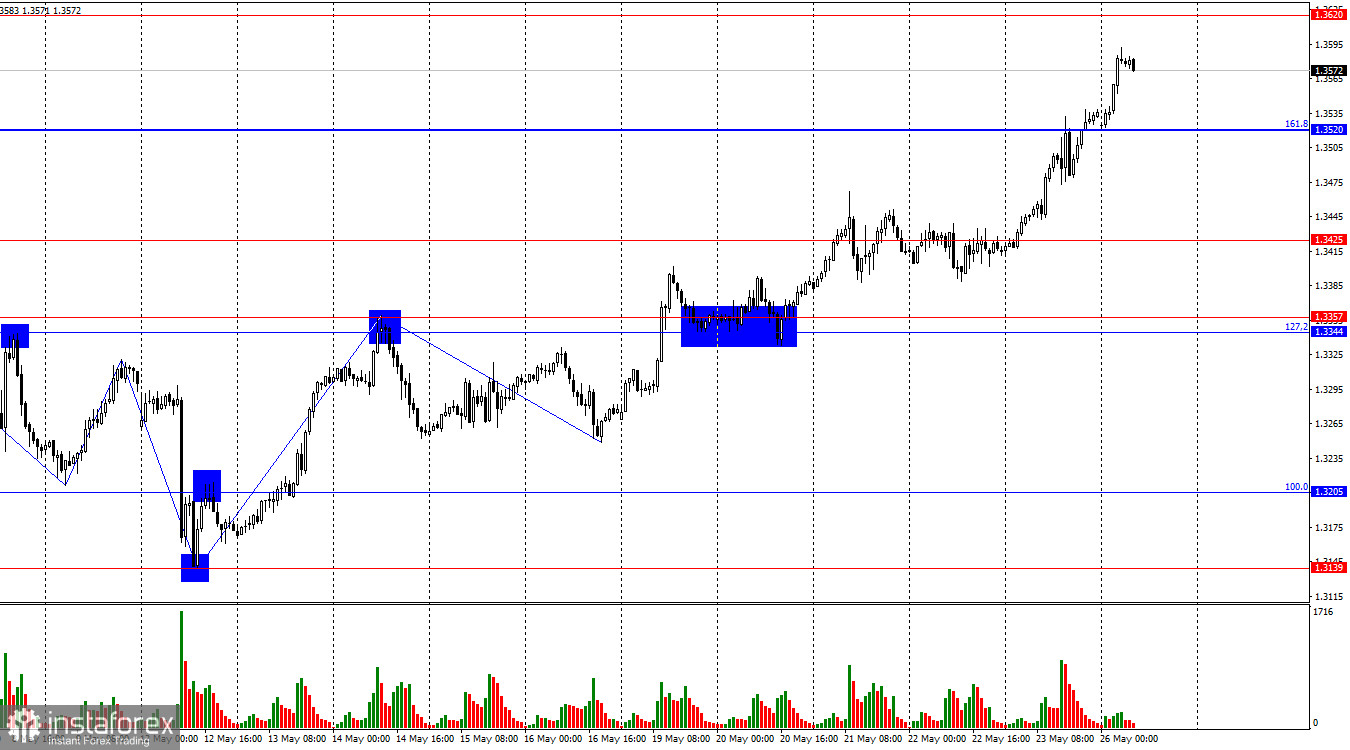

On the hourly chart, the GBP/USD pair continued its upward movement on Friday and consolidated above the 161.8% Fibonacci retracement level at 1.3520. The bulls' offensive hasn't let up for a minute—Monday began with another 65-point rally. A rejection from the 1.3620 level could trigger a minor pullback, but bears are currently absent from the market. A consolidation above 1.3620 will increase the chances of further growth toward the next Fibonacci level at 200.0% – 1.3715.

