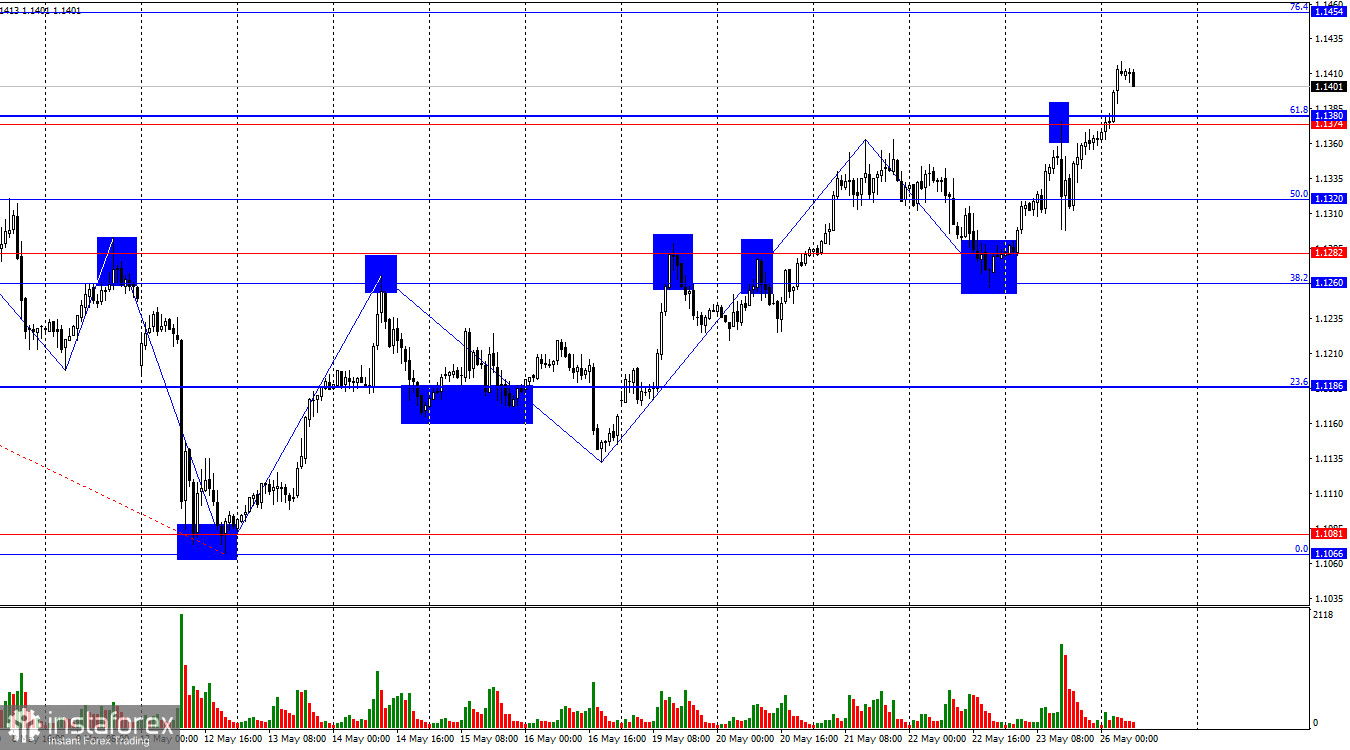

The wave structure on the hourly chart has shifted. The most recent upward wave broke the previous high, while the most recent completed downward wave failed to break the previous low. This confirms a bullish trend. News of progress in U.S.–China trade talks and the Fed's hawkish tone offered only temporary support to the bears. Once again, Donald Trump's policies are putting significant pressure on the U.S. dollar.

There was virtually no news on Friday, yet bulls continued their offensive throughout the day. Trump resumed talking about tariffs, criticized the EU's weak negotiating stance in trade talks, and lashed out at U.S. companies unwilling to relocate production back to America. In my view, Trump now understands the futility of his own strategy, acknowledging the failure of his political and economic plans. Markets are reacting to the helplessness of the U.S. president with continued selling of the dollar.

On Sunday evening, Jerome Powell gave a speech. As usual, everyone heard what they wanted to hear. Most traders interpreted it as a sign that the FOMC is on the verge of resuming monetary easing, justifying further dollar selling. However, in reality, Powell gave no indication of a rate cut anytime soon. The Fed Chair reiterated that the central bank needs to wait for final tariff decisions, assess how far they exceed projections, and understand the economic impact before taking any action on rates.

