The yen failed the test as a safe-haven currency. The Israel–Iran conflict triggered a correction in USD/JPY toward a downtrend. For most of the year, investors had the impression that the Japanese currency had stripped the U.S. dollar of its status as the primary safe-haven asset on Forex. However, once Donald Trump announced a ceasefire, the bears on this pair regained their footing.

The pullback in USD/JPY was driven by the economic characteristics of the two countries. While the United States is a net exporter of energy commodities, Japan is an oil importer. A Brent crude rally slows Japan's economic growth and weighs on its currency. Fortunately, the ceasefire between Israel and Iran returned Brent to its previous levels. As a result, the yen could return to its time-tested strength — monetary policy divergence.

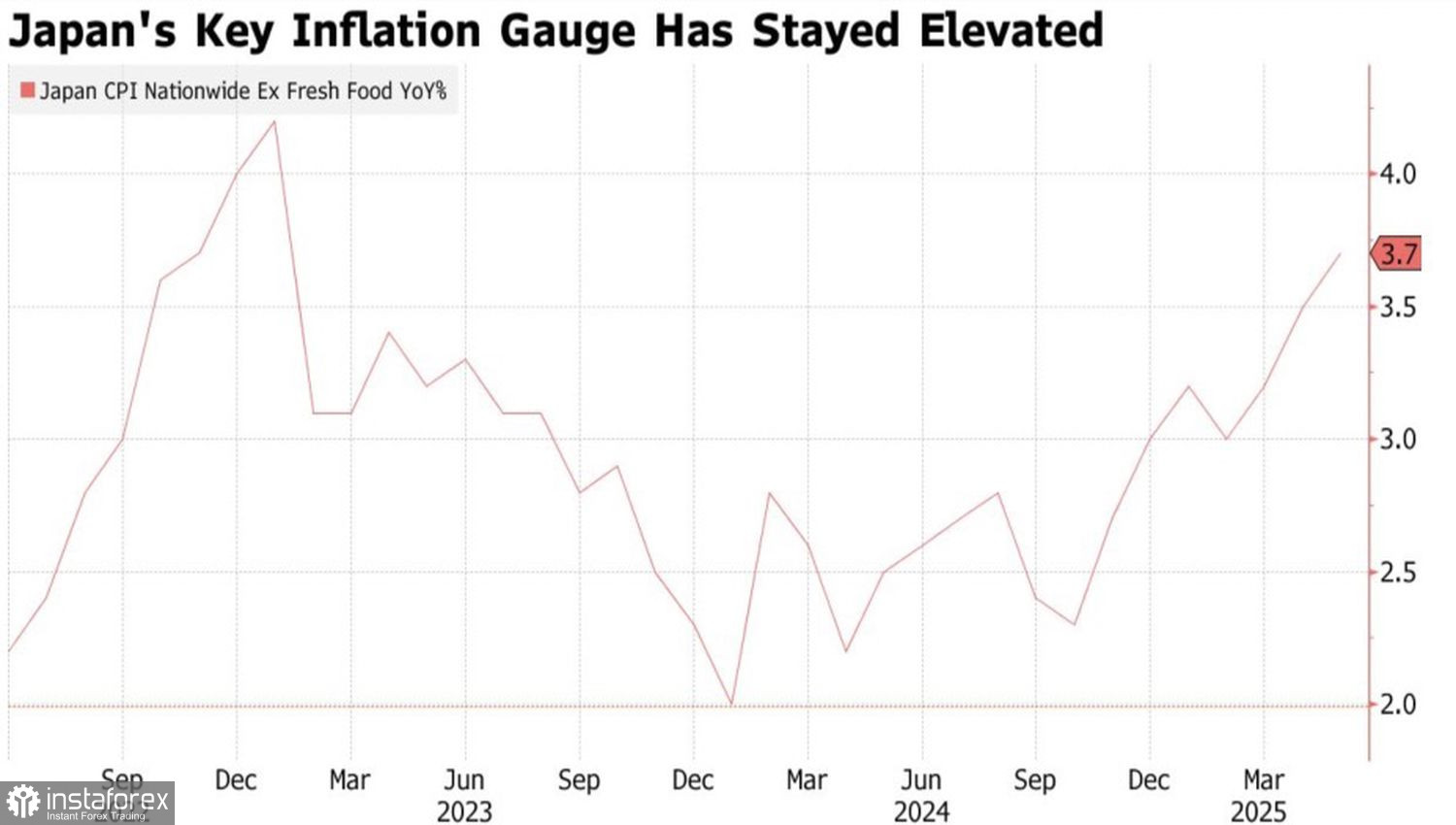

Dynamics of Japanese Inflation

At its June meeting, the Bank of Japan deemed it appropriate to keep the overnight interest rate at 0.5% despite elevated inflation levels. The primary argument was a slowdown in economic activity due to uncertainty stemming from U.S. tariffs. If the situation becomes clearer, the BoJ would be ready to tighten its monetary policy, especially since consumer prices in May accelerated to a new two-year high of 3.7%. Following this, Board Member Naoki Tamura called for a swift increase in borrowing costs.

