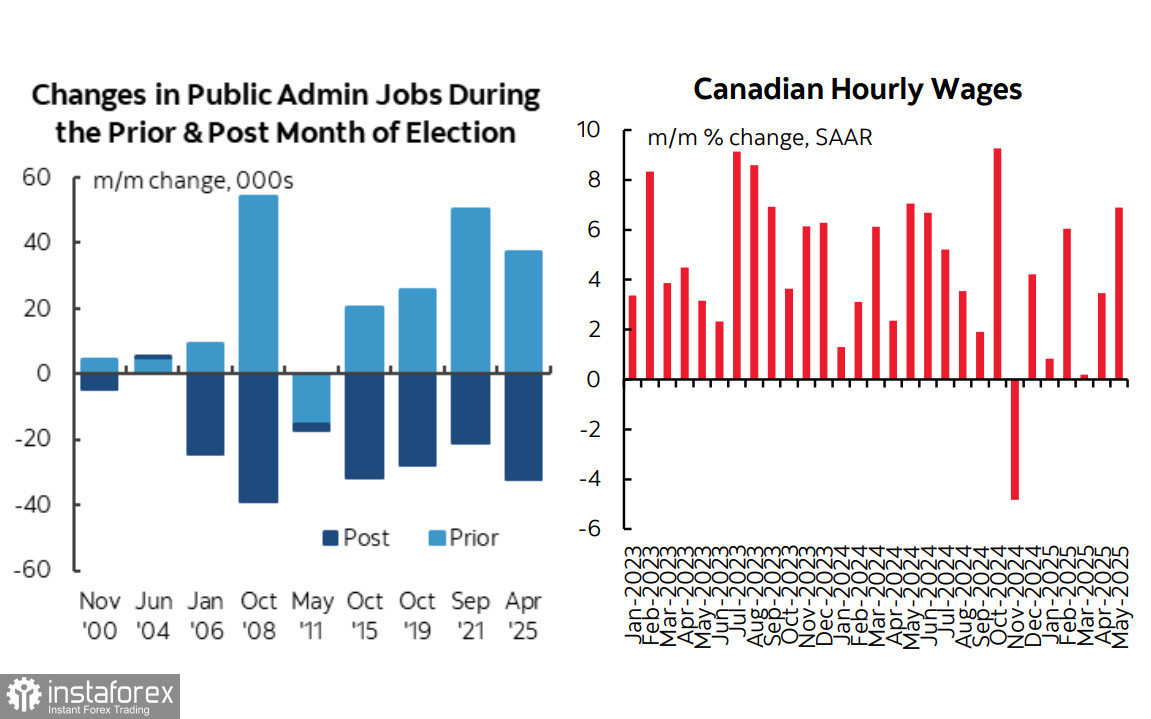

Net employment change in May amounted to +8.8 thousand jobs, exceeding April's growth and presenting very strong data, especially against expectations — a loss of about 15 thousand jobs had been forecasted. This increase occurred despite an anticipated drop of 32.2 thousand jobs in public administration. Excluding this sector, the net employment growth in May was 41 thousand, which is significant for a country with a relatively small population.

It's also worth noting that all the job growth came from full-time employment (+57.7 thousand), while part-time employment fell by 48.8 thousand. Most of the increase was concentrated in the services sector, and wages surged sharply, with a month-over-month growth of 6.9%, the strongest figure since October.

The Bank of Canada held its latest monetary policy meeting two days before the employment report was published, keeping the interest rate unchanged at 2.75%, as expected. The central bank's tone was cautious and restrained, which is not surprising amid global uncertainty. In his opening remarks, BoC Governor Tiff Macklem stated: "The Governing Council considered that further rate cuts might be necessary if the economy weakens and price pressures subside," but he also clarified: "I would not interpret this as forward guidance; it was merely part of our discussions."

Considering the latest macroeconomic reports, it is safe to say that the likelihood of a rate cut in July has decreased rather than increased. The core inflation index rose in April, and the probability of inflation slowing in May is low, as there is significant revival in the services sector alongside strong wage growth.

For now, it seems that the Canadian economy is showing fewer signs of needing financial easing, giving the Bank of Canada reason to maintain a pause — especially if inflation shows renewed growth. This conclusion suggests that the Canadian dollar holds strong positions for further strengthening.

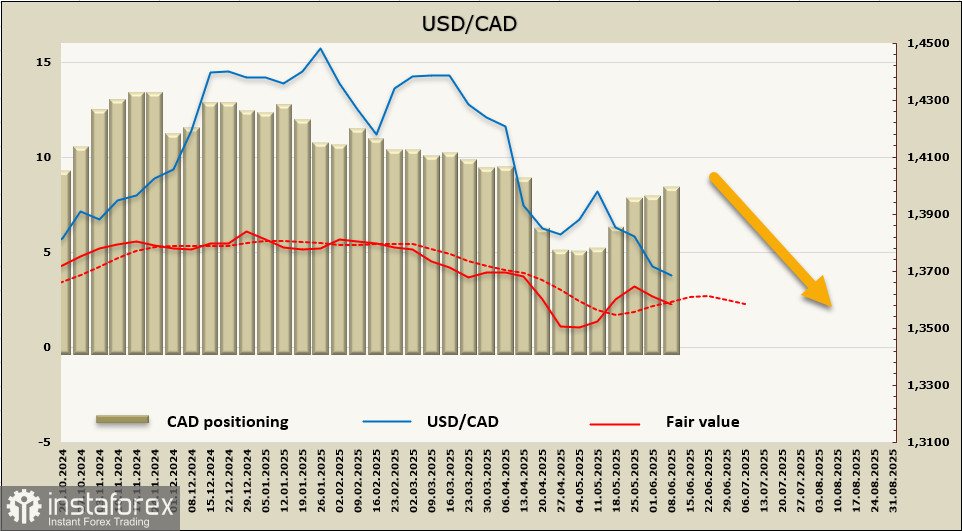

The reduction in short positions on CAD against the U.S. dollar has reversed, but USD/CAD is not reacting to the change in positioning — the U.S. dollar remains under pressure. The estimated price has turned south again.

Technical Outlook

In the previous analysis, it was noted that a break below the support zone of 1.3690/3710 could signal growing bearish sentiment, threatening the long-term bullish trend that has been in place since 2021. The loonie (CAD) has now fallen below this zone and is trying to consolidate beneath it. The absence of a corrective rally could strengthen the bearish momentum, with the next major target now at the 1.3410/30 support level. Fundamentally, Canada currently appears stronger, with stable core economic indicators — a contrast to the situation in the United States.