A fairly large number of macroeconomic publications are scheduled for Friday, but most of them will not interest traders. For example, the report on industrial production in Germany or the retail sales report in the Eurozone. Even the GDP report in the Eurozone (third estimate for the first quarter) is unlikely to have any impact on market sentiment. However, U.S. publications may trigger a storm of emotions in the market. The NonFarm Payrolls and unemployment rate reports remain among the most important. If the U.S. labor market shows signs of slowing and unemployment continues to rise, traders will associate these events with Donald Trump's tariff policy and will expect the Fed to resume its monetary policy easing cycle. And right now, it doesn't take much for the dollar to fall.

Analysis of Fundamental Events:

There's absolutely nothing noteworthy among fundamental events. The ECB meeting has already taken place, and the Bank of England and Fed meetings will be held later, but they carry no intrigue either. Both central banks are 90% likely to leave key interest rates unchanged.

We believe the market still cares only about the ongoing trade war. The dollar's decline may continue if trade agreements with most countries are not signed before the end of the grace period — and that ends in just a month. The dollar may continue to fall even without new tariffs from Trump, as market sentiment toward the U.S. president and his policies remains extremely negative. The International Trade Court decided to block Trump's tariffs, but the U.S. Appeals Court overturned this decision the same day. Later, it was announced that tariffs on imported steel and aluminum would be increased.

General Conclusions:On the last trading day of the week, both currency pairs will trade based on technical factors in the first half of the day and U.S. macroeconomic data in the second. Thus, we can expect sluggish, low-volatility movements in the morning and a storm after lunch.

Main Rules of the Trading System:

- The strength of a signal is determined by how quickly it is formed (bounce or breakout). The less time it takes, the stronger the signal.

- If two or more false signals are generated around the same level, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate many false signals or none at all. In any case, at the first signs of flat conditions, it's better to stop trading.

- Trading positions should be opened between the start of the European session and the middle of the American session; afterward, all trades should be closed manually.

- On the hourly timeframe, it is preferable to trade MACD signals only when there is good volatility and a trend confirmed by a trendline or trend channel.

- If two levels are located too close to each other (5 to 20 points apart), they should be considered a support or resistance area.

- After moving 15–20 points in the right direction, set the Stop Loss to breakeven.

