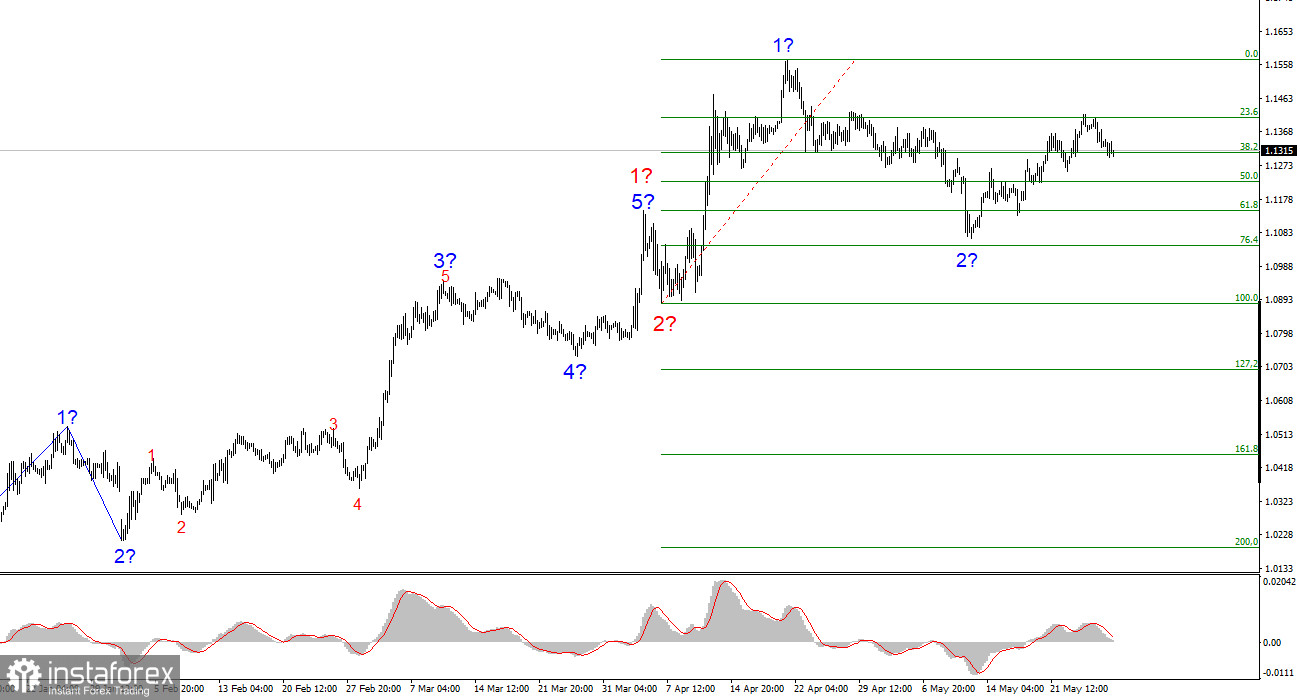

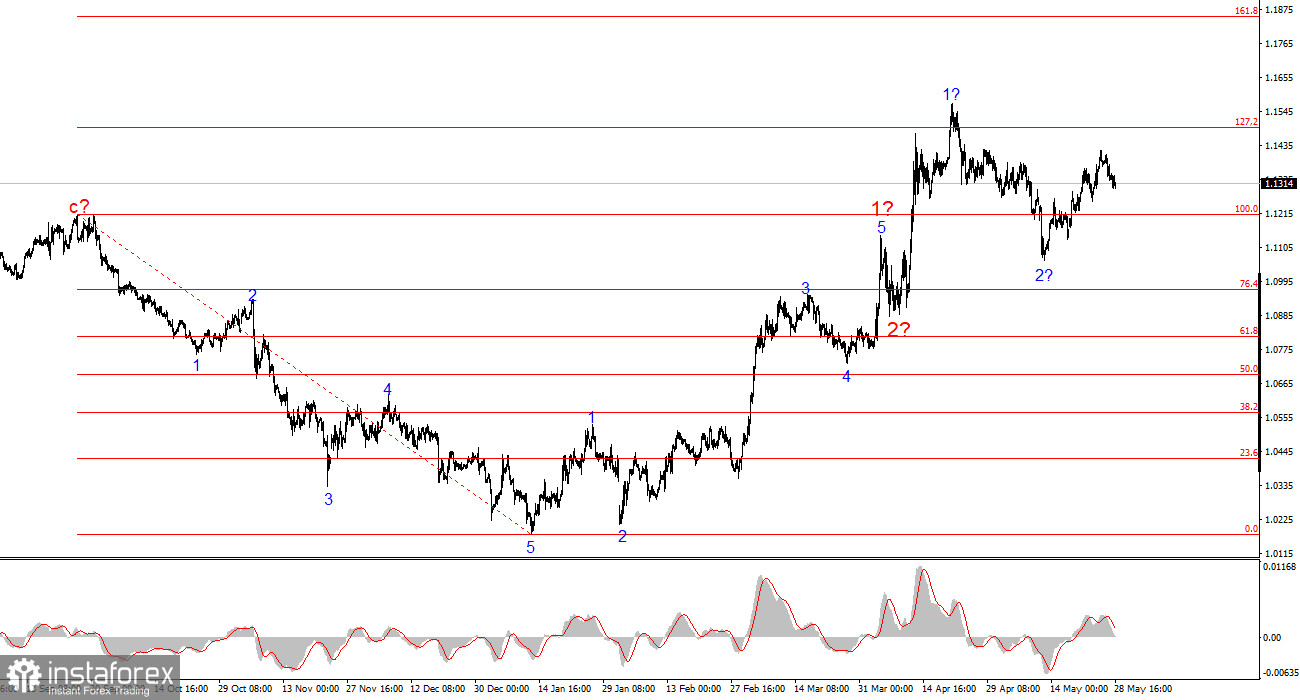

The wave structure on the 4-hour EUR/USD chart has transformed into a bullish configuration and continues to follow that trajectory. There is little doubt that this transformation was driven solely by the new U.S. trade policy. Prior to February 28, when the U.S. dollar began to depreciate sharply, the wave pattern indicated a convincing downward trend, with a corrective wave 2 in progress. However, Donald Trump's weekly announcements about various new tariffs triggered a sharp drop in demand for the dollar. As a result, the entire trend segment starting from January 13 now presents as a bullish impulse wave.

At present, it is assumed that wave 2 within wave 3 has been completed. If this is correct, the upward movement in the pair is likely to continue over the coming weeks and months. However, the U.S. dollar will remain under pressure unless Donald Trump completely reverses his current trade policy—a scenario with very low probability. That said, the dollar is unlikely to keep falling indefinitely. For now, though, there are no grounds to expect strong growth in the U.S. currency.

On Wednesday, EUR/USD remained virtually unchanged, and price movements were minimal. As expected, the market took a short pause, given the lack of news during the day. Honestly, even on Monday and Tuesday, the dollar's gains looked questionable. The greenback strengthened slightly following the announcement that the proposed tariff hike on the EU—up to 50%—would be postponed until July 9, as Donald Trump decided to give Brussels more time for negotiations. However, I must remind readers that an extension of the grace period or a delay in tariff increases is not a de-escalation of the trade war. It is simply the absence of further escalation. In other words, there is no actual good news.