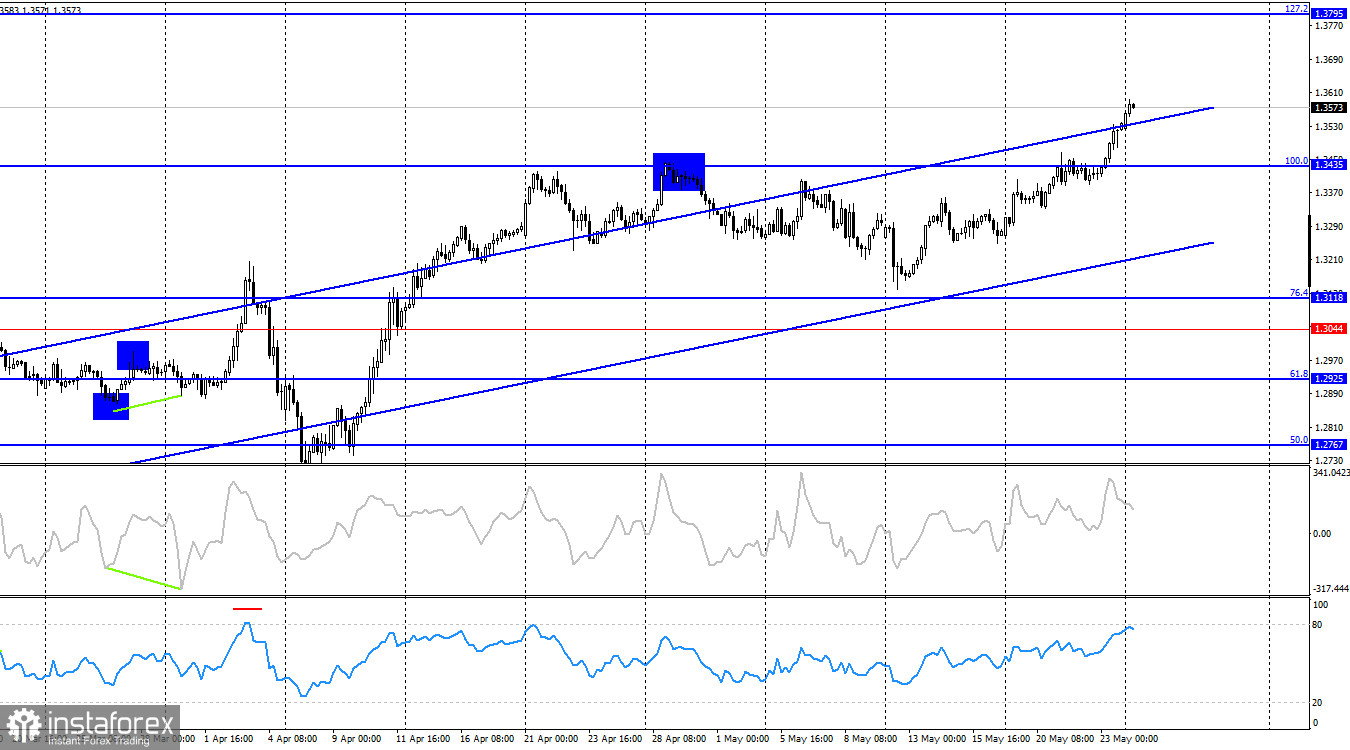

The wave structure has become more complex, but remains overall clear. The latest upward wave broke the previous high, while the last completed downward wave failed to break the prior low. Thus, the bearish trend has shifted to a bullish one. Bulls would normally struggle to push above 1.3425 without new developments—such as tariff hikes from Donald Trump—but such news did arrive at the end of last week.

Donald Trump decided to raise all tariffs on EU goods to 50%, citing stalled negotiations with Brussels. While it's hard to say what exactly that means, it's likely that the EU's latest offer didn't satisfy him. The U.S. President seems to want everything at once, often disregarding the interests of the EU or any other country. It's worth noting that this tariff hike is not yet final—more likely, it's a new threat aimed at pressuring the EU into making concessions. Nevertheless, Trump has "recommended" that Congress implement the hike starting June 1.

There's no mystery as to how traders interpreted this news: the U.S. dollar plummeted, and dollar selling continues around the clock. Even today, with no relevant news in play, bulls can keep pushing. There is no longer any struggle between bulls and bears—the bears are simply gone. Dollar bulls were hoping for a pause in the trade war, but that was short-lived.

On the 4-hour chart, the pair has already consolidated above the 100.0% Fibonacci level at 1.3435, which opens the way to the next target at 127.2% – 1.3795. No divergences are forming on any indicators today. The bullish trend is firmly intact and could persist for a long time. Trump clearly doesn't care about the dollar's fate.

