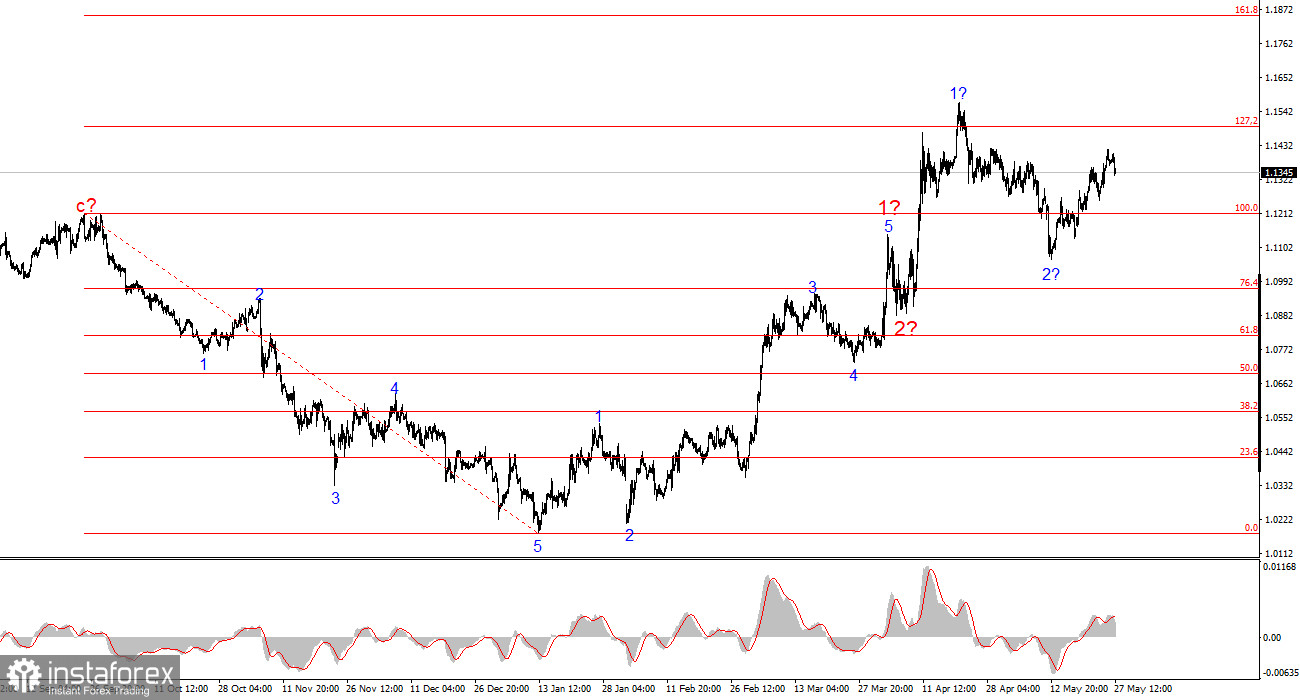

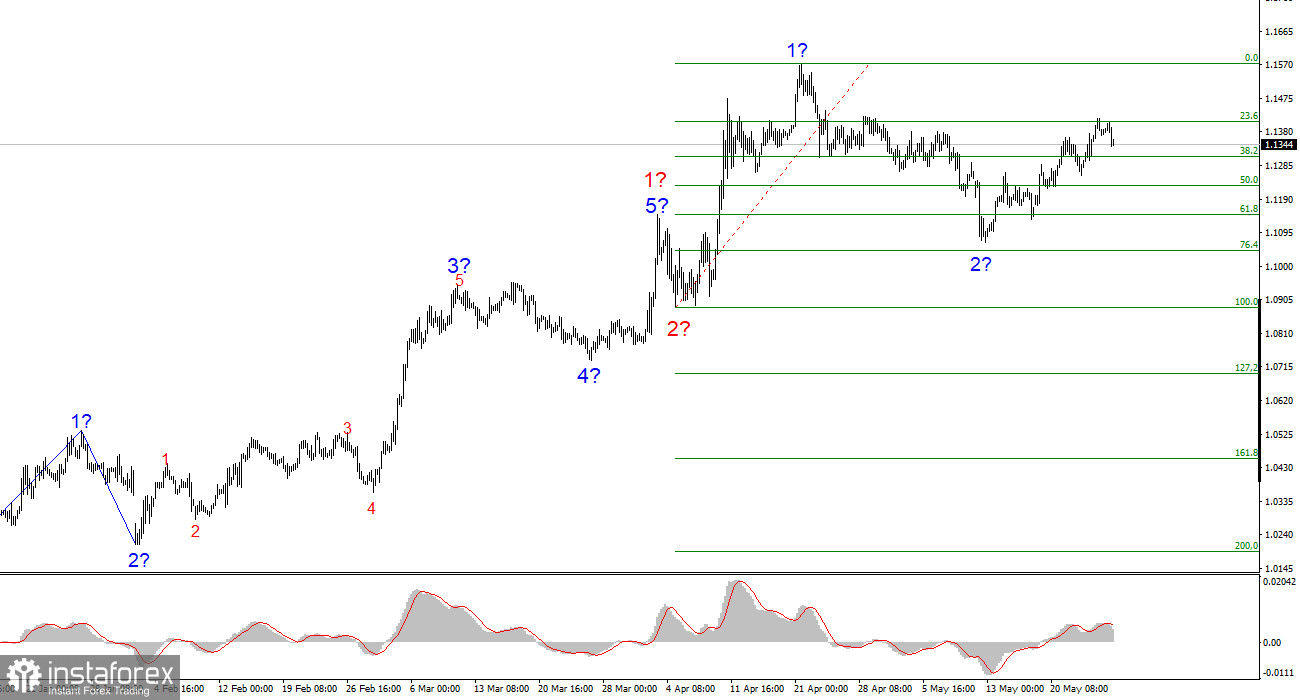

The wave pattern on the 4-hour chart for EUR/USD has shifted into a bullish structure and continues to hold that form. I believe there's little doubt that this transformation has occurred solely due to the new U.S. trade policy. Until February 28, when the U.S. dollar began to decline sharply, the wave pattern clearly reflected a downward trend segment and was forming corrective Wave 2. However, Donald Trump's weekly announcements about various new tariffs did their job—demand for the dollar began to drop rapidly, and the entire trend segment starting from January 13 has now taken the form of an impulsive bullish move.

At present, it appears that Wave 2 of 3 has completed. If this assumption is correct, price appreciation is expected to continue over the coming weeks and months. That said, the U.S. dollar will remain under pressure unless Donald Trump completely reverses his trade policy. The chances of that happening are extremely slim, but the dollar won't fall forever either. At the moment, there are no strong reasons to expect a sustained recovery in the greenback.

On Tuesday, EUR/USD fell by 60 basis points, but again, no strong conclusions can be drawn. In fact, it would be a mistake to assume that the dollar is strengthening just because it gained 0.4%. Over the past four months, demand for the U.S. dollar has been steadily declining, and nothing seems to be stopping the ongoing wave of dollar sell-offs. The news backdrop in recent days and weeks has not changed in a way that would justify renewed demand for the dollar.

Previously, each analyst had at least a partially unique perspective. Now, the news flow is so straightforward that everyone agrees on the reasons for the dollar's decline. Global trust in the U.S. has plummeted since Trump's re-election. The U.S. dollar—long regarded as a safe haven currency—is now seen as a risky asset.

