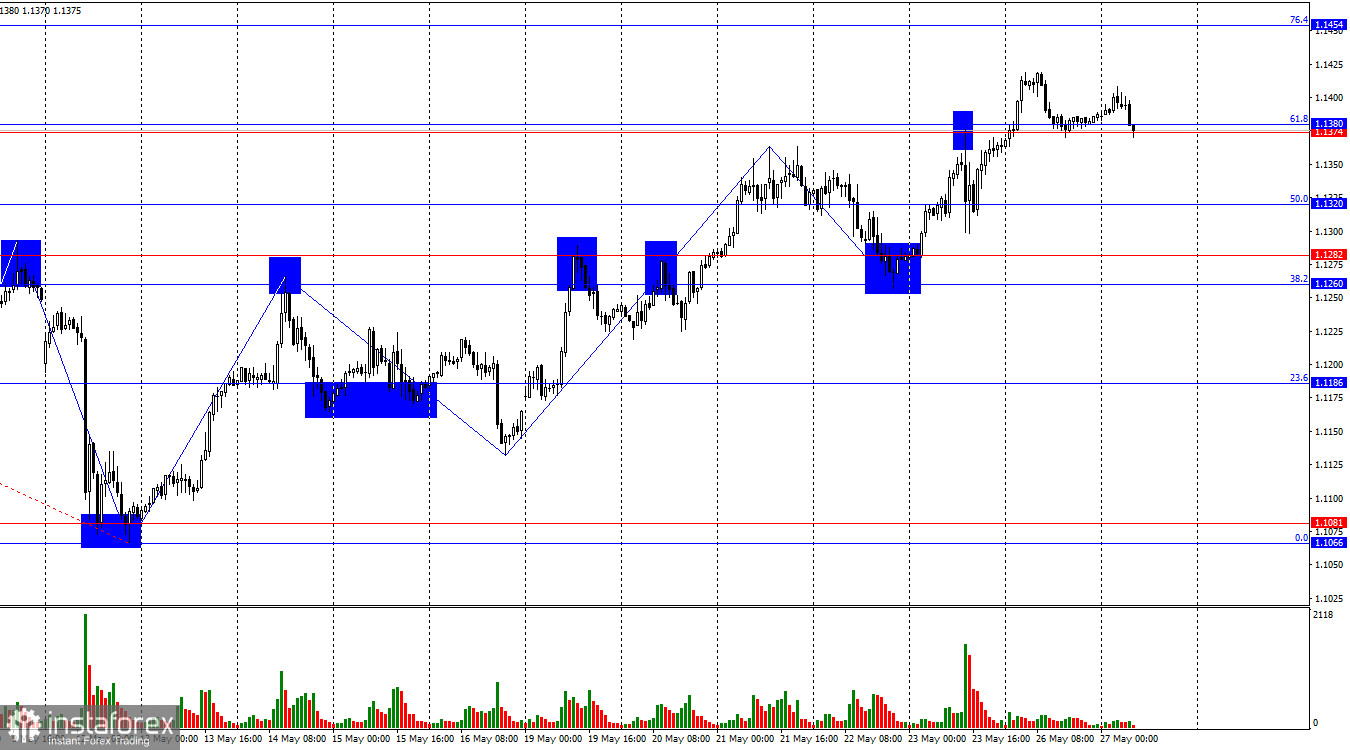

On Monday, the EUR/USD pair returned to the support zone of 1.1374–1.1380. A rebound from this zone would once again work in favor of the euro and a resumption of growth toward the 76.4% retracement level at 1.1454. The bulls haven't retreated or given up—they've only taken a short pause after their latest advance. A consolidation below the 1.1374–1.1380 zone would favor the U.S. dollar and allow for some recovery toward the 50.0% Fibonacci level at 1.1320.

