Analysis of Friday's Trades

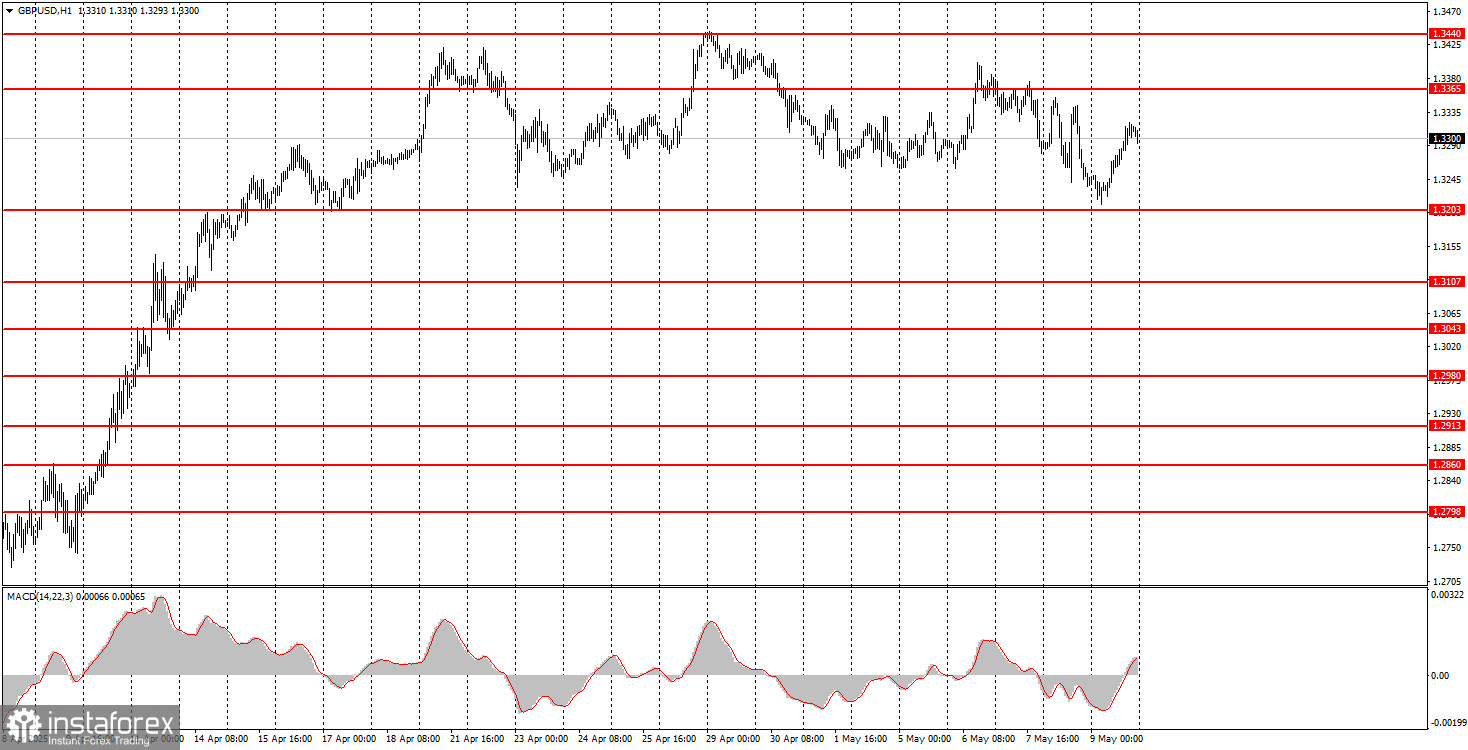

1H Chart of GBP/USD

On Friday, the GBP/USD currency pair exhibited a tendency to rise. As we can see, first of all, the pair once again failed to exit the sideways channel. Secondly, the dollar still has no demand in the currency market. Let's recall that last week, the US currency had an excellent opportunity to improve its catastrophic position: the Federal Reserve took a "hawkish" stance, the Bank of England cut its key interest rate, and Donald Trump signed a trade agreement with the UK. Only the last piece of news requires explanation. In our view, if the dollar plunged when Trump imposed trade tariffs (including against the UK), then it should rise when Trump removes tariffs or signs a trade agreement. At present, the entire market is moving in relation to the dollar. Thus, three major factors supported the US currency, yet even that wasn't enough to break out of the flat range.