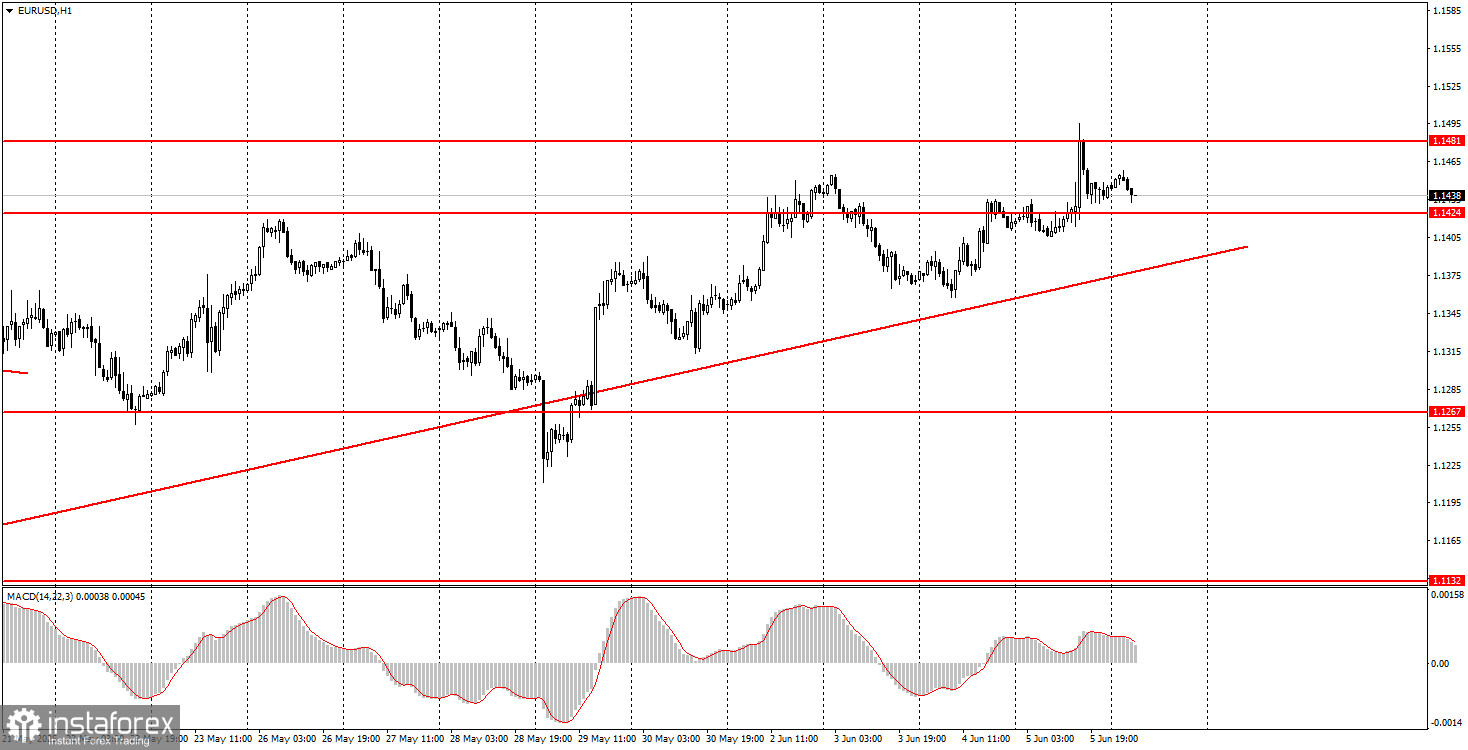

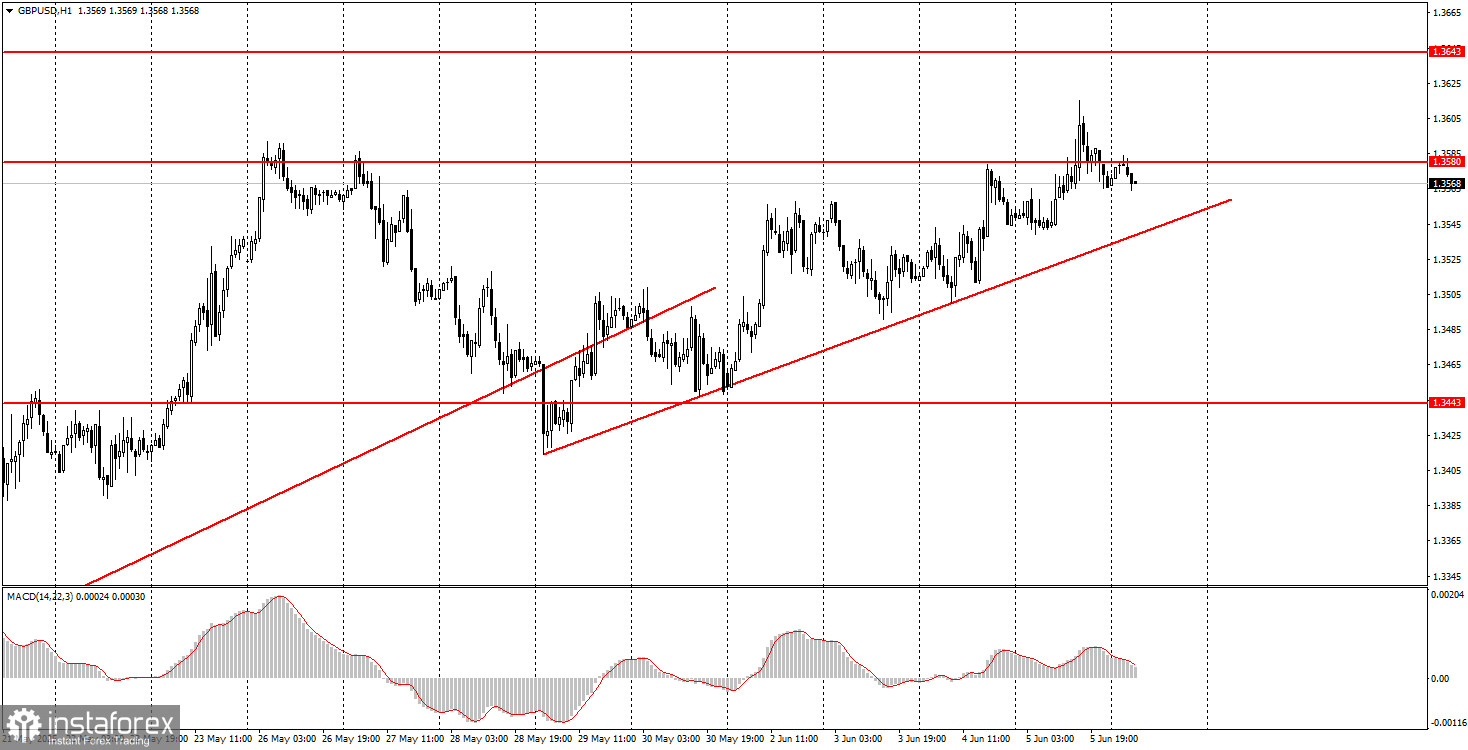

What's on the Charts:

- Support and resistance levels — levels that serve as targets when opening buy or sell trades. Take Profit levels can be placed near them.

- Red lines — channels or trendlines showing the current trend and indicating the preferred trading direction.

- MACD (14,22,3) — histogram and signal line — an auxiliary indicator that can also serve as a source of signals.

- Important speeches and reports (always listed in the news calendar) can significantly impact the movement of currency pairs. Therefore, it is recommended to trade with maximum caution or exit the market during their release to avoid sharp reversals against the preceding trend.

Beginner forex traders should remember that not every trade will be profitable. Developing a clear strategy and good money management are the keys to success in long-term trading.