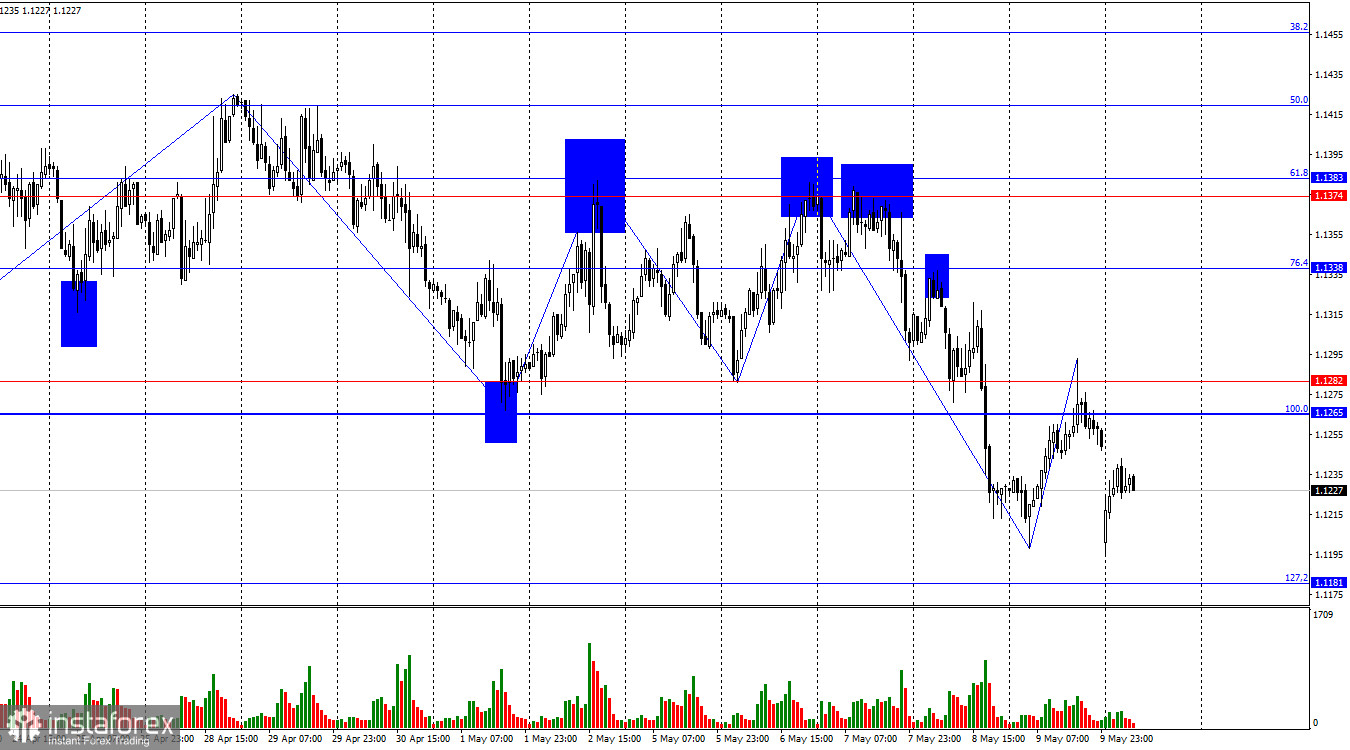

Good day, dear traders! On Friday, the EUR/USD pair rose to the resistance zone of 1.1265–1.1282, rebounded, and reversed in favor of the U.S. dollar. The downward movement may continue today toward the 127.2% Fibonacci retracement level at 1.1181. A rebound from this level would signal a potential new upward wave toward the 1.1265–1.1282 zone.

The wave structure on the hourly chart has shifted. The last completed upward wave failed to break the previous peak, while the most recent downward wave broke the previous low. Thus, the trend has now shifted to "bearish." Recent waves have been very weak and small, indicating low trader activity and weak bearish pressure. Few updates have come from the White House, and traders are waiting for the outcomes of trade agreement talks. However, the dollar has begun to recover, which is already a positive sign.

