The demand for risky assets persisted, and the U.S. dollar weakened significantly. In addition to weak housing market data and Jerome Powell's comments, sharp criticism from Trump directed at the Federal Reserve led to another round of dollar depreciation.

Pressure on Fed Chairman Jerome Powell from U.S. President Donald Trump has intensified again. Traders reacted cautiously to these verbal interventions from the White House, seeing them as a threat to the central bank's independence. Such statements undermine confidence in the dollar as a reserve currency, prompting market participants to seek alternative safe havens in gold, the yen, and the Swiss franc. At the same time, stagnation in the housing sector has fueled concerns over a potential slowdown in U.S. economic growth. A decline in new home sales signals potential future problems, causing analysts to revise U.S. GDP forecasts downward.

This morning, the euro may continue to rise, as the only notable release is the June GfK Consumer Climate Index for Germany. This indicator, which reflects German consumers' willingness to spend, could serve as a key barometer of sentiment in the eurozone's largest economy.

A positive result, exceeding analysts' expectations, could reinforce confidence in the European economy's resilience and thus support further euro growth.

As for the United Kingdom and the pound, retail sales data from the Confederation of British Industry (CBI) will be published today, followed by a speech from Bank of England Governor Andrew Bailey.

The CBI retail sales data may provide signals on consumer sentiment in the UK. Analyzing these figures will help assess household spending dynamics and determine how effective the government's stimulus measures have supported the economy. A decline in sales may indicate deteriorating consumer confidence and a potential economic slowdown, which could pressure the Bank of England to take additional monetary easing steps.

However, the key event of the day will undoubtedly be Andrew Bailey's speech. The market will closely monitor his tone, looking for hints about the central bank's next steps. Special attention will be paid to inflation risks, the outlook for rate cuts, and the overall assessment of the UK economy.

If the data matches economists' expectations, acting based on the Mean Reversion strategy is best. If the data is significantly above or below expectations, the Momentum strategy is preferable.

Momentum Strategy (Breakout):

EUR/USD

Buying on a breakout above 1.1695 could lead to a rise in the euro toward 1.1720 and 1.1750;

Selling on a breakout below 1.1670 could lead to a decline in the euro toward 1.1630 and 1.1585.

GBP/USD

Buying on a breakout above 1.3720 could lead to a rise in the pound toward 1.3770 and 1.3818;

Selling on a breakout below 1.3690 could lead to a decline in the pound toward 1.3660 and 1.3630.

USD/JPY

Buying on a breakout above 144.80 could lead to a rise in the dollar toward 145.30 and 145.60;

Selling on a breakout below 144.50 could lead to a sell-off in the dollar toward 144.10 and 143.66.

Mean Reversion Strategy (Pullbacks):

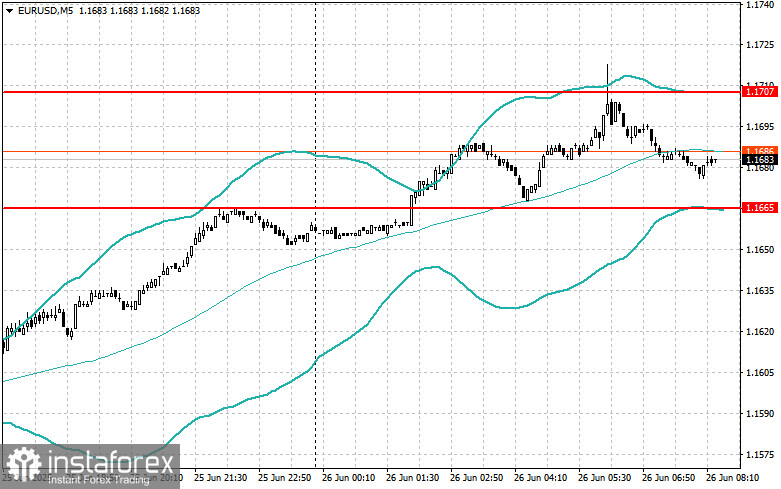

EUR/USD

I will look for selling opportunities after a failed breakout above 1.1707 followed by a return below that level;

I will look for buying opportunities after a failed breakout below 1.1665 followed by a return to that level.

