The GBP/USD currency pair rose by 300 pips over the past week and appears to be in no hurry to stop. Even on Friday, the price failed to initiate a downward correction despite the near absence of macroeconomic and fundamental drivers following a strong rally. This once again confirms that the market is currently not considering buying the dollar under any circumstances. If that's the case, what movement should we expect in the coming week?

There will be plenty of events and reports in the coming days—especially in the U.S. In the UK, attention is focused on business activity indices and a speech by Bank of England Governor Andrew Bailey. But the U.S. will deliver more noteworthy events. It starts with Jerome Powell's speech. Recall that last week, Donald Trump launched a new wave of criticism at the Federal Reserve and Powell personally and is already looking for a replacement. It's unlikely that the Fed Chair will yield to pressure this time, but he might still comment on the situation. We believe Powell's rhetoric will remain unchanged. If he has been resisting Trump's monetary views during his second term, there's little reason for him to back down just a year before the end of his mandate.

Therefore, traders are likely to pay more attention to the macroeconomic data from across the ocean. Here's what's expected: first, the Nonfarm Payrolls report, which is forecasted to show relatively low figures for June. Keep in mind that the forecast is largely irrelevant, as the actual data rarely aligns with it. The greater the deviation from the forecast, the more likely it is that a sharp market reaction will occur. Second, the unemployment rate may remain at 4.2%, though the actual figure may differ. Third, the ISM Manufacturing PMI.

Important events will occur almost daily, and significant reports will be published nearly every day as well. Additionally, we must not forget about Trump, who remains the key market driver. It looks like we're heading into another highly volatile week, and it's still hard to say what could support the dollar during this period. Currently, we see no news or events that could provide strong support for the U.S. currency. There are no technical signals indicating a decline, either across any timeframe or trading system. Not even overbought conditions or divergences. Once again, the dollar is unlikely to see meaningful growth.

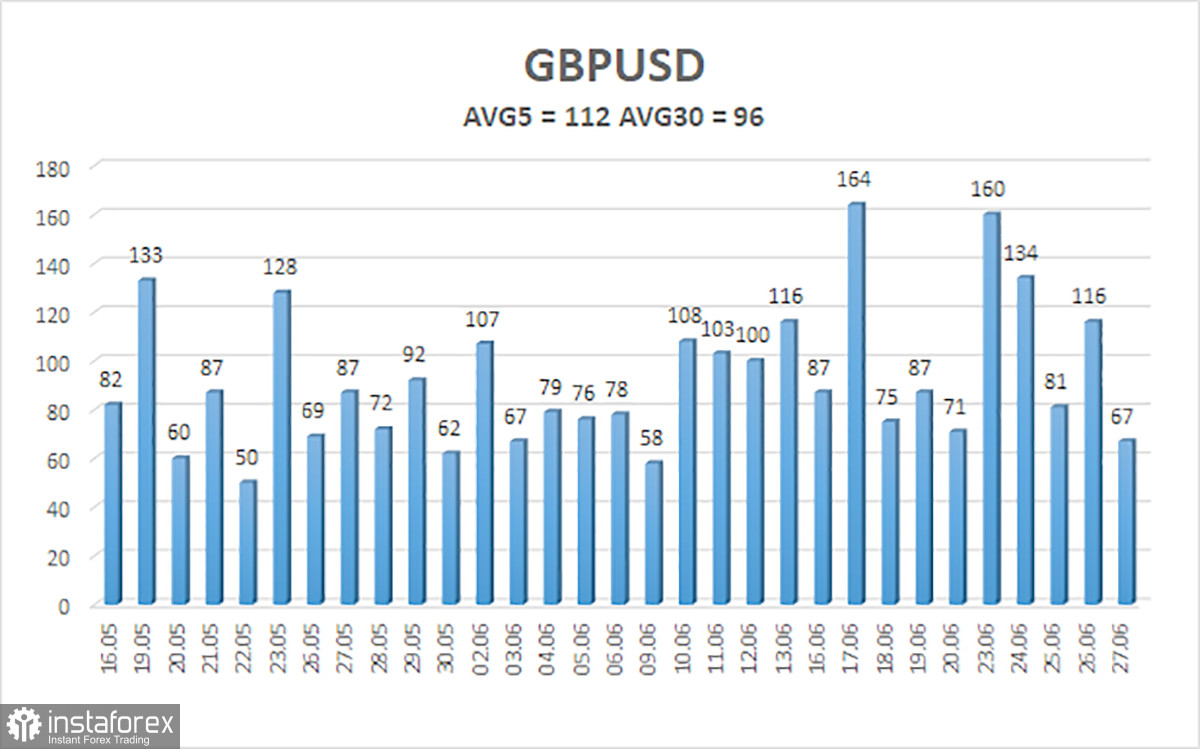

The average volatility for GBP/USD over the last five trading days is 112 pips, which is considered "moderate" for the pound/dollar pair. On Monday, June 30, we expect the pair to move within the range defined by the levels 1.3608 and 1.3830. The long-term regression channel is pointing upward, indicating a clear upward trend. The CCI indicator entered the oversold zone, which triggered a renewed uptrend.

Nearest Support Levels:

S1 – 1.3672

S2 – 1.3611

S3 – 1.3550

Nearest Resistance Levels:

R1 – 1.3733

R2 – 1.3794

Trading Recommendations:

The GBP/USD pair continues its uptrend and has completed another minor correction. In the medium term, Trump's policies are likely to continue putting pressure on the dollar. Therefore, long positions with targets at 1.3794 and 1.3830 remain relevant if the price is above the moving average. If the price falls below the moving average line, small short positions can be considered with targets at 1.3550 and 1.3489. However, as before, we do not expect strong growth of the dollar. Occasionally, the U.S. currency may show short-lived corrections. For a sustained rally, real signs of an end to the global trade war are needed.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.