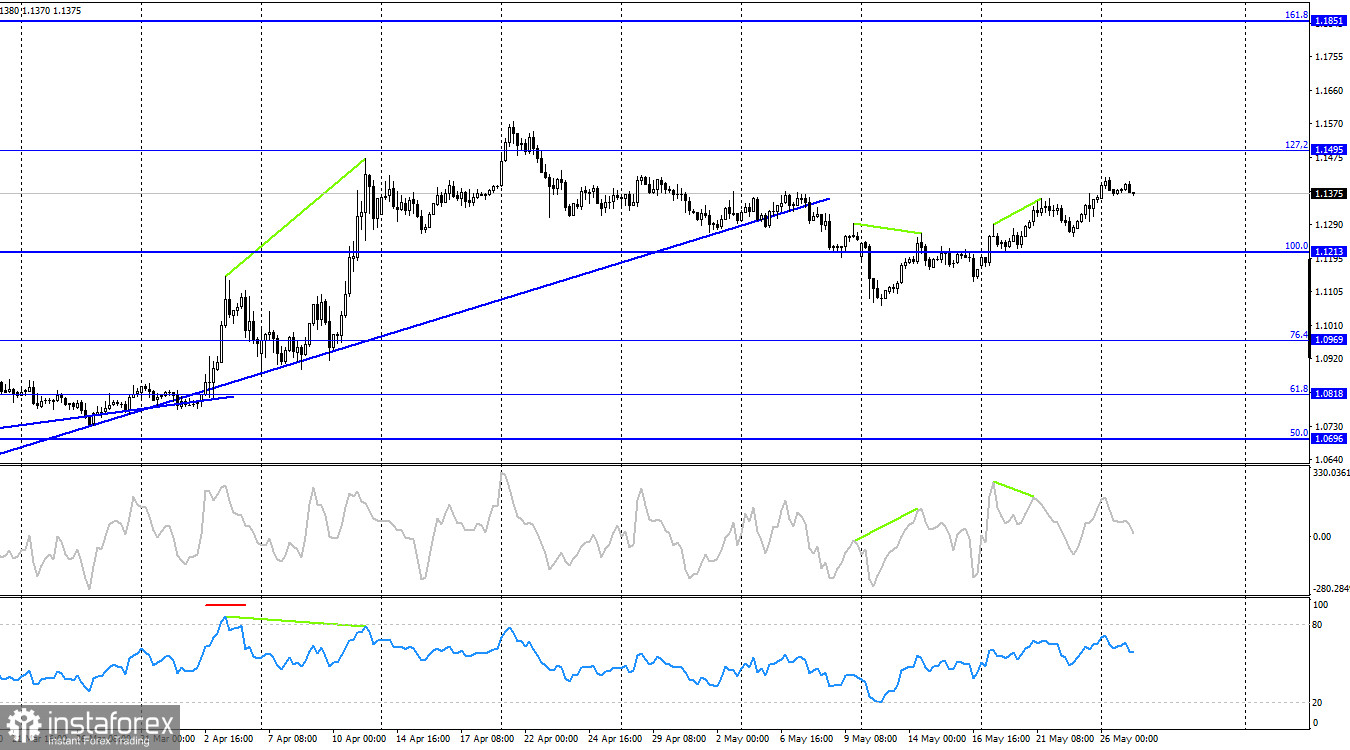

On the 4-hour chart, the pair has reversed in favor of the euro and continues its rise toward the 127.2% Fibonacci retracement level at 1.1495. The previous bearish divergence only triggered a minor pullback. Currently, no new divergences are emerging on any indicator. A rebound from 1.1495 could signal a reversal in favor of the U.S. dollar and a move down toward the 100.0% level at 1.1213, while a breakout above 1.1495 would increase the likelihood of continued growth toward the next retracement level at 1.1851 (161.8%).

