At the close of the most recent regular trading session, U.S. stock indices posted modest losses. The S&P 500 declined by 0.56%, the Nasdaq 100 fell by 0.71%, and the Dow Jones Industrial Average dropped by 0.58%.

However, during today's Asian session, U.S. index futures received a boost after the vast majority of tariffs imposed by President Donald Trump were ruled illegal and blocked by a U.S. trade court. A strong earnings report from Nvidia Corp. also lifted investor sentiment. A three-judge panel of the U.S. Court of International Trade in Manhattan unanimously sided with Democratic-led states and small businesses, who accused Trump of misusing emergency powers to justify most of the tariffs.

This court decision was undoubtedly a breath of fresh air for markets weary of ongoing trade war uncertainty. Investors interpreted the tariff block as a signal of reduced risks to the global economy, which was immediately reflected in stock prices. Optimism is now fueled by hopes for a more predictable and stable trade policy, which in turn could spur global trade and investment.

Nvidia Corp.'s report further supported the upbeat tone. The company posted impressive results, surpassing analysts' expectations, reinforcing the view that the tech sector remains a key driver of U.S. economic growth. Nvidia's success is particularly tied to rising demand for graphics processors used in data centers and artificial intelligence applications. Shares of Nvidia rose nearly 5% in after-hours trading in New York.

Futures on the S&P 500 and Nasdaq 100 climbed by 1.6% and 2%, respectively. Asian indices gained 0.6%, while Japanese and South Korean markets rose by 1.5%. The yen weakened and the dollar strengthened, with the dollar index reaching its highest level in over a week. The yield on 10-year U.S. Treasury notes rose by three basis points.

The court gave the administration 10 days to comply with the ruling but did not provide specific instructions on how the tariffs should be reversed. Since Trump's team has already filed an appeal, the U.S. Supreme Court may ultimately have the final say in this high-stakes case, which could significantly impact the global economy and trade landscape.

Meanwhile, shares of Chinese tech companies fell after the Trump administration ordered some American manufacturers to halt shipments of chips and semiconductors to China.

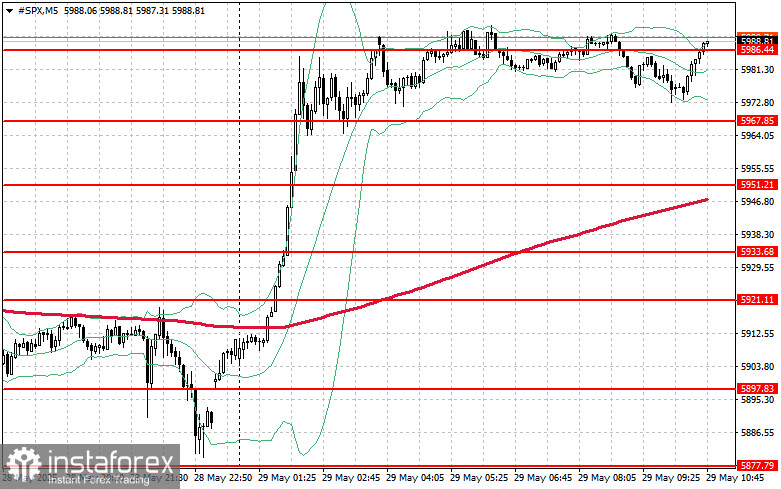

Technical Outlook for the S&P 500:

The primary target for buyers today will be to break through the nearest resistance at $5986. This would signal further upward movement and potentially open the way to a new level at $5999. Another key objective for bulls is to gain control over $6017, which would further strengthen their position.

If the market moves downward amid declining risk appetite, buyers must step in near the $5967 level. A breakdown there would likely send the index back to $5951 and open the door to $5933.