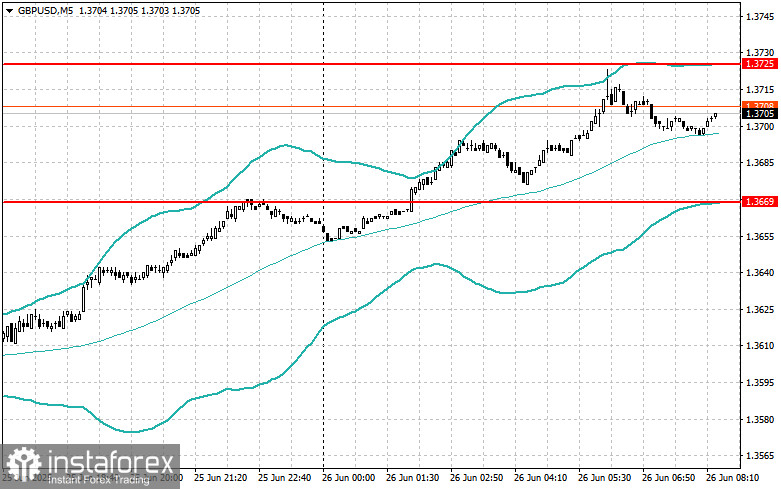

GBP/USD

I will look for selling opportunities after a failed breakout above 1.3725 followed by a return below that level;

I will look for buying opportunities after a failed breakout below 1.3669 followed by a return to that level.

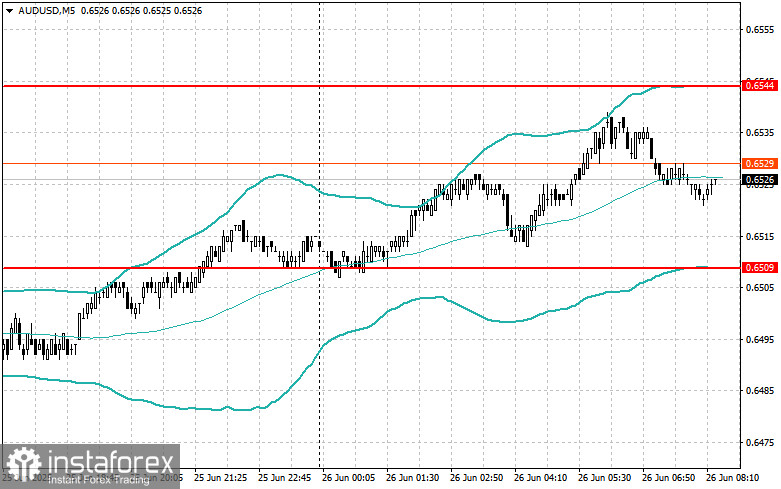

AUD/USD

I will look for selling opportunities after a failed breakout above 0.6544 followed by a return below that level;

I will look for buying opportunities after a failed breakout below 0.6509 followed by a return to that level.

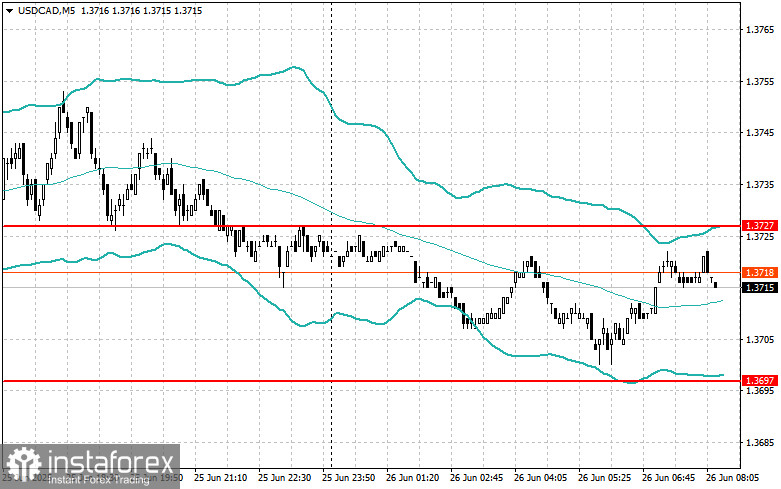

USD/CAD

I will look for selling opportunities after a failed breakout above 1.3727 followed by a return below that level;

I will look for buying opportunities after a failed breakout below 1.3697 followed by a return to that level.