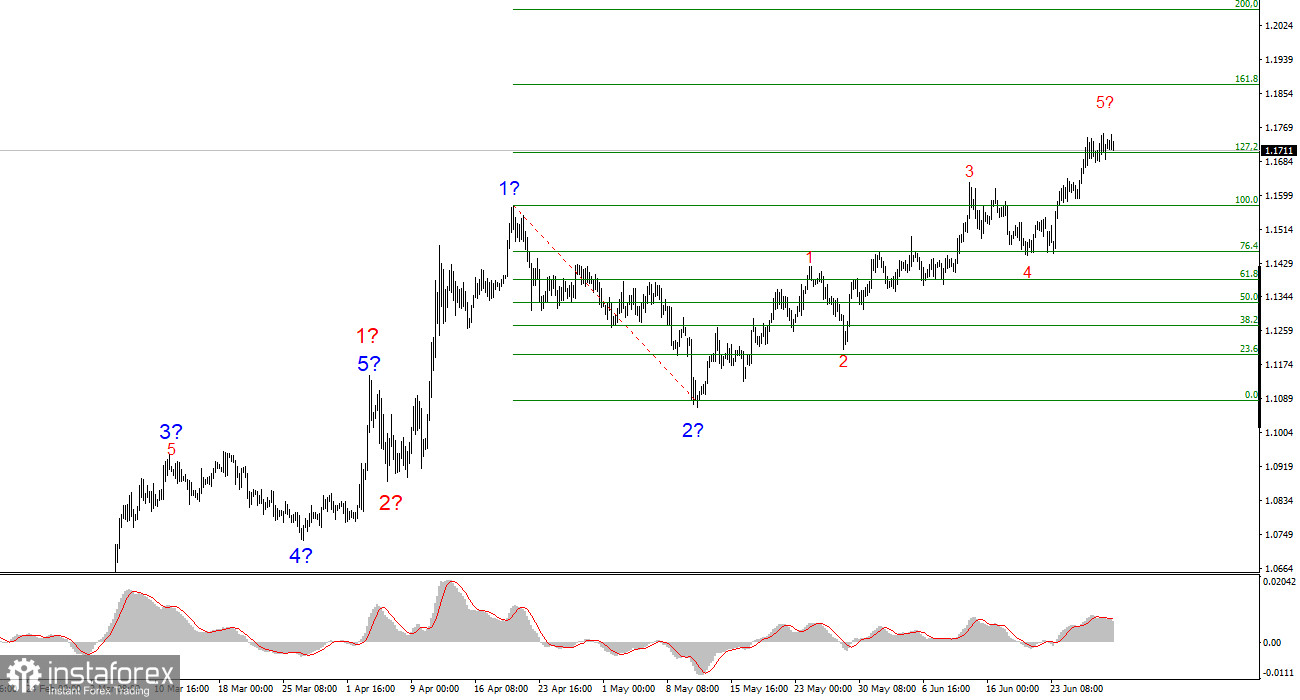

The wave pattern on the 4-hour chart for EUR/USD continues to indicate the formation of an upward trend segment. Until February 28, when the U.S. dollar began to decline, the entire wave pattern resembled a convincing downward trend. It was forming a corrective wave 2. However, the trade war initiated by Donald Trump—intended to increase budget revenues and reduce the trade deficit—has so far worked against the U.S. dollar. Demand for the dollar began to fall sharply, and now the entire trend segment, which started on January 13, has taken on a bullish impulsive form.

Currently, it appears that wave 3 within wave 3 is still developing, which could become much longer than it currently seems. If the present wave pattern is correct, then price growth is likely to continue in the coming weeks and months. However, the U.S. dollar will remain under pressure only if Donald Trump does not completely reverse his trade policy. The likelihood of such a reversal is very low, but anything could happen on July 9. Realizing the futility of his plan, Trump might unexpectedly announce an amnesty, claiming he does not wish to cause harm. But the probability of this scenario is, of course, extremely low.

The EUR/USD rate rose by several dozen basis points on Monday, which does not affect the current wave pattern. A five-wave upward structure has formed, so now the U.S. dollar even has some chance to strengthen, as wave analysis suggests the formation of a corrective set of waves. And that is the dollar's only chance in the near term. However, looking at this week's economic calendar, one begins to doubt such a scenario. Numerous important reports from the U.S., Trump remaining active at the helm without taking a break, and his ongoing criticism of Jerome Powell and the Federal Reserve all lead the market to one conclusion—sooner or later, the interest rate will be cut. And it will be cut significantly.

Therefore, even with the most compelling wave pattern, I wouldn't bet on a strong U.S. dollar recovery right now. On Monday, Germany released retail sales data, which showed a larger-than-expected decline of 1.6% month-on-month. Additionally, Germany's inflation report for June indicated a slowdown to 2.0% year-on-year, rather than the expected increase to 2.2%. Inflation continues to slow, although at a much more gradual pace than before. Nonetheless, the ECB may respond to this further deceleration in consumer price growth with another round of monetary policy easing—its ninth. This is not a problem for the euro, but the market is not inclined to overlook the potential risks facing the dollar.

Conclusions

Based on the EUR/USD analysis, I conclude that the pair continues to build an upward trend segment. The wave pattern remains fully dependent on news related to Trump's decisions and U.S. foreign policy, and there are still no positive developments. Wave 3 may extend as far as the 1.25 level. Therefore, I continue to consider long positions targeting the 1.1875 level, which corresponds to the 161.8% Fibonacci level. A de-escalation of the trade war could reverse the uptrend, but currently there are no signs of reversal or de-escalation.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are hard to trade and often change.

- If you are unsure about market conditions, it's better to stay out.

- Absolute certainty in market direction does not and cannot exist. Always use Stop Loss orders.

- Wave analysis can be combined with other analysis types and trading strategies.