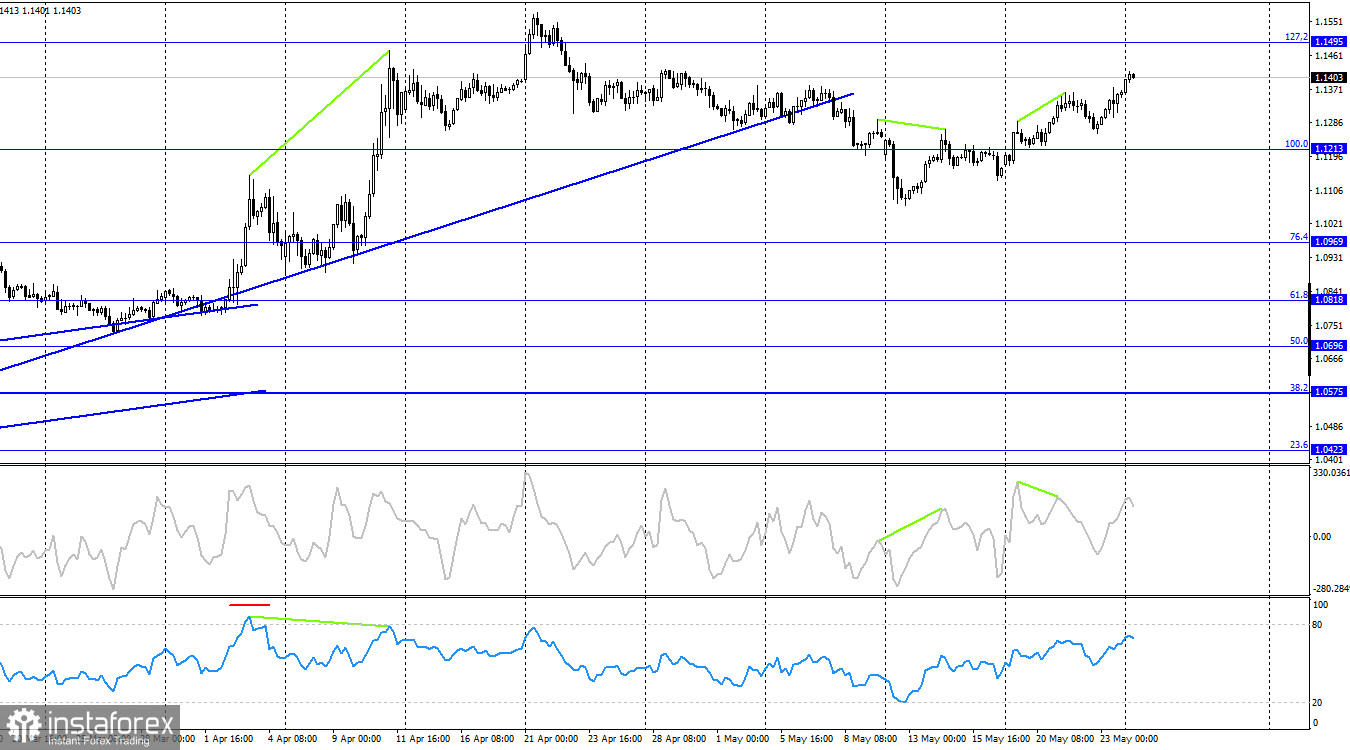

On the 4-hour chart, the pair reversed in favor of the euro and continued to rise toward the 127.2% Fibonacci level at 1.1495. A previous bearish divergence only led to a minor pullback, and currently, no new divergences are forming on any indicator. A rejection from 1.1495 would signal a potential reversal in favor of the U.S. dollar and a decline toward the 100.0% Fibonacci level at 1.1213. A break above 1.1495, however, would increase the likelihood of further growth toward the 161.8% level at 1.1851.