Judging by Jerome Powell's address to Congress, the Federal Reserve has options. If inflation accelerates due to tariffs while the U.S. economy remains strong, the federal funds rate will stay at its current 4.5% level for an extended period. Conversely, a continuation of the disinflationary trend alongside a cooling labor market could prompt monetary easing as early as July. This divergence in central bank stances underpins the downtrend in USD/JPY.

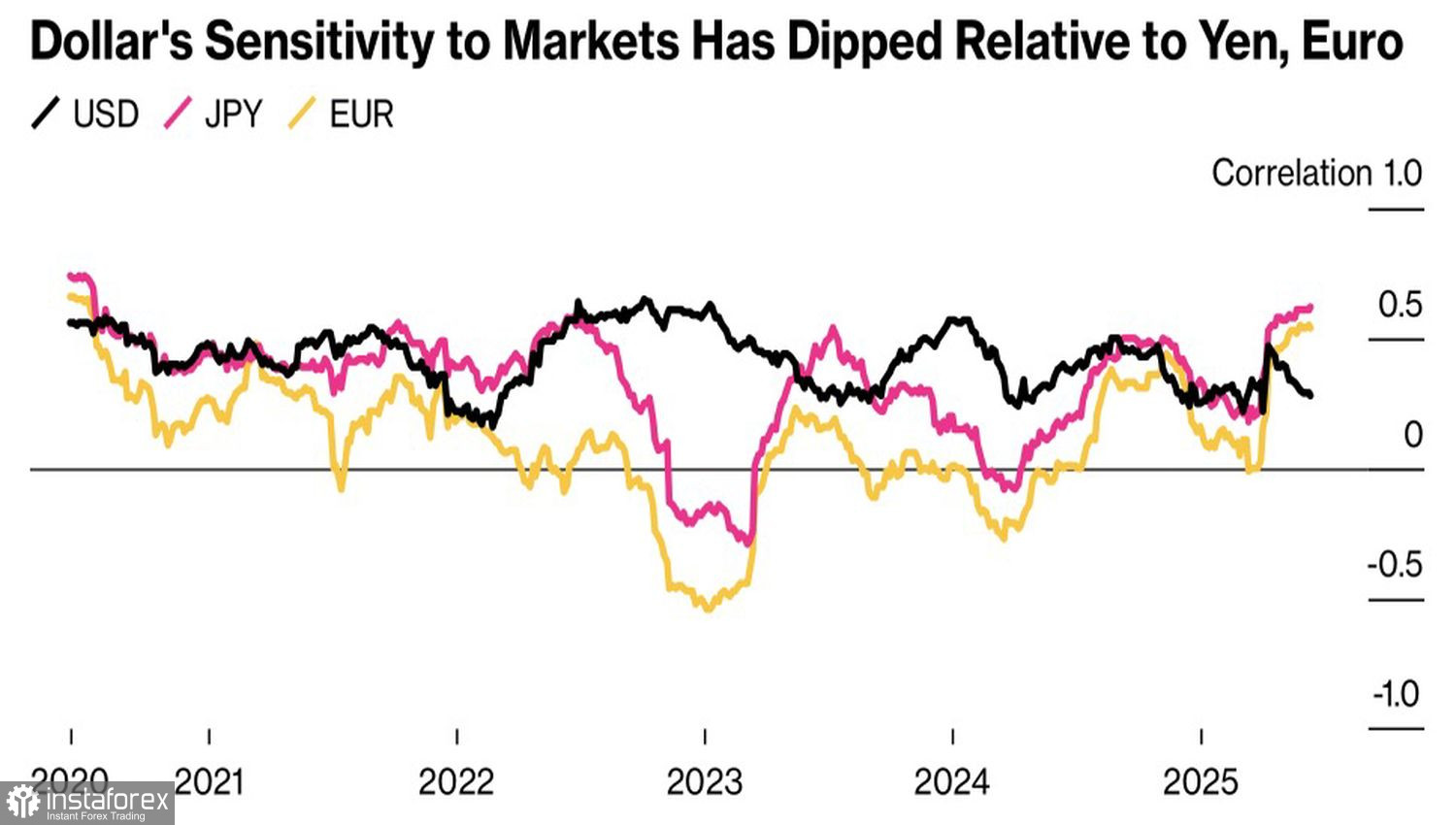

Correlation of Funding Currencies with Risk

While investors still question whether the yen has overtaken the U.S. dollar as the primary safe-haven asset, the greenback is taking on a different role — the main funding currency. Its sensitivity to risk has declined compared to rivals like the yen and the euro. Meanwhile, the return on carry trades involving emerging market currencies — such as the Indian and Indonesian rupiah, the Turkish lira, the South African rand, and the Brazilian real — has jumped to 8% in 2025. For comparison, losses from euro-based carry trades were 2.2%, and returns from using the yen were only 2.6%.