There was no news background on Friday, but over the weekend, it was reported that direct negotiations between Ukraine and Russia could take place this week to reach a peace agreement. The U.S. has urged both parties to agree to a meeting and has threatened to withdraw all support for Ukraine if it refuses talks, and to impose new large-scale sanctions against Russia if Moscow declines. Kyiv has stated it is ready for direct negotiations and wants to announce a 30-day ceasefire starting May 12. Negotiations will be held over the month to achieve a long-term peace. Moscow has said that talks should begin first before a ceasefire is discussed. The negotiations are expected to take place in Istanbul and will effectively continue the dialogue that started in spring 2022. This presents a real opportunity to end a conflict that has lasted more than three years. This is not the best news for the U.S. dollar, which still retains its status as a "safe haven" currency, as a reduction in geopolitical tensions in Eastern Europe may shift investor interest toward riskier assets.

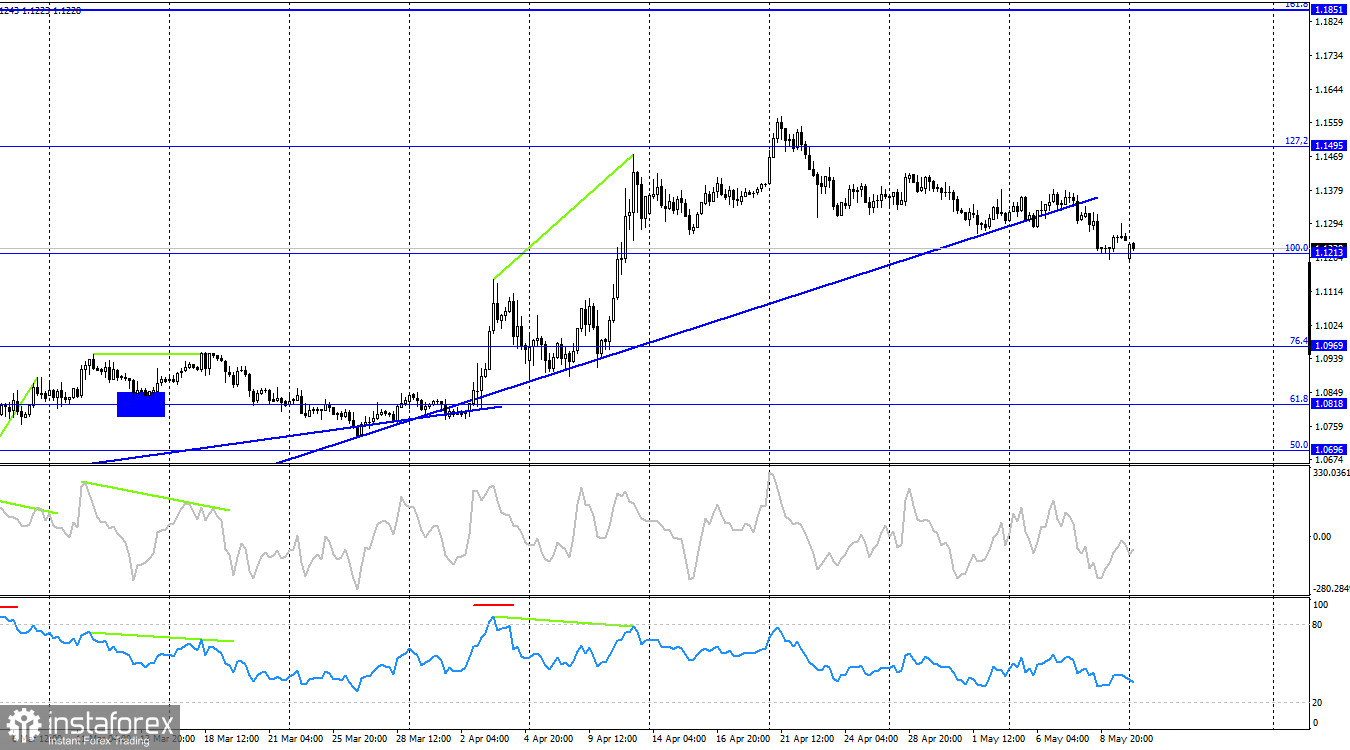

On the 4-hour chart, the pair declined to the 100.0% Fibonacci retracement level at 1.1213. A rebound from this level will favor the euro and a resumption of growth toward the 127.2% level at 1.1495. A close below 1.1213, combined with a break below the trendline, would increase the likelihood of further decline toward the next retracement level at 76.4% – 1.0969. No divergences are forming on any indicator today.

