Yesterday's news that Trump postponed the date for introducing higher tariffs on European goods boosted demand for the euro, which led to a sharp rise in the EUR/USD pair during the Asian session. Investors interpreted this move as a sign of a possible easing in trade tensions between the United States and the European Union, which positively impacted the outlook for the European economy. However, despite the market's optimistic response, caution is still advised. Trade negotiations between the U.S. and the EU are complex and unpredictable. Additionally, concerns about slowing global economic growth continue to linger, which could further exacerbate the challenges facing the European market.

Given the complete absence of fundamental data at the beginning of the week, investor focus will be directed toward the speeches by Joachim Nagel, President of the Bundesbank, and Christine Lagarde, President of the European Central Bank. Their remarks, especially those relating to monetary policy forecasts and inflation expectations, could significantly impact the euro's exchange rate. Statements on the eurozone's geopolitical developments and economic growth prospects will also be important. Optimistic assessments may strengthen investor confidence in the euro, while fears of a recession could trigger a decline. Political factors should not be ruled out, either. Any statements concerning the fiscal policies of EU member states or prospects for deeper European integration could add further volatility to the currency market.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

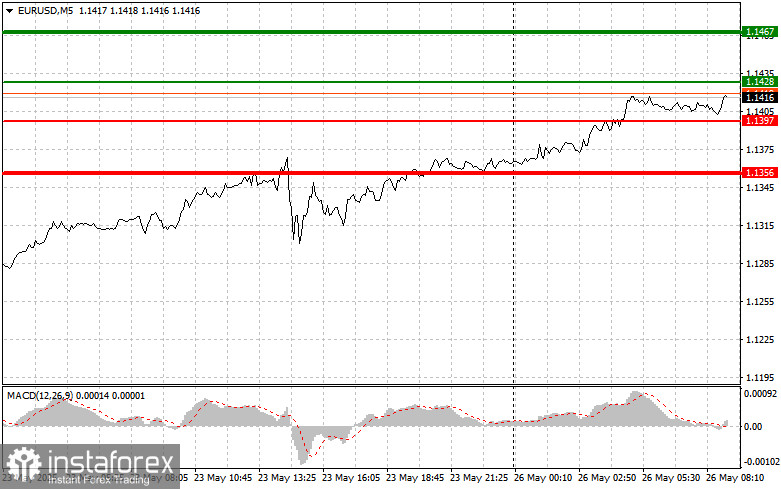

Scenario 1: Today, I plan to buy the euro when the price reaches around 1.1428 (green line on the chart), targeting a rise toward 1.1467. At 1.1467, I plan to exit the market and open a short position, aiming for a 30–35 pip move in the opposite direction. Continued euro growth can be expected after yesterday's news. Important: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1397 level, with the MACD indicator in the oversold zone. This will limit the downside potential and lead to a market reversal to the upside. A rise toward the opposite levels of 1.1428 and 1.1467 can be expected.

Sell Scenario

Scenario 1: I plan to sell the euro after it reaches the 1.1397 level (red line on the chart), targeting 1.1356, where I plan to exit and open a buy position in the opposite direction, aiming for a 20–25 pip move. Significant pressure on the pair is unlikely to return today. Important: Before selling, ensure the MACD indicator is below the zero line and starting to decline from it.

Scenario 2: I also plan to sell the euro today if there are two consecutive tests of the 1.1428 level while the MACD indicator is in the overbought zone. This will cap the pair's upside potential and trigger a reversal to the downside. A decline toward the opposite levels of 1.1397 and 1.1356 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.