Based on this, I expect the upward wave formation and bullish trend segment to continue. This week may remain relatively subdued, as there is little major economic data scheduled. Trump appears to have cooled his stance toward China and the EU, granting both parties time for negotiations, meaning further escalation headlines are unlikely. I believe we will witness lackluster market behavior through the end of the week. The bullish trend is likely to persist, as reversing it would require a complete U-turn in Trump's trade policy.

Summary Conclusions

Based on the current EUR/USD analysis, the pair is continuing to develop a bullish trend. In the short term, the wave pattern will depend entirely on news related to Trump's decisions and U.S. foreign policy. Wave 3 of the bullish trend appears to be unfolding, with potential targets extending as far as the 1.2500 area. As such, I continue to favor buying, with targets above 1.1572, which corresponds to 423.6% Fibonacci extension. It's worth remembering that any de-escalation in the trade war could trigger a reversal in the uptrend, although there are currently no signs of such a shift.

On the higher time frame, the wave pattern has also turned bullish. A long-term upward wave structure is likely in development, but it remains vulnerable to another complete reversal triggered by Trump's policy moves.

Key Principles of My Analysis

- Wave structures should be simple and clear. Complex formations are difficult to trade and are often subject to change.

- If you're uncertain about what's happening in the market, it's better to stay out.

- Absolute certainty about market direction is never possible. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.