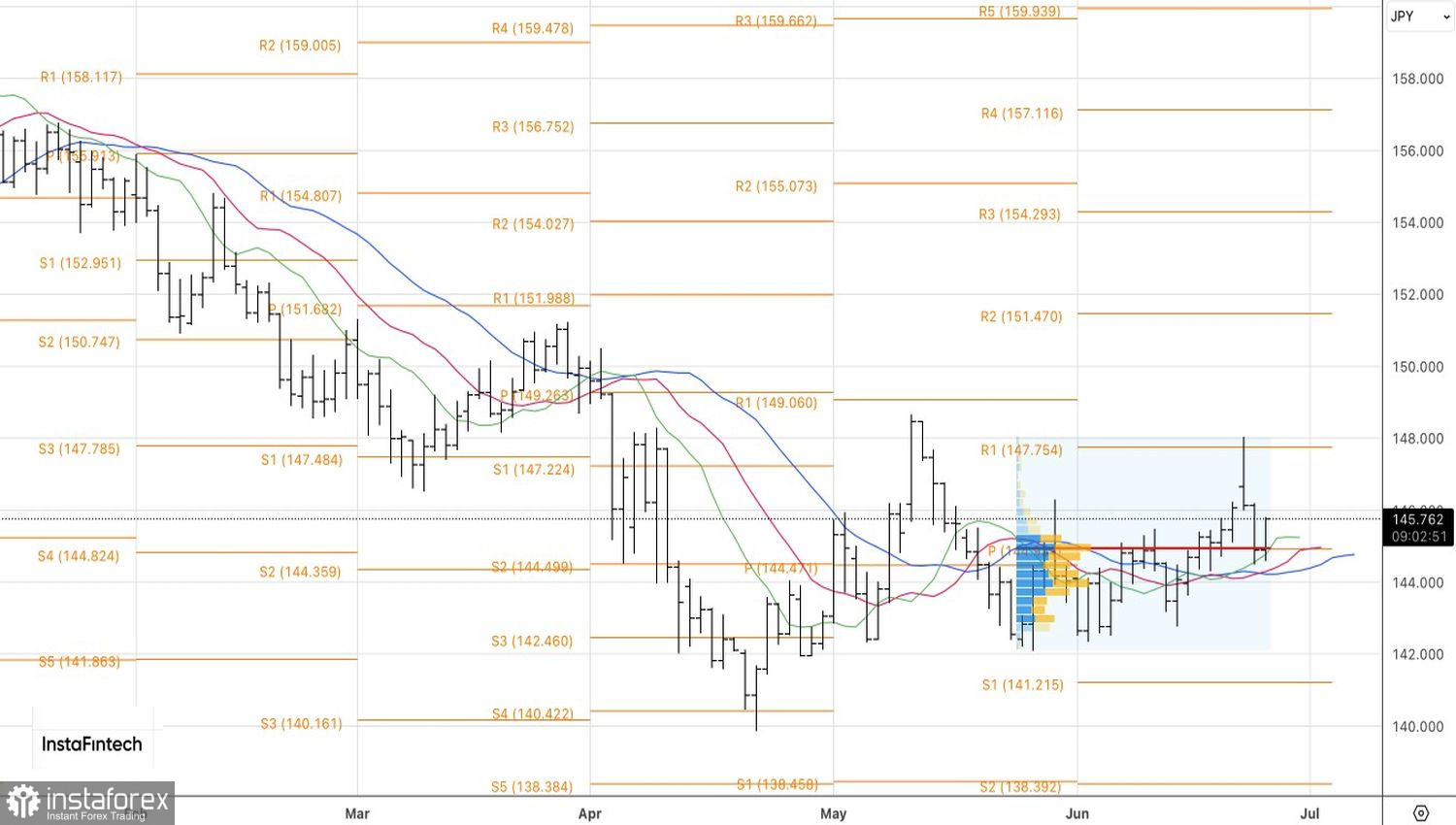

From a technical standpoint, on the daily USD/JPY chart, a rebound from the fair value level of 144.9 highlights the strength of the bulls. For the correction to gain traction, they must break through resistance at 146.15. This would open the way for long positions. On the contrary, a drop below 144.9 would be a signal to sell.