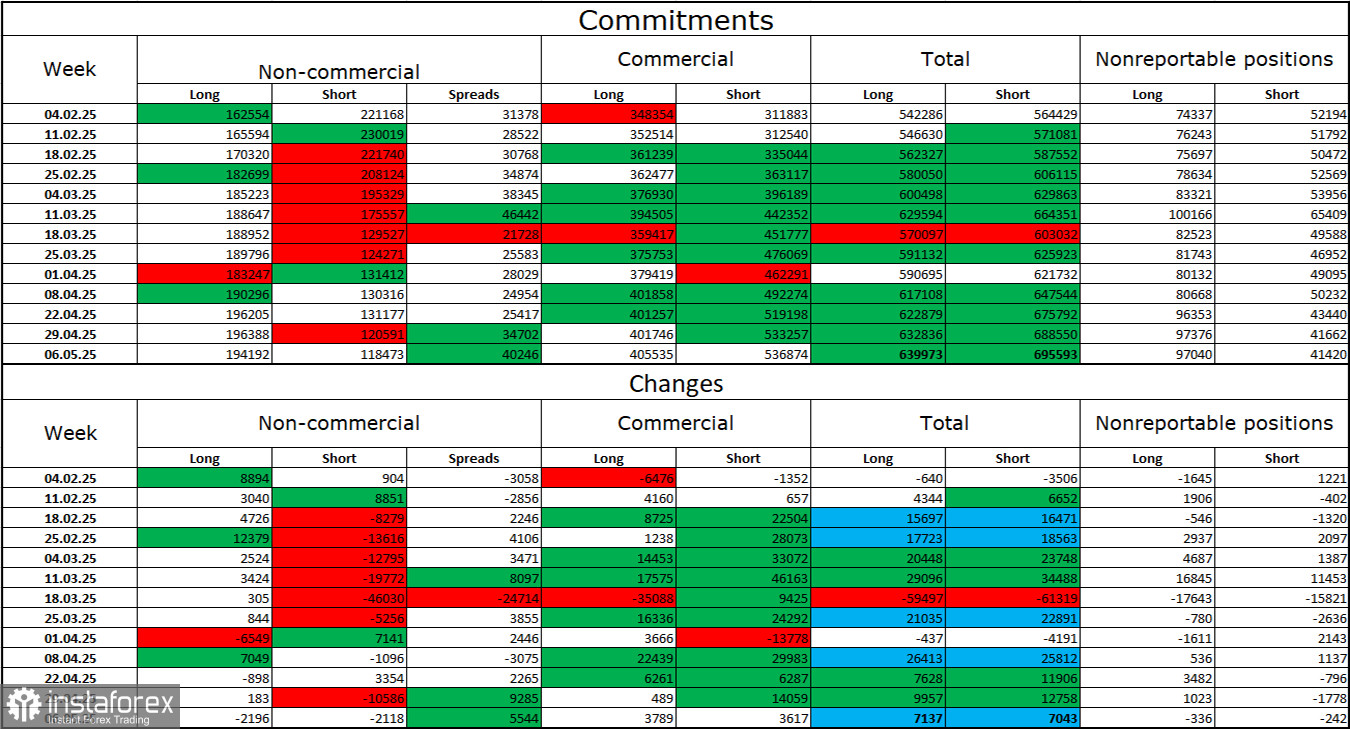

Commitments of Traders (COT) Report:

During the last reporting week, professional traders closed 2,196 long contracts and 2,118 short contracts. The sentiment of the "Non-commercial" group has long since turned "bullish"—thanks to Donald Trump. The total number of long contracts held by speculators now stands at 194,000, and short contracts at 118,000, though just a few months ago the situation was reversed and showed no signs of trouble.

Large speculators were dumping euros for twenty consecutive weeks, but for the last 13 weeks, they've been closing shorts and adding to longs. The difference in monetary policy between the European Central Bank and the Federal Reserve continues to favor the dollar due to widening rate differentials. However, Donald Trump's policies are a stronger factor for traders, as they could push the U.S. economy into recession.

News calendar for the U.S. and Eurozone:

May 12 contains no significant economic events. Therefore, the news background will not influence market sentiment on Monday.

EUR/USD forecast and trader advice:

Short positions on the pair were possible after a rebound from 1.1374 on the hourly chart, targeting 1.1265. It was also possible to sell from the 1.1240–1.1265 resistance zone with targets at 1.1181 and 1.1074. Buying can be considered after a rebound from the 1.1181 level on the hourly chart, with a target of 1.1265.

The Fibonacci grids are constructed from 1.1265–1.1574 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.