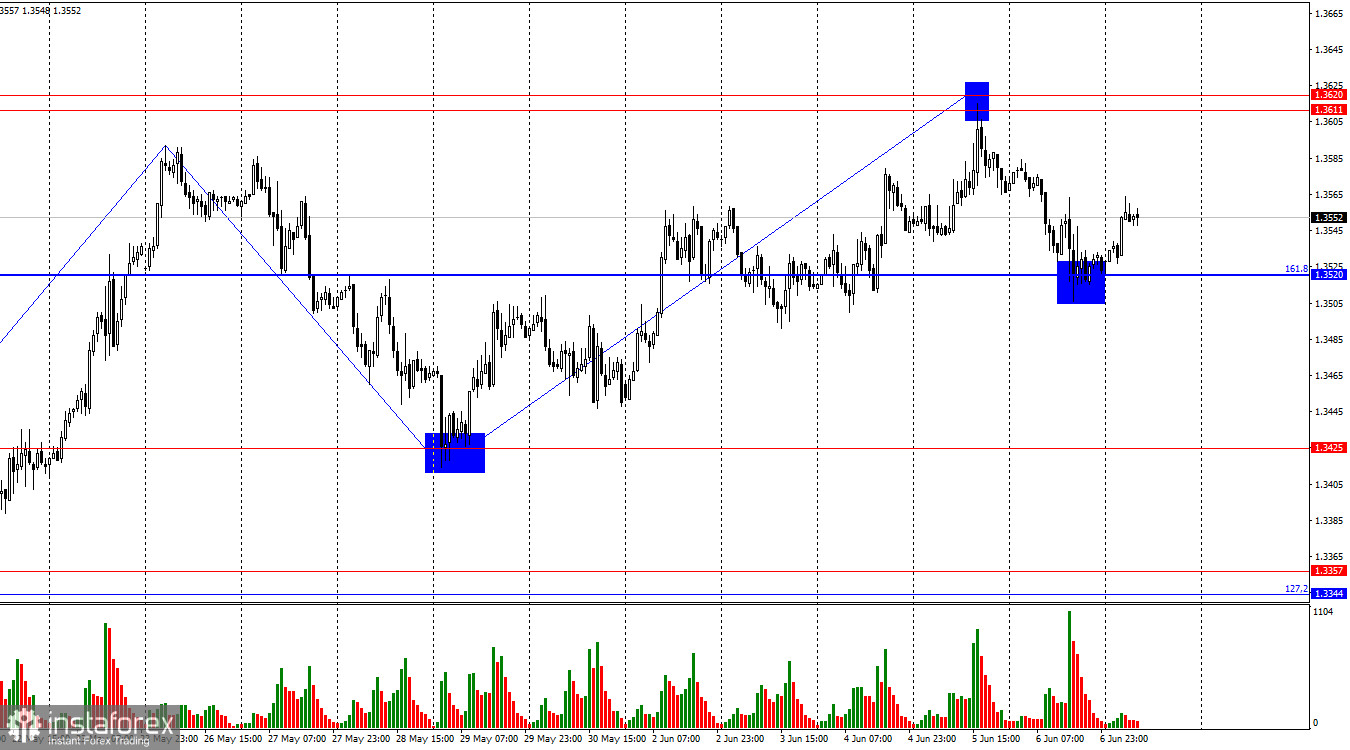

On the hourly chart, the GBP/USD pair continued its decline on Friday and reached the 161.8% Fibonacci correction level at 1.3520. A rebound from this level favored the British pound. Thus, the upward movement may resume toward the resistance zone of 1.3611–1.3620. A consolidation below 1.3520 would suggest stronger gains for the U.S. dollar, targeting the 1.3425 level.

The wave situation clearly indicates the continuation of the bullish trend. The last upward wave broke above the previous wave's peak, while the last downward wave did not break below the previous low. It will be hard for the bulls to rely on further growth without new announcements from Donald Trump regarding an increase or introduction of new import tariffs. However, the U.S. president is ready to raise tariffs and escalate the trade war with China to a new level. Thus, the bulls have every reason to initiate new attacks.