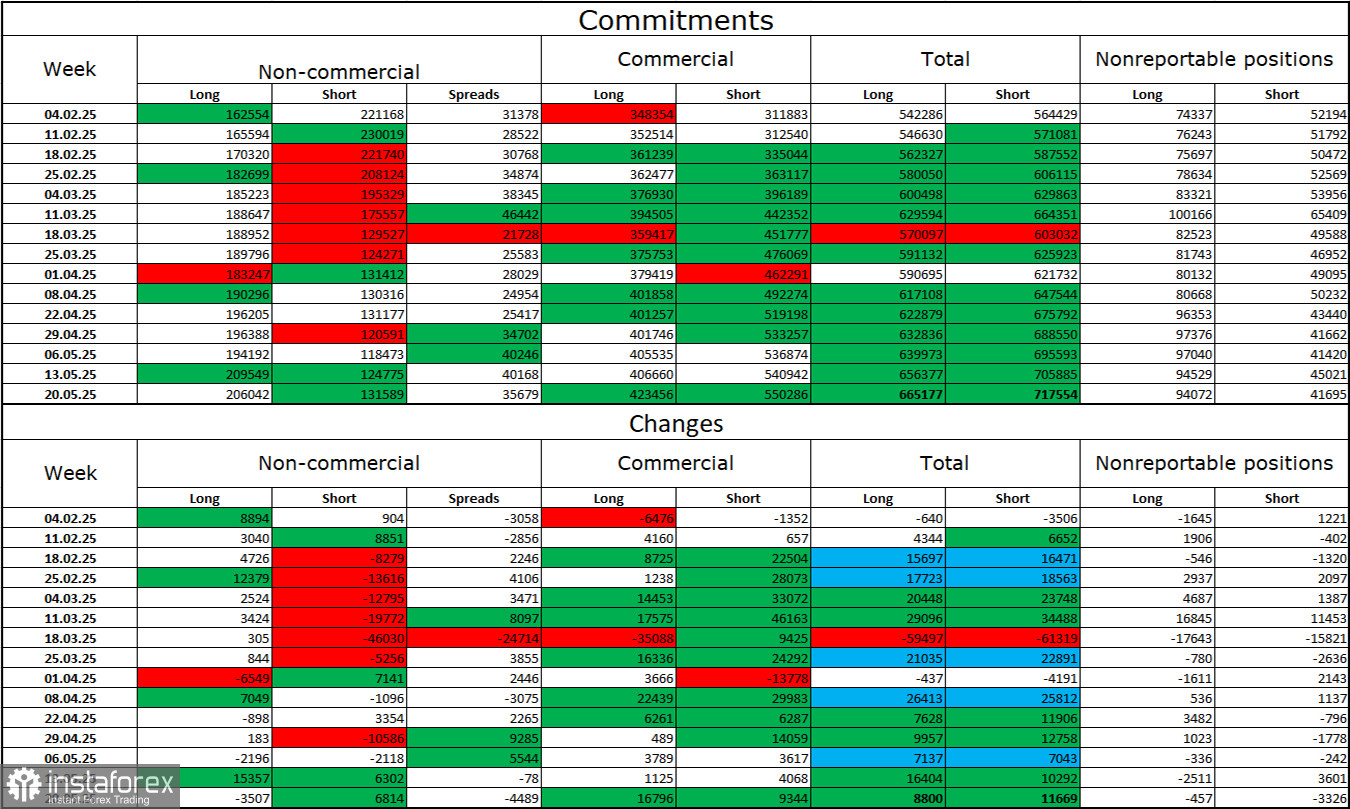

Commitments of Traders (COT) Report:

In the latest reporting week, institutional traders closed 3,507 long positions and opened 6,814 short positions. Nevertheless, sentiment among the "Non-commercial" group remains bullish, largely thanks to Donald Trump's policies. The total number of long positions held by speculators now stands at 206,000, compared to 132,000 shorts—a gap that continues to widen.

For sixteen consecutive weeks, large players have been reducing short positions and increasing longs. While the rate policy divergence between the ECB and Fed still technically favors the dollar, Trump's political strategy outweighs that factor, as it could trigger a recession and long-term structural challenges for the U.S. economy.

News Calendar for the U.S. and Eurozone:

- Eurozone – Speech by ECB President Christine Lagarde (13:20 UTC)

May 26 features only one notable event, so market sentiment on Monday is unlikely to be driven by news flow.

EUR/USD Forecast and Trader Tips:

Selling opportunities emerged following a rejection from the 1.1374–1.1380 level on the hourly chart, with downward targets at 1.1320 and the 1.1260–1.1282 support level. The nearest target has already been reached. Buying was previously recommended following a close above the 1.1260–1.1282 level, with targets at 1.1338 and 1.1374—both of which have now been reached. A close above 1.1380 now justifies new long positions, targeting 1.1454.

Fibonacci Grids:

- Hourly Chart: 1.1574–1.1066

- 4-Hour Chart: 1.1214–1.0179