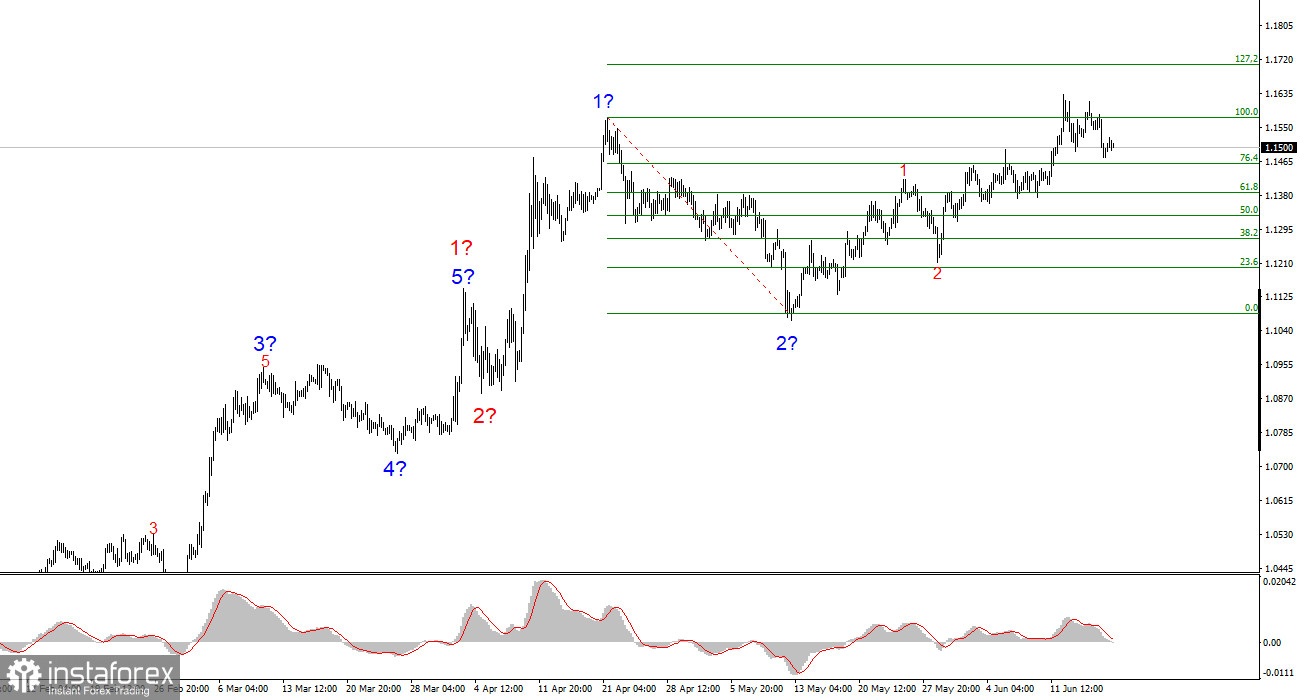

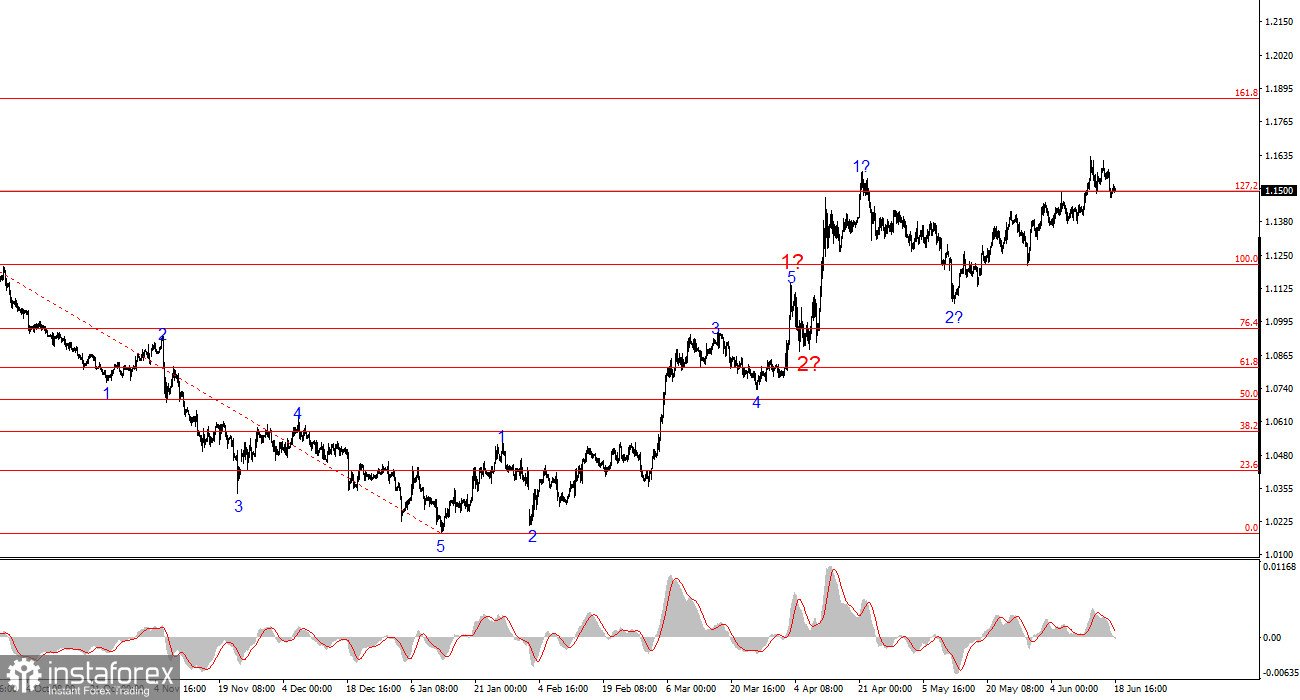

The wave pattern on the 4-hour chart of the EUR/USD pair continues to indicate the formation of a bullish trend segment. This transformation is entirely due to the new U.S. trade policy. Before February 28, when the U.S. dollar began to decline, the entire wave pattern resembled a clear bearish trend. At that time, a corrective wave 2 was forming. However, the start of the trade war initiated by Donald Trump—intended to boost budget revenues and reduce the trade deficit—has so far worked against the U.S. currency. Demand for the dollar has rapidly declined, and now the entire trend segment that began on January 13 has taken on an impulsive bullish structure.

Currently, it is presumed that wave 3 of 3 is still in progress. If this is correct, prices should continue rising in the coming weeks and months. However, the U.S. dollar will likely remain under pressure unless Donald Trump completely reverses his trade policy—a scenario that seems highly unlikely. At this point, there is little reason to expect a strong recovery in the U.S. currency.

The EUR/USD pair gained 20 basis points on Wednesday, but the most noteworthy developments have already happened—and more are still ahead. On Tuesday evening, demand for the U.S. dollar surged, leading to an 80-point increase in the currency. This sharp move naturally raised questions, but upon closer examination, the reason is quite clear. It was reported that Donald Trump is prepared to declare war on Iran and launch a devastating strike on its military and nuclear facilities. Recall that last Friday night, Israel launched a missile attack on Iran, which led to increased demand for the dollar. As we can see, the dollar may have lost its "safe haven" status in the eyes of investors, but this