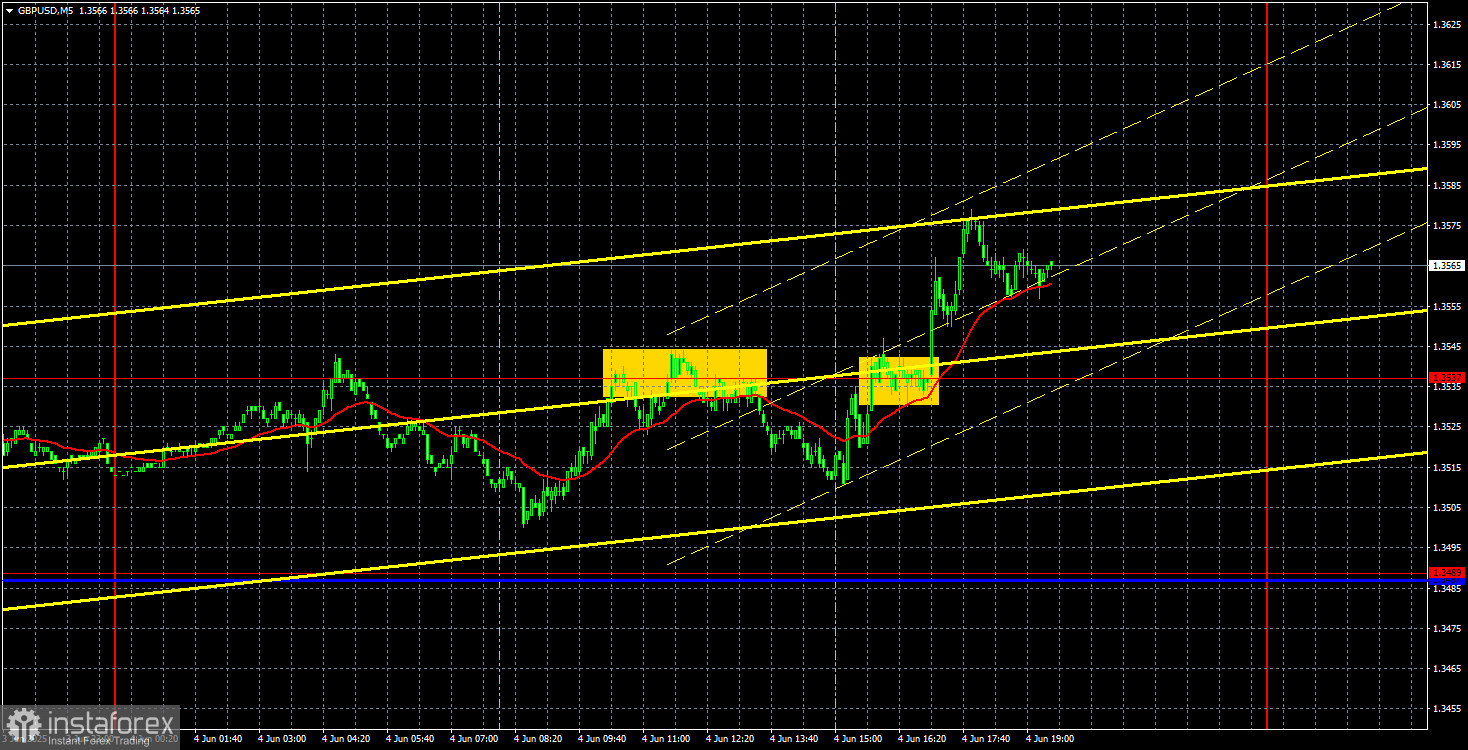

GBP/USD 5-Minute Analysis

On Wednesday, the GBP/USD currency pair also traded higher, although volatility remained low. Nevertheless, the British pound rose throughout the day. While there were no strong reasons for this during the European session, they emerged during the American session. Even in the morning, the UK released a services PMI report that turned out better than expected. Thus, even that report — from which absolutely nothing was expected — triggered new buying in the pair. And what can we say about the ADP and ISM reports, which are more significant and disappointing? Naturally, the market happily continued to dump the U.S. dollar.

The pair has approached its local and 3-year highs in the hourly time frame. It seems that breaking through these levels and continuing the rise is only a matter of time. We still do not see the most important thing — not positive news on the trade war, but even a slight desire from the market to buy the dollar occasionally. Recall that most dollar-positive news is ignored, while any weak report from the U.S. triggers a new wave of dollar selling. However, Trump, not the U.S. economy, is to blame for this attitude toward the dollar.

Yesterday, two trading signals were formed in the 5-minute time frame. First, the pair bounced off the 1.3537 level, leading to a 16-pip drop. Then, the pair broke through 1.3537, leading to a 25-pip rise. As we can see, movements throughout the day were weak despite the macroeconomic data, and the trading signals were weak, too. The first trade resulted in a small loss, as the price failed to move 20 pips in the desired direction. The second trade could be closed with a small profit.

COT Report

COT reports for the British pound show that commercial traders' sentiment has constantly changed over the past few years. The red and blue lines, representing the net positions of commercial and non-commercial traders, cross frequently and generally hover near the zero mark. They are again close to each other, indicating an approximately equal number of long and short positions. However, the net position has been growing over the past year and a half.

The dollar continues to decline due to Trump's policies, so market makers' demand for the pound is currently not of major importance. If the de-escalation of the global trade war resumes, the dollar may have a slight chance to strengthen. According to the latest COT report for the British pound, the "Non-commercial" group opened 14,200 BUY contracts and 2,800 SELL contracts. Thus, the net position of non-commercial traders grew by 11,400 contracts.

The pound has grown significantly lately, but it's important to understand that the main reason is Trump's policies. Once this reason is neutralized, the dollar could recover — but no one knows when that will happen. The pound itself has no fundamental reasons for growth. Nevertheless, traders currently have more than enough "Trump factor" to make trading decisions.

GBP/USD 1-Hour Analysis

The GBP/USD pair maintains its upward trend in the hourly time frame despite consolidating below the ascending channel. Further movement in the pair entirely depends on Donald Trump and developments in the Global Trade War rather than technical analysis. Overall sentiment and the market's attitude toward America and its president remain sharply negative, making it difficult for the dollar to expect significant growth. Additionally, Trump continues to upset the market with new measures and tariffs, and U.S. macroeconomic data are increasingly weak.

For June 5, we highlight the following important levels: 1.2981-1.2987, 1.3050, 1.3125, 1.3212, 1.3288, 1.3358, 1.3439, 1.3489, 1.3537, 1.3637-1.3667, 1.3741. The Senkou Span B (1.3462) and Kijun-sen (1.3511) lines can also serve as sources of signals. Setting the Stop Loss to breakeven is recommended once the price moves 20 pips in the right direction. Ichimoku indicator lines can shift during the day, which should be considered when determining trading signals.

No significant events are scheduled in the UK for Thursday — neither major nor minor. In the U.S., there will only be the jobless claims report. Therefore, we are likely in for another not-so-exciting day.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.