawn from 1.3205–1.2695 on the H1 chart and from 1.3431–1.2104 on the H4 chart.