The GBP/USD currency pair also continued its upward movement on Tuesday. If you want to understand just a small portion of the reasons behind the latest decline of the U.S. dollar, we recommend reading the EUR/USD article. However, this article is not about economics or important legislative acts, monetary policy, or business activity. It is about Donald Trump—his remarks and decisions. Simply because nothing else matters right now. We've long had the impression that even if the Fed raised rates to 10% tomorrow, the market wouldn't even notice. Remember that the Bank of England cut its rate twice in 2025, and the European Central Bank cut four times. The Federal Reserve—zero times, yet the dollar is still plunging at the speed of light.

Yesterday was filled with geopolitical developments in the Middle East. The situation changed every 30 minutes, and ordinary internet users couldn't fully understand what was happening. There's a political tactic where a deliberately controversial topic is created to distract the public or voters from urgent issues. It seems that Trump keeps creating new distractions from the problems he has caused. But that's just speculation.

Yesterday, Trump managed not only to declare a ceasefire and then publicly call on Iran and Israel not to attack each other—to the amusement of the whole world—but also found time to once again lash out at Jerome Powell and the Fed. Honestly, we no longer understand—does Trump truly believe that his weekly attacks on the Fed will have no consequences? Just a week ago, Trump publicly called Powell an "idiot," and yesterday mocked him by calling him "Always-Late Powell."

Once again, Trump urged the Fed to cut rates by at least 2–3%. The U.S. president stated that the economy was doing fine and inflation was low. "Then why does he refuse to lower the rate?" the White House leader asked. If anyone thinks Trump's words make sense, they are mistaken. Powell has repeatedly explained in recent months—not just his own stance, but the stance of the entire Federal Open Market Committee—not to cut rates. The tariffs introduced by Trump are sure to raise inflation, and currently, no one in the world understands what the final import prices will be.

Remember that Trump hasn't signed a single trade deal (except with the UK) in 2.5 months of active negotiations. Talks with China and the EU—the U.S.'s largest trading partners—are on the verge of collapse simply because Brussels and Beijing do not understand what the White House actually wants. Therefore, Powell isn't cutting the rate due to total uncertainty, not due to unwillingness. However, Trump claims that the Fed's refusal to lower rates costs the U.S. $800 billion a year. Where this number comes from—guess for yourself. No one in the U.S. government bothers to explain it.

