The stock market quickly bought the dip. Oil is swinging wildly. Forex appears paralyzed by the unfolding events in the Middle East. Investors are trying to assess the consequences of the escalating Israeli-Iranian conflict. The U.S. is a net exporter of crude oil, so a Brent rally is good news for the greenback. On the other hand, having lost its status as a primary safe-haven asset, the U.S. dollar could come under pressure amid rising geopolitical risks.

Deutsche Bank sees geopolitics as a buying opportunity. The bank analyzed 32 political events since 1939 that triggered asset sell-offs in financial markets. On average, it took 16 trading days to reach the bottom, followed by a recovery over the next 17 trading sessions.

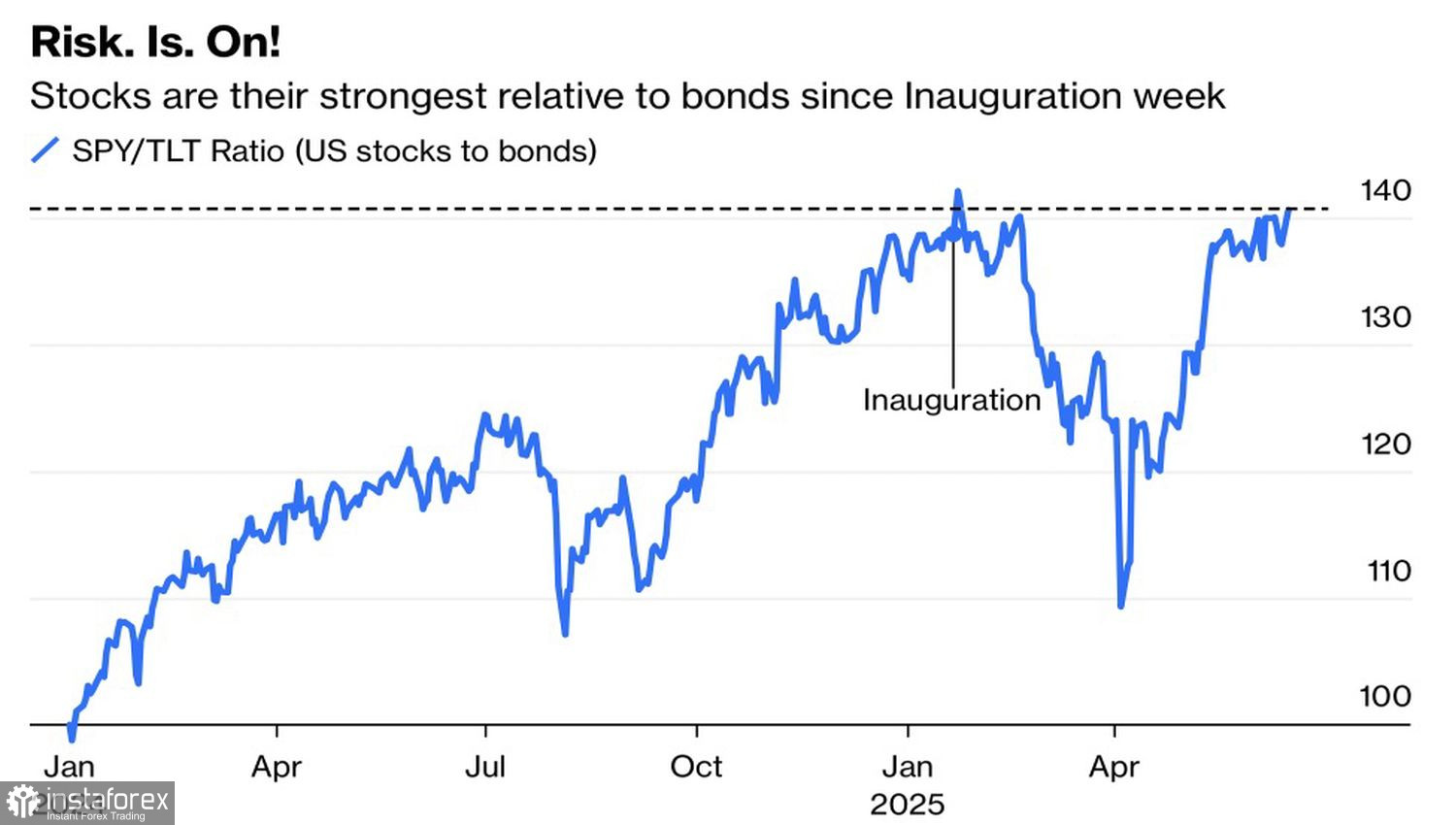

In 2025, U.S. stock indices have become so accustomed to buying the dip that they didn't wait. The ratio of U.S. stocks to bonds has returned to its highest level since the inauguration of the 47th president. Risk appetite is through the roof. Technically, this should support the dollar.

