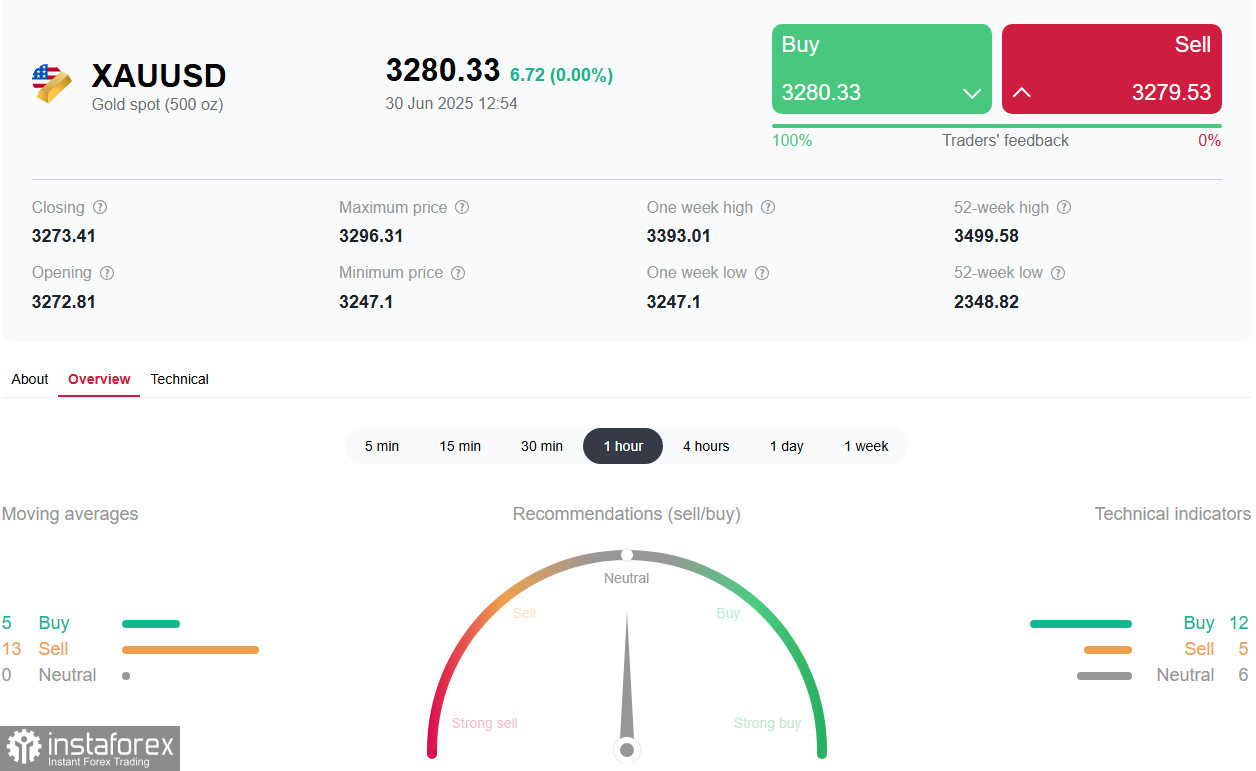

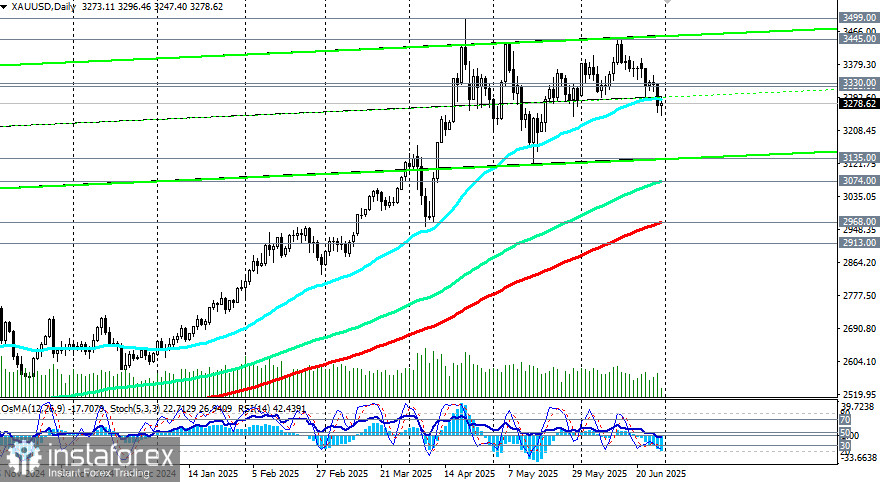

Despite the bears' attempt to push gold prices lower at the beginning of Monday's trading session (recall that last week, the XAU/USD pair hit its lowest level since May 30, near the 3255.00 mark), prices had returned above the 3280.00 level by the start of the European session.

Investors are evaluating the likelihood of changes to the Federal Reserve's monetary policy following last week's events. According to data released last Friday, the core personal consumption expenditures (PCE) price index for May accelerated from +0.1% to +0.2% month-over-month (from +2.6% to +2.7% year-over-year), while the broader PCE index rose from +2.2% to +2.3% year-over-year.

It is worth noting that gold prices are highly sensitive to changes in the monetary policy settings of the world's major central banks, particularly the Fed. Rising inflation is prompting Fed officials to be more cautious about cutting interest rates.

*) See also: InstaForex Trading Indicators for XAU/USD

Earlier, Fed Chair Jerome Powell and other central bank officials stated that amid declining inflation, the focus would be on maintaining labor market stability.

However, before the release of the PCE indices last week, Powell told Congress that he still considered a rate cut appropriate this year. This comes amid pressure from U.S. President Donald Trump, who is calling for an immediate rate cut.

Against this backdrop, market expectations for a possible July rate cut rose to nearly 25.0%, compared to just 10.0%–12.0% two weeks earlier.

On Thursday, the U.S. Department of Labor will publish its latest monthly report for June. Moderately weak results are expected: nonfarm payrolls are projected to increase by 110,000 (after 139,000 in May), average hourly earnings are expected to slow from 0.4% to 0.3%, and the unemployment rate is anticipated to rise from 4.2% to 4.3%. Economists note that the U.S. economy needs to generate at least 150,000 new jobs to maintain labor market stability.

The cooling labor market, alongside rising inflation, places the Fed in a difficult position. The central bank is mandated to monitor inflation and keep it below the 2.0% target. At the same time, GDP growth and labor market conditions are also top priorities for the Fed.