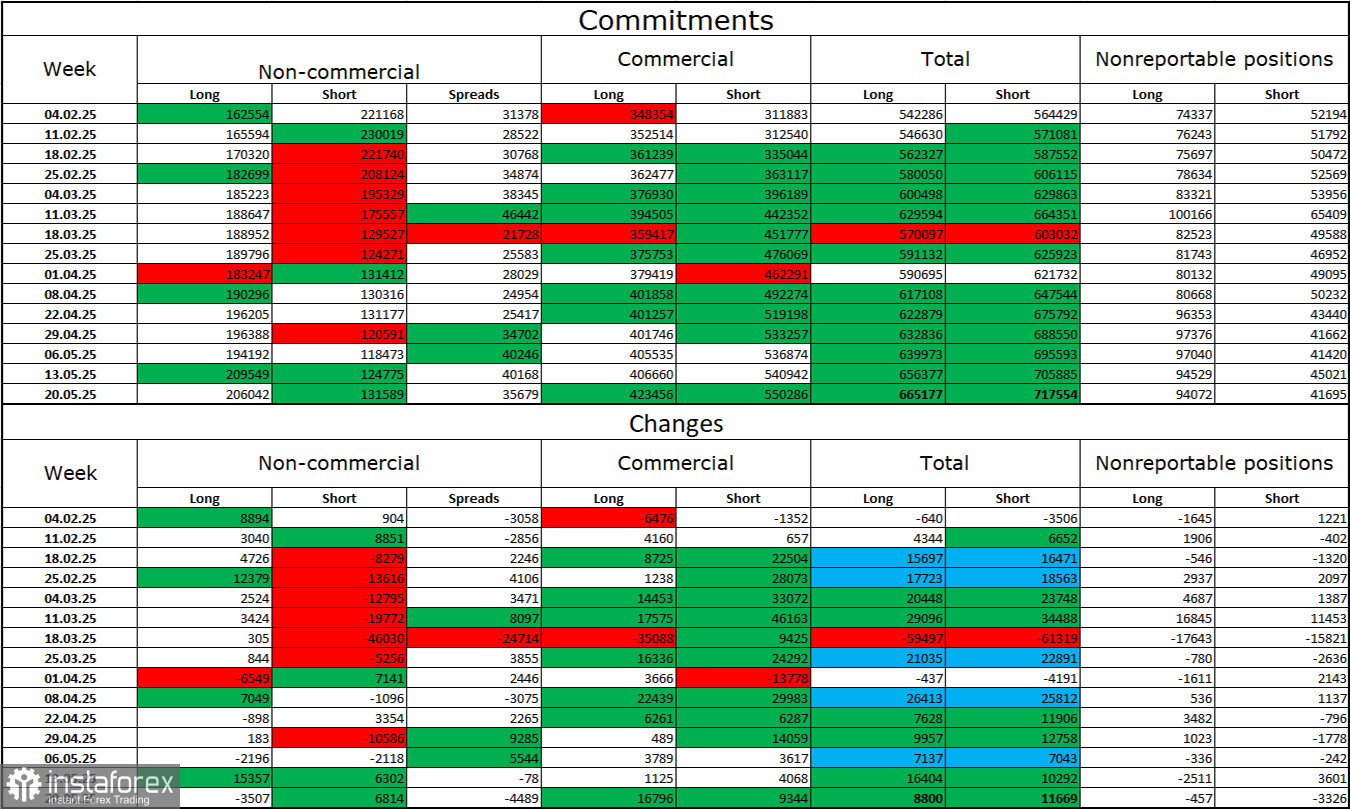

Commitments of Traders (COT) Report:

Over the past reporting week, professional traders closed 3,507 long positions and opened 6,814 short positions. Sentiment among the "Non-commercial" group remains bullish—thanks to Donald Trump. The total number of long positions held by speculators now stands at 206,000, while short positions total 132,000—and the gap is steadily widening. Thus, demand for the euro persists, while interest in the dollar continues to decline. The situation remains unchanged.

For 16 consecutive weeks, large players have been reducing short positions and increasing longs. Despite the divergence in monetary policy between the ECB and the Fed—favoring a wider interest rate differential that should support the dollar—Trump's policies are currently a stronger market factor. They risk causing a recession in the U.S. and triggering a range of long-term structural issues.

News Calendar for the U.S. and the EU:

- EU – GfK German Consumer Confidence Index (06:00 UTC)

- U.S. – Change in Durable Goods Orders (12:30 UTC)

The economic calendar for May 27 contains two key entries. The news background may influence market sentiment on Tuesday, with stronger impact likely in the second half of the day. Bears urgently need support from news and reports.

EUR/USD Forecast and Trading Recommendations:

Selling the pair is advisable if it closes below the 1.1374–1.1380 zone, targeting 1.1320 and 1.1282. Buying was previously recommended above the 1.1260–1.1282 zone, with targets of 1.1338 and 1.1374—all of which have been reached. A rebound from the 1.1374–1.1380 zone would offer a new opportunity to open long positions, with a target of 1.1454.

Fibonacci grids are drawn from 1.1574–1.1066 on the hourly chart and 1.1214–1.0179 on the 4-hour chart.