- First, the dollar is in a sustained downtrend, which naturally reduces interest in holding it.

- Second, the new U.S. trade policy is expected to bring more harm than benefit to the country itself.

But that's not all. Trump is also pushing a new tax-cut bill which, according to economists, could increase the national debt by $2.3 trillion if passed. The bill, despite its title, is not a true tax cut, as it includes several controversial provisions. Trump barely managed to push it through the House of Representatives, and now faces a vote in the Senate.

General Conclusions

Based on this EUR/USD analysis, I conclude that the instrument is continuing to form a bullish trend segment. In the near term, the wave pattern will be entirely dependent on the news background, especially on Trump's decisions and U.S. foreign policy. Wave 3 of the upward trend has now begun, with potential targets extending up to the 1.2500 level. I therefore continue to consider buy positions, with targets above 1.1572, which corresponds to the 423.6% Fibonacci extension.

It should be remembered that a de-escalation of the trade war could reverse the bullish trend—but at the moment, there are no signs of either a reversal or de-escalation.

On the higher time frame, the wave structure has clearly transformed into a bullish trend. A long-term upward wave sequence may be unfolding—but news from Donald Trump personally still has the power to turn everything upside down again.

Core Principles of My Analysis:

- Wave structures should be simple and clear. Complex patterns are difficult to trade and often subject to revision.

- If you're not confident in the market situation, it's better to stay out.

- There can never be 100% certainty in market direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.