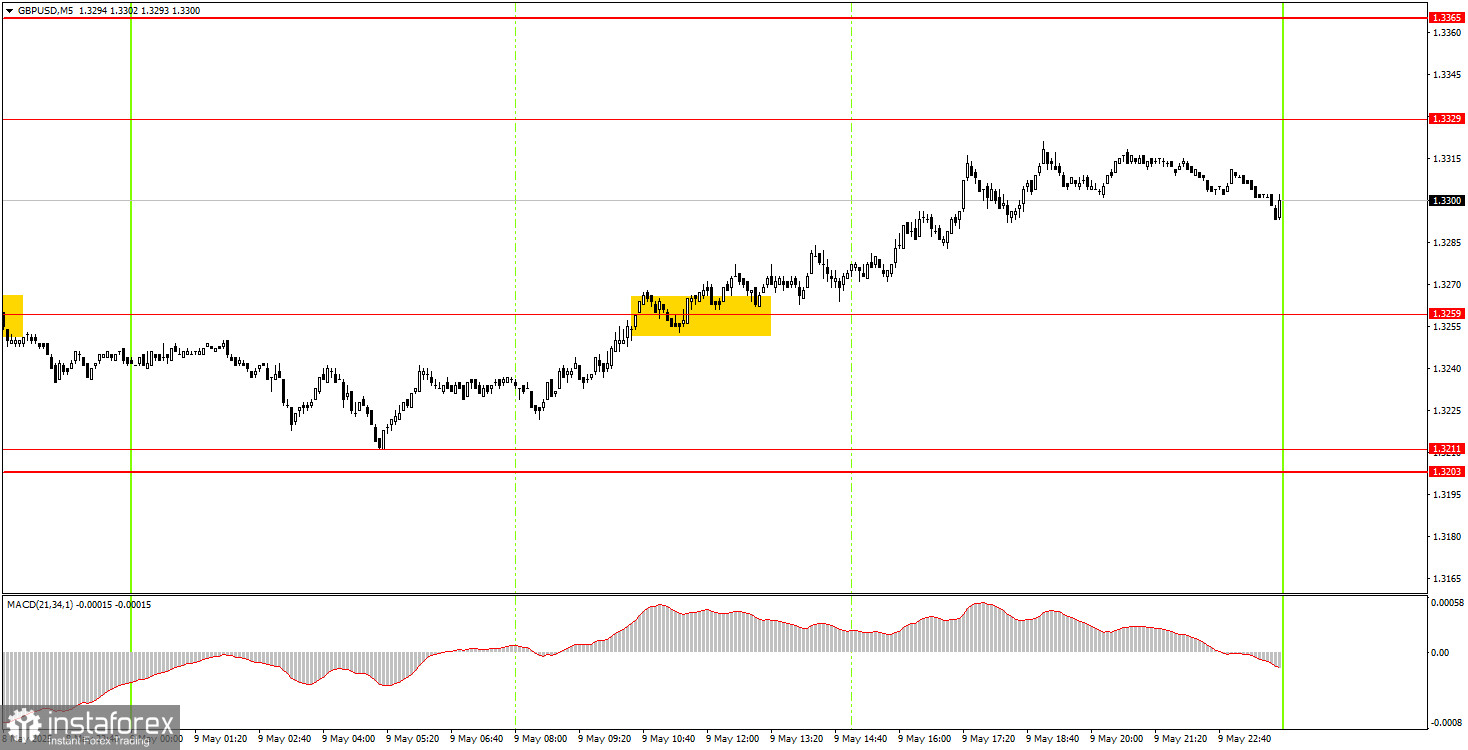

5M Chart of GBP/USD

Only one trading signal was generated in the 5-minute time frame on Friday, but the intraday price action was quite solid. During the European session, the price broke above the 1.3259 level and moved around 40 pips in the desired direction. It was not a huge move, but it was still decent. Closing the trade in profit before the market closed would have been easy.

Trading Strategy for Monday:

In the hourly time frame, the GBP/USD pair continues to follow Donald Trump's lead, meaning the pound sterling keeps crawling upward or at least holding steady at elevated levels. The pair remains stuck in a flat range. The market only halfheartedly responds to fundamental background, while largely ignoring macroeconomic data. Therefore, if the pound finally breaks out of the flat range, we might expect the dollar to strengthen, at least from a technical perspective. We continue to note how reluctantly the pound is giving up its ground.

The GBP/USD pair may move in either direction on Monday, as it remains within the sideways channel. The recent Fed and BoE meetings supported the dollar, but this hasn't provided relief. Even the UK–US trade deal didn't trigger meaningful dollar strength. The flat movement continues.

On the 5-minute time frame, trading can be done using the following levels: 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3145–1.3167, 1.3203–1.3211, 1.3259, 1.3329, 1.3365, 1.3421–1.3440, 1.3488, 1.3537, 1.3580–1.3598. On Monday, there are no important events scheduled in either the US or the UK, so novice traders will need to rely on technical analysis alone.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.