On Friday, the news background did not bode well for the bears. Nonetheless, the labor market and unemployment reports turned out to be decent. Specifically, the unemployment rate did not rise, and Nonfarm Payrolls showed 139,000 new jobs, slightly better than traders' expectations. This provided some market support, although weak, as the reports did not significantly exceed forecasts. The dollar continues to face pressure from the ongoing trade war and the fact that there is no shift toward de-escalation. Donald Trump reduced tariffs to minimal levels for three months for all countries, but this approach does not guarantee the signing of trade agreements. Moreover, trade agreements themselves do not ensure a more favorable trade balance for the U.S. in the future. There are no details or information about the progress of negotiations or future terms. Therefore, I cannot conclude how tariffs will ultimately impact the economy, unemployment, and inflation—and neither can anyone else.

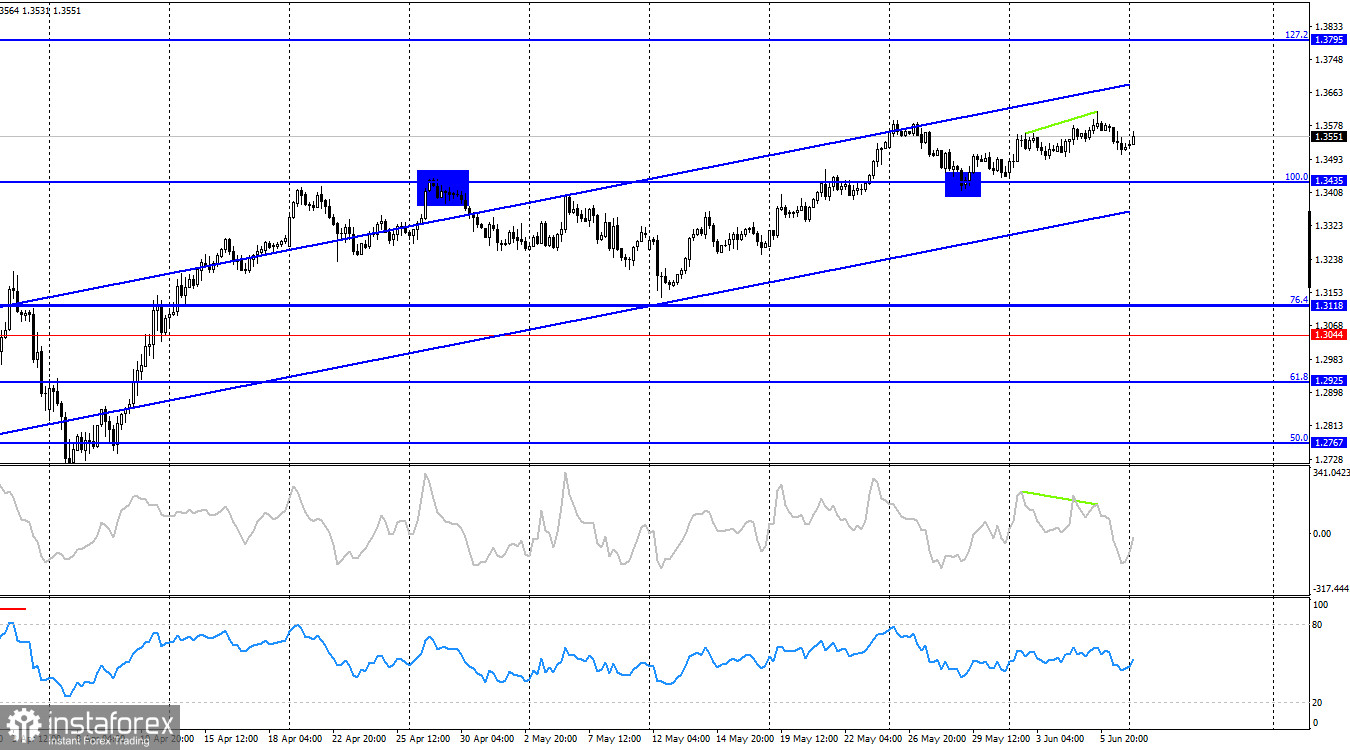

On the 4-hour chart, the pair consolidated above the 100.0% Fibonacci level at 1.3435 and rebounded upward. Thus, the growth may continue toward the next 127.2% corrective level at 1.3795. The bullish trend is not in doubt for now, but a closure below 1.3435 would suggest a decline toward the 76.4% corrective level at 1.3118. A bearish divergence has formed on the CCI indicator, which could offer some help to the bears and the dollar, but I do not expect a strong decline yet.