logic still sometimes plays out. Last Friday, the Middle East conflict reignited, and yesterday, the market feared the U.S. might become fully involved in the war. However, it's worth noting that by Wednesday, the market had moved past this narrative, and dollar buying ceased. Just like last Friday, market participants quickly "recovered" from the shock.

These two spikes in the U.S. dollar had no impact on the current wave pattern. The instrument remains within a bullish wave structure with no signs of early completion. In just a few hours, the results of the fourth FOMC meeting of the year will be announced—which, in my view, could pose new problems for the dollar. Still, there's no need to speculate; we don't have long to wait.

Conclusions

Based on the analysis of EUR/USD, I conclude that the pair continues to form a bullish trend segment. The wave pattern still depends entirely on news related to Trump's decisions and U.S. foreign policy. The targets for wave 3 may extend as far as the 1.2500 level. Therefore, I continue to consider long positions, with initial targets near 1.1708 (which corresponds to the 127.2% Fibonacci level) and beyond. A de-escalation of the trade war could reverse the bullish trend, but currently, there are no signs of reversal or de-escalation.

On the higher wave scale, the pattern has transitioned into a bullish configuration. It is likely we are witnessing the start of a long-term upward wave cycle, though Trump-related news could still turn everything upside down again.

Core Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are hard to interpret and often change.

- If you're unsure about what's happening in the market, it's better not to enter.

- There is never 100% certainty about the direction of movement. Always use Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.