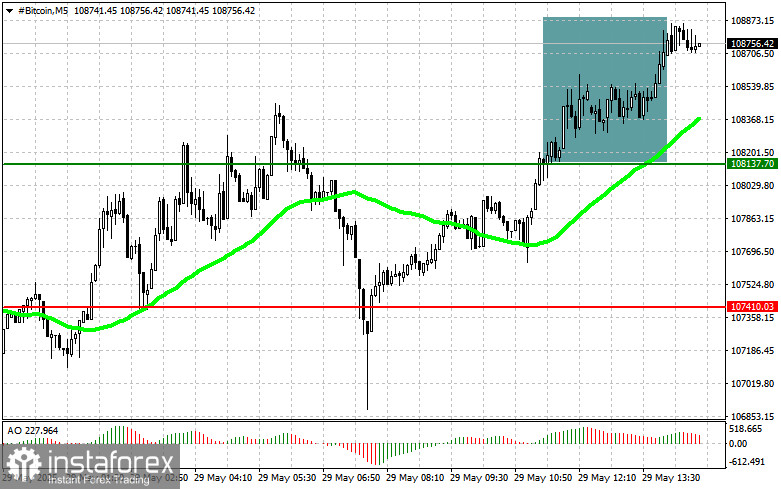

Bitcoin has shown a fairly solid rebound, climbing back above the $108,000 mark and breaking through $109,000. The chart below highlights a morning breakout through the $108,100 level.

Statistics confirm that new participants and players actively enter the market. Amid growing interest in the cryptocurrency space and Bitcoin's price volatility, analyzing whale behavior clears up the picture. According to the latest data, the number of wallets holding between 1,000 and 10,000 BTC continues to grow steadily, signaling an ongoing accumulation process.

Interestingly, the data provided by CryptoQuant excludes wallets owned by miners and crypto exchanges, which allows for a more accurate assessment of independent investor behavior. Monitoring groups specializing in crypto market activity report that wallets with 1,000 to 10,000 BTC represent one of the most active whale groups. Their actions significantly impact price movements and overall market sentiment.

The accumulation of Bitcoin by these wallets likely reflects strong confidence among large holders in the long-term bullish outlook for cryptocurrency. They may view current price levels as attractive buying opportunities, betting on further price increases in the future.

The activity of these wallets deserves close attention, as large transactions made by whales can trigger short-term price swings and increase market volatility.

Intraday strategy

As for the intraday strategy in the crypto market, I plan to continue buying based on any major dips in Bitcoin and Ethereum, expecting the bullish mid-term trend to remain intact.

Short-term trading strategy

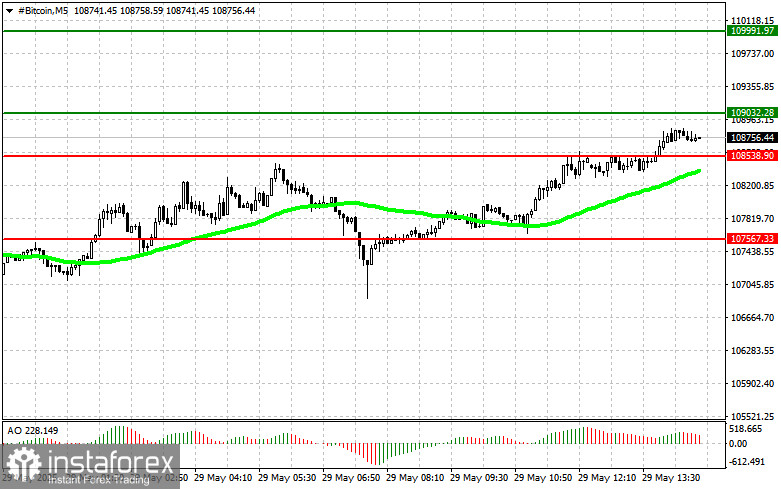

Bitcoin

Bitcoin buy scenarios

Scenario 1: I'll buy Bitcoin today upon reaching the $109,000 entry point, targeting a rise to $110,000. At the $110,000 mark, I'll exit long positions and sell immediately on the pullback. Before executing a breakout buy, I'll make sure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario 2: Buying BTC from the lower boundary at $108,500 is also possible, provided there's no bearish reaction to a break below. In this case, the targets will be $109,000 and $110,000.

Bitcoin sell scenarios

Scenario 1: I'll sell Bitcoin today if it reaches the $108,500 entry point, targeting a drop to $107,500. At $107,500, I'll exit short positions and buy immediately on the bounce. Before selling on a breakout, I'll ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario 2: Selling BTC from the upper border at $109,000 is also viable if there's no bullish reaction to a breakout. Targets here would be $108,500 and $107,500.

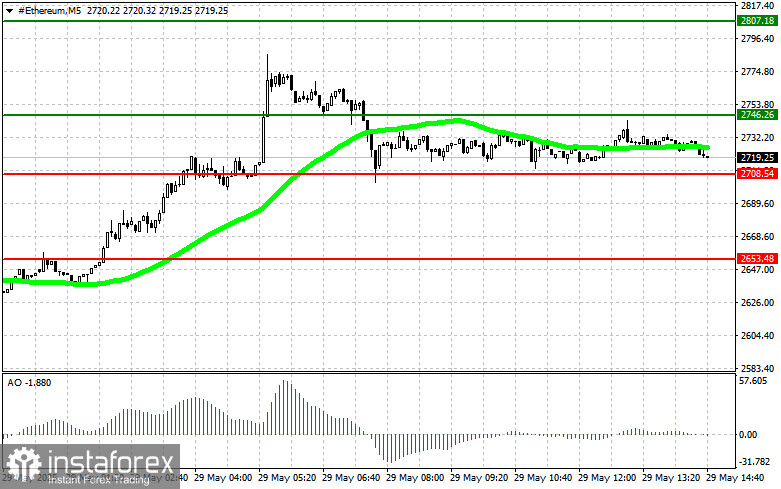

Ethereum

Ethereum buy scenarios

Scenario 1: I'll buy Ethereum today upon reaching the $2,746 entry point, with a target at $2,807. At $2,807, I'll exit long positions and sell on the pullback. Before executing the breakout buy, I'll check that the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario 2: Buying ETH from the lower boundary at $2,708 is an option if there's no market reaction to a downside break, targeting $2,746 and $2,807.

Ethereum sell scenarios

Scenario 1: I'll sell Ethereum today if it hits the $2,708 entry point, aiming for a decline to $2,653. At $2,653, I'll exit short positions and buy immediately on the bounce. Before selling on a breakout, I'll ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario 2: Selling ETH from the upper border at $2,746 is also possible if there's no bullish reaction to the breakout, with targets at $2,708 and $2,653.