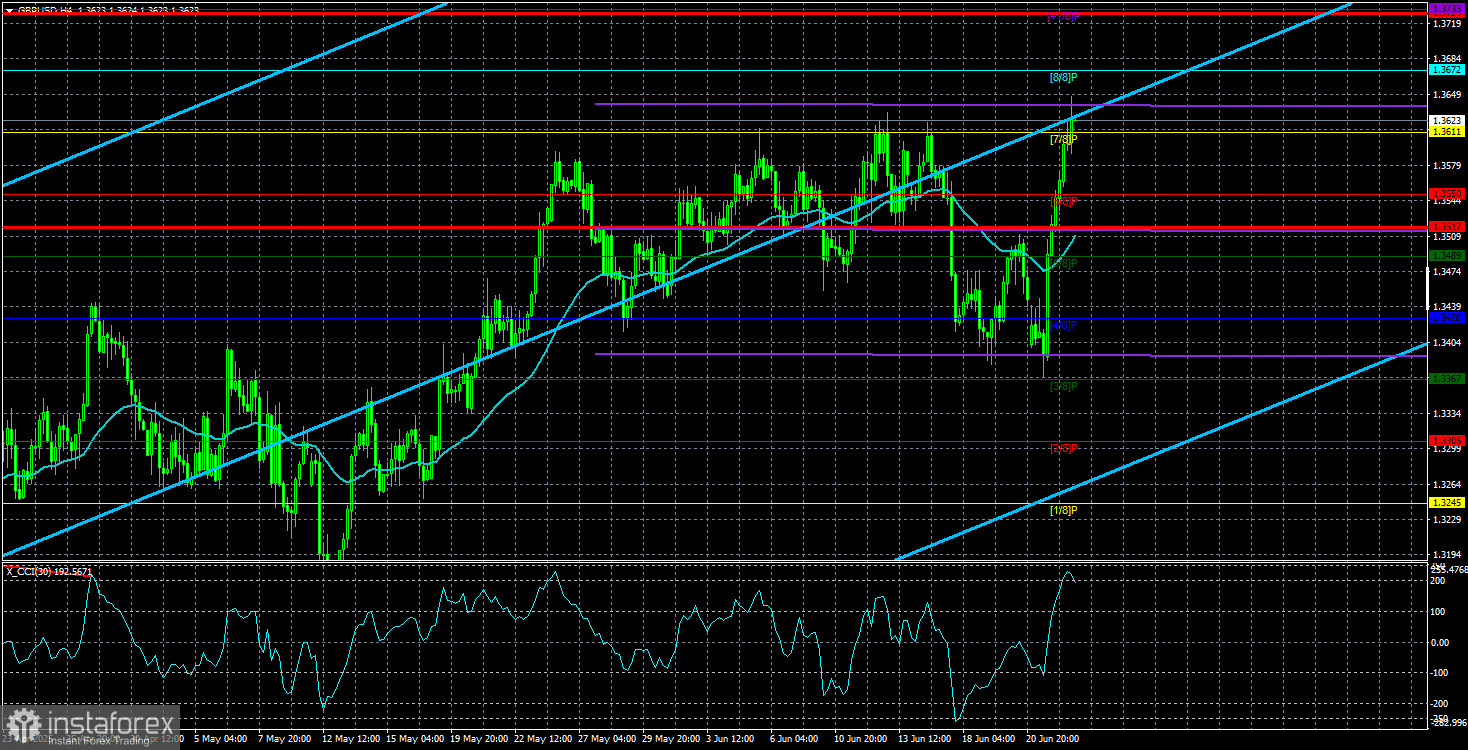

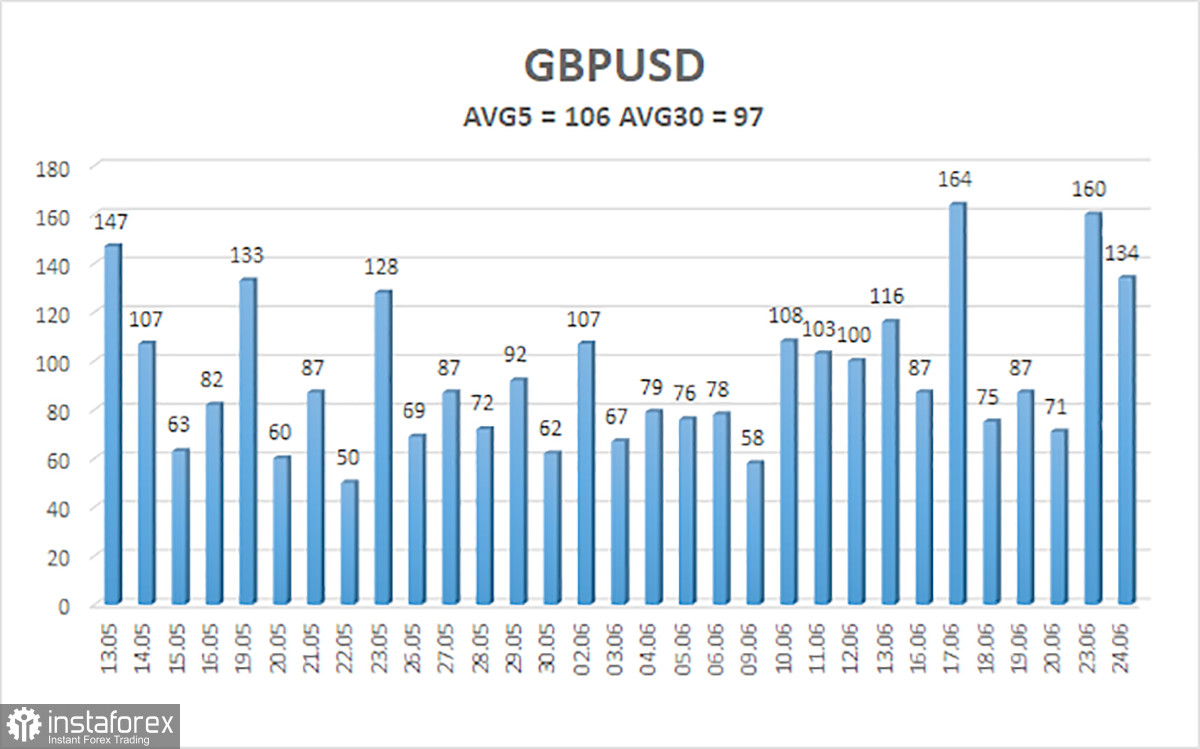

The average volatility of the GBP/USD pair over the last five trading days is 106 pips. For the pound/dollar pair, this is considered "moderate." On Wednesday, June 25, we expect the pair to move within the range defined by 1.3517 and 1.3729. The long-term regression channel is directed upward, clearly indicating a bullish trend. The CCI indicator entered oversold territory last week, which ultimately triggered a resumption of the upward trend.

Nearest Support Levels:

S1 – 1.3611

S2 – 1.3550

S3 – 1.3489

Nearest Resistance Levels:

R1 – 1.3672

R2 – 1.3733

R3 – 1.3794

Trading Recommendations:

The GBP/USD currency pair remains in an upward trend and has completed another weak correction. In the medium term, Trump's policies will likely continue to pressure the dollar. However, in the short term, any escalation in the Middle East may periodically support the dollar.

Thus, long positions targeting 1.3672 and 1.3733 remain relevant if the price is above the moving average. If the price falls below the moving average line, short positions may be considered with targets at 1.3428 and 1.3367. But again, we do not expect strong dollar growth under current conditions. From time to time, the U.S. currency may show only corrective rebounds. For a true rally, the dollar needs real signs of an end to the global trade war.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.