Stock-to-Bond Ratio Dynamics

But in reality, things are more complicated. Currency rates are driven by a combination of factors. While the markets' reluctance to acknowledge the long-term nature of the Middle East conflict supports the U.S. dollar, the situation is different regarding the cooling U.S. economy.

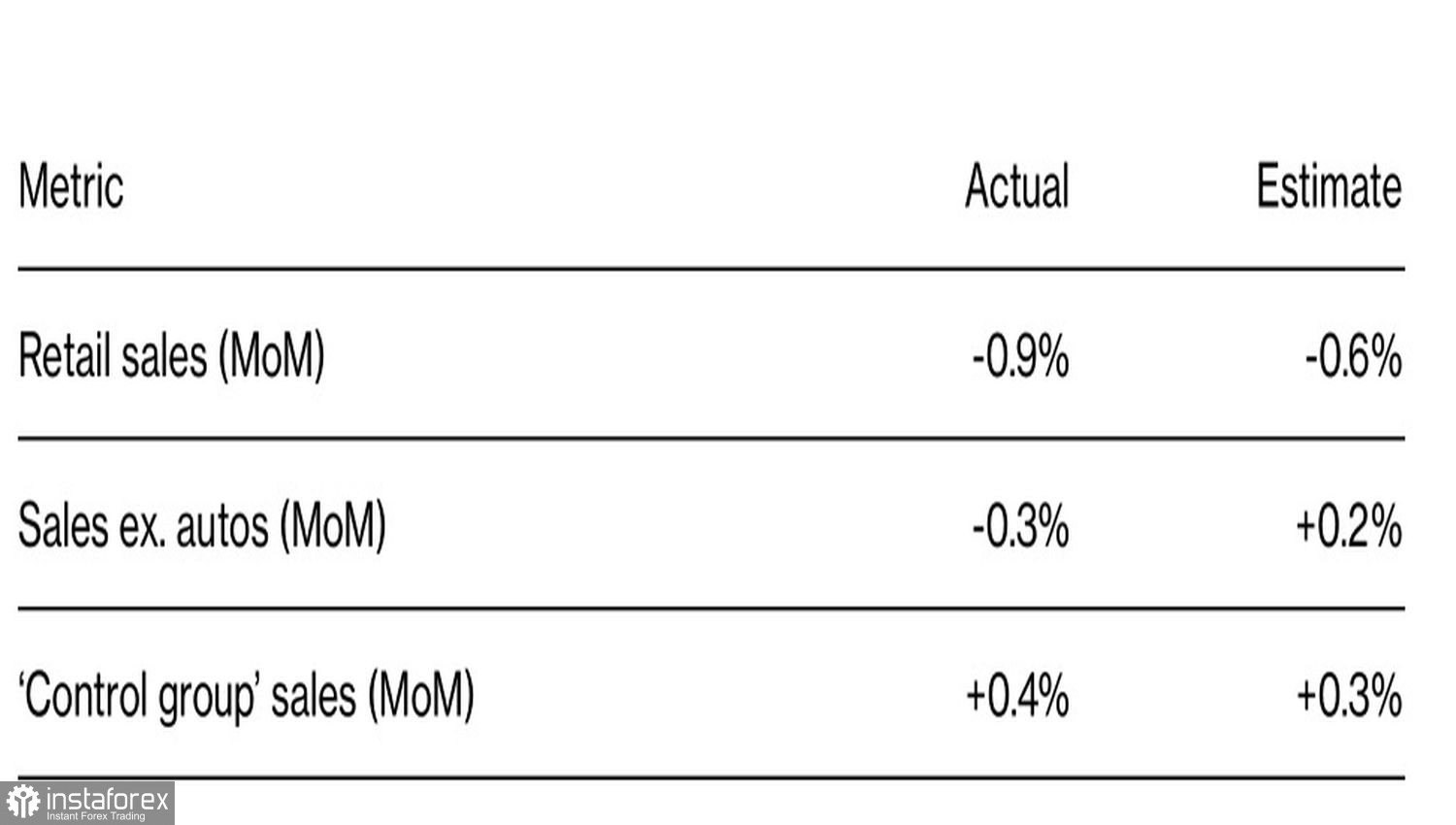

U.S. retail sales fell by 0.9% month-over-month in May. With April's figure revised downward to 0.1%, this marks the first consecutive decline since late 2023. The U.S. economy continues to slow. Isn't that reason enough for a dovish shift by the Federal Reserve?