According to last week's data, the U.S. economy contracted by -0.5% (annualized) in Q1 of this year (the previous estimate was -0.2%). The U.S. Department of Commerce attributes part of this decline to the White House's tariff policy and higher import duties, which have disrupted business operations. This marked the first economic contraction in three years.

If upcoming labor market data also confirm a worsening situation, the probability of Fed monetary easing will increase, likely triggering further growth in gold prices. The recent two-week decline in gold may, therefore, present an excellent opportunity to buy.

Among the negative factors for gold at present are the easing of geopolitical tensions in the Middle East and the potential for a trade deal between the U.S. and China, although official Beijing has so far refrained from commenting on this matter.

Amid a weakening dollar, criticism of Fed policy from President Donald Trump, and lingering concerns about the consequences of the trade war, gold prices in April surpassed $3,500 per ounce for the first time in history. In the following weeks, prices pulled back, but renewed tensions in the Middle East pushed prices back up to around $3,400 per troy ounce.

Should investment demand weaken, global economic prospects improve, and geopolitical tensions ease, a decline in gold prices is likely to occur.

In an optimistic scenario for gold — which some market experts assess with a 20% probability — a new all-time high may occur in Q3. Concerns over tariffs, geopolitical risks, and the risk of stagflation would drive this.

Thus, the gold market remains subject to many variables, and further price dynamics will depend on the interplay between these factors.

At the time this report was written, the XAU/USD pair was trading around 3278.00 after breaking through key support levels at 3330.00, 3321.00, 3300.00, and 3293.00, entering a short-term bearish zone. Nonetheless, considering the ongoing uptrend in XAU/USD, it may be reasonable to place pending buy orders near local lows and around the 3260.00–3250.00 levels.