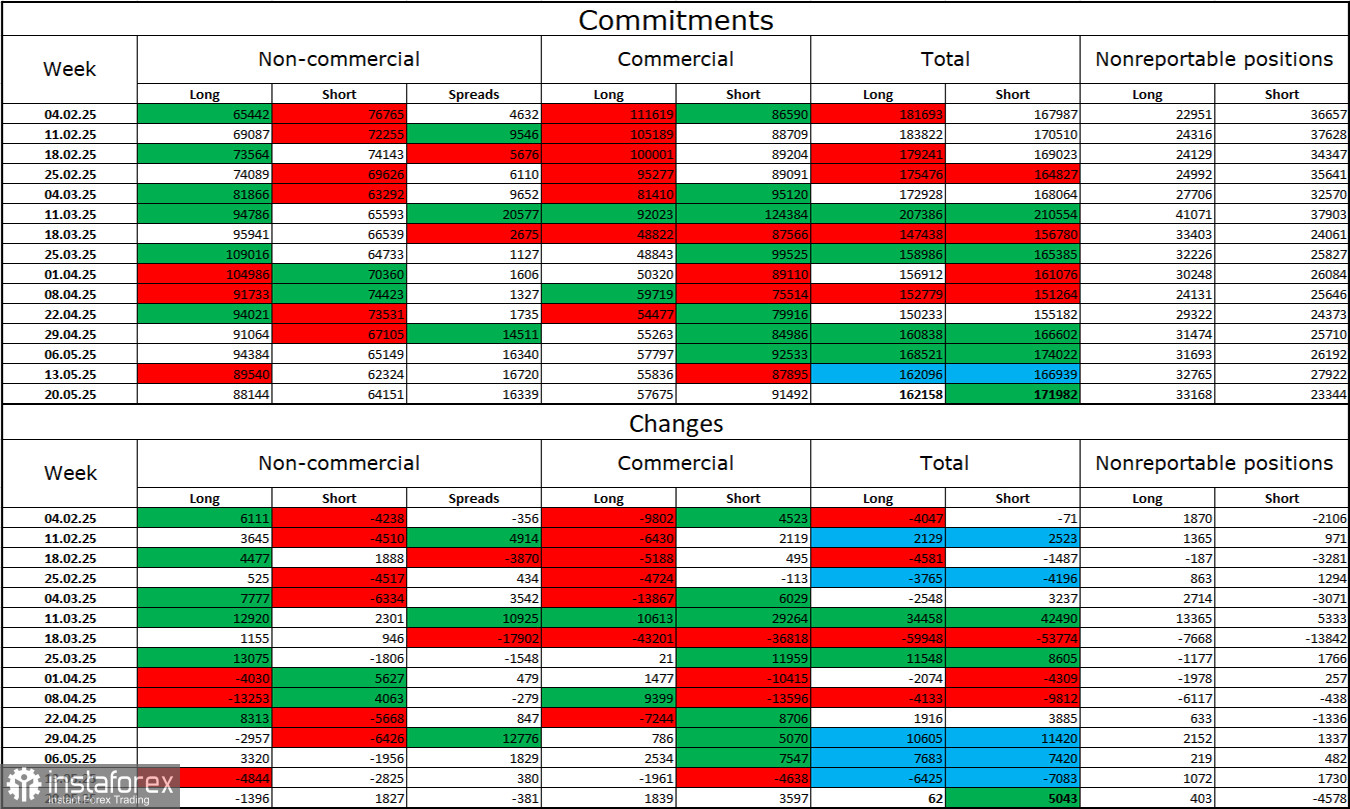

Commitments of Traders (COT) Report:

The sentiment among "Non-commercial" traders changed very little last week. The number of long positions decreased by 1,396, while short positions rose by 1,827. Bears lost their advantage long ago. The current spread between longs and shorts is 24,000 in favor of the bulls (88,000 vs. 64,000).

Despite potential headwinds, the pound still faces medium-term downside risks, but recent developments have shifted the market in the long-term. Over the past three months, long positions have grown from 65,000 to 88,000, while shorts have fallen from 76,000 to 64,000. Under Donald Trump, confidence in the dollar has eroded, and the COT data shows that traders are in no rush to buy it. Regardless of the broader news background, the dollar continues to fall due to Trump's actions.

Economic Calendar for the U.S. and UK:

Monday contains no noteworthy economic events. The news background will not influence market sentiment for the rest of the day.

GBP/USD Forecast and Trader Tips:

- Selling: Possible today from 1.3620 (hourly chart) targeting 1.3520, but keep in mind the absence of sellers.

- Buying: Previously valid on a close above 1.3344–1.3357 targeting 1.3425 (already hit). New long positions were possible after a close above 1.3435 on the 4-hour chart.

- The next bullish targets are 1.3620 and 1.3715.

Fibonacci Levels:

- Hourly chart: 1.3205–1.2695

- 4-hour chart: 1.3431–1.2104