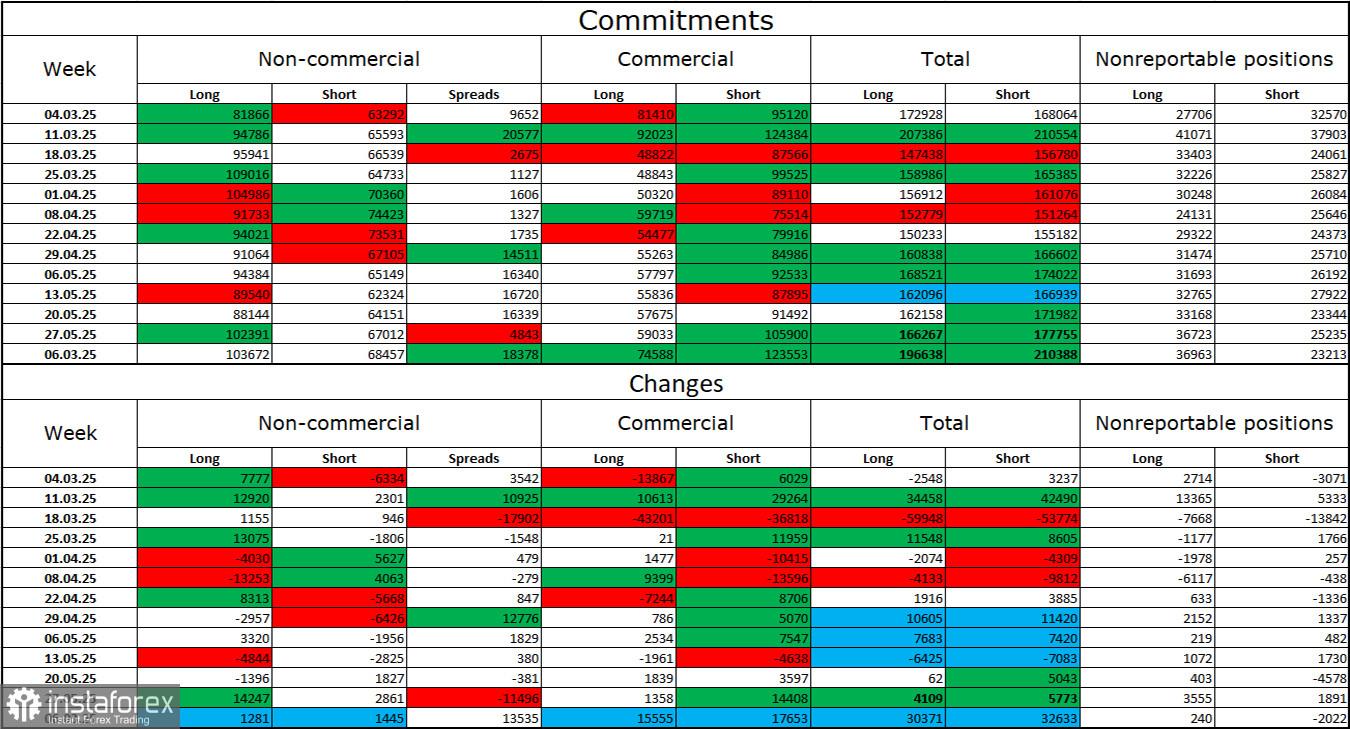

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" traders category remained unchanged over the last reporting week. The number of long positions held by speculators increased by 1,281, while the number of shorts increased by 1,445. Bears have long lost their advantage in the market. The gap between the number of long and short positions is now 35,000 in favor of the bulls: 103,000 against 68,000.

In my opinion, the pound still faces downside risks, but recent events have reversed the market in the long term. Over the past three months, the number of long positions has increased from 65,000 to 103,000, while short positions have decreased from 76,000 to 68,000. Under Donald Trump, confidence in the dollar has weakened, and the COT reports show there is no strong desire among traders to buy the dollar. Thus, regardless of the general news background, the dollar continues to decline amid events surrounding Donald Trump.

Economic Calendar for the U.S. and the U.K.:

On Monday, there are no significant economic events scheduled. The news background is expected to have no influence on traders' sentiment today.

GBP/USD Forecast and Trading Tips:

Sales of the pair were possible after a rebound from the resistance zone of 1.3611–1.3620 on the hourly chart, targeting 1.3520. This target was reached. Buying opportunities could be considered after the rebound from 1.3520, targeting 1.3611–1.3620. These trades can remain open today.

Fibonacci Grids:

Built from 1.3205–1.2695 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.