U.S. Retail Sales Chart

Societe Generale believes that the U.S. dollar, having lost its safe-haven status, will weaken amid escalating geopolitical and trade tensions. Donald Trump not only plans to end Iran's nuclear program but also intends to send letters to multiple countries outlining the tariffs imposed on them. The trade war risks flaring up again. That's bad news for the U.S. economy—and for EUR/USD bears.

The bank plans to closely monitor Jerome Powell's signals during his press conference and now forecasts the euro could reach 1.20, and sooner than previously expected.

In my opinion, geopolitics supports the U.S. dollar rather than hinders it. The equity market rally dampens the "sell America" strategy. Additionally, the fact that the shock is external this time—not originating from the U.S.—gives the greenback an advantage.

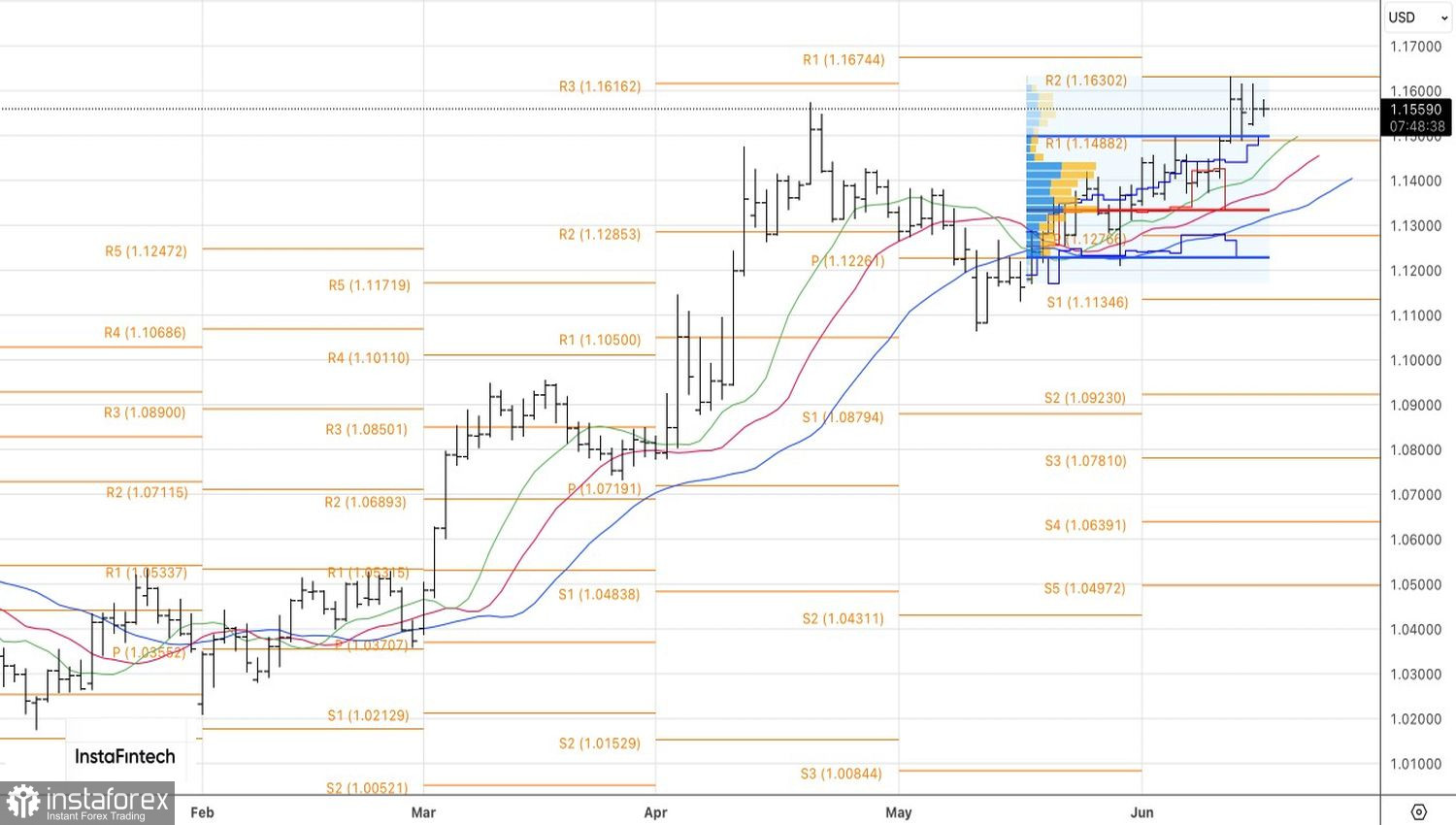

Technically, on the daily EUR/USD chart, there was a false breakout above the 1.149–1.161 range. A second breakout attempt of the 1.161 resistance may justify renewed buying. Conversely, a successful breach of 1.149 support would be a reason to sell.