Trade Review and Guidance for Trading the Euro

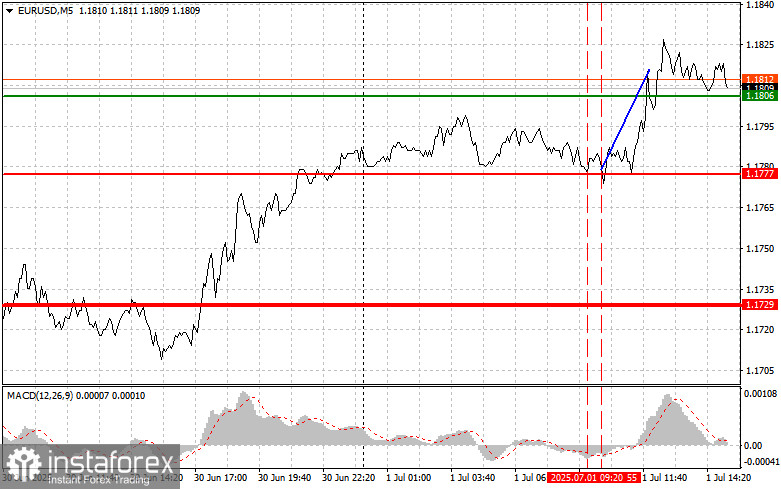

The first test of the 1.1777 price occurred when the MACD had already moved well below the zero line. The second test coincided with the MACD being in oversold territory, which led to the execution of Buy Scenario #2 and a 40-point rise in the euro.

Positive data from the Eurozone Manufacturing PMI, which came close to the 50-point threshold, triggered increased demand for the euro in the first half of the session. However, the strengthening of the European currency was short-lived, and investor focus quickly shifted to U.S. data.

In the second half of the day, pressure on EUR/USD could return—but only if the U.S. ISM Manufacturing PMI for June shows strong results. In addition, Fed Chair Jerome Powell is expected to reaffirm the Fed's current policy stance and rule out any premature rate cuts. Markets are closely analyzing any hints from the Fed regarding future monetary policy. Persistent inflation driven by trade tariffs and a strong labor market create conditions for a continued hawkish approach, and confirmation of this stance could support the U.S. dollar. On the other hand, weak manufacturing data could force investors to revise their forecasts and negatively affect the dollar.

For the intraday strategy, I will continue to focus on executing Buy and Sell Scenarios #1 and #2.

Buy Signal

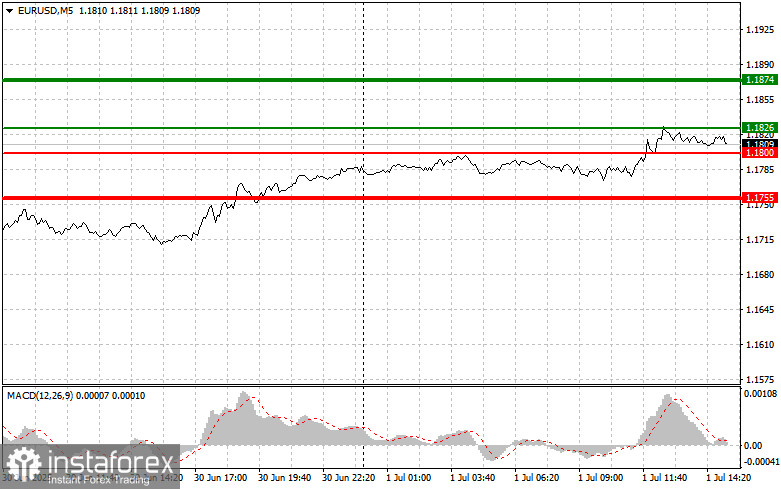

Scenario #1:Buy the euro when the price reaches around 1.1826 (green line on the chart), targeting a rise toward 1.1874. At 1.1874, I plan to exit the market and open short positions in the opposite direction, targeting a 30–35 point correction from the entry point. This scenario will only be valid if weak U.S. data is released.Important! Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise.

Scenario #2:I also plan to buy the euro today if there are two consecutive tests of the 1.1800 price level, and the MACD is in the oversold zone. This will limit the pair's downward potential and trigger a reversal to the upside. Growth can be expected toward resistance levels at 1.1826 and 1.1874.

Sell Signal

Scenario #1:Sell the euro after the price reaches 1.1800 (red line on the chart). The target will be 1.1795, where I plan to exit and then immediately buy in the opposite direction, targeting a 20–25 point rebound. Selling pressure will return if strong U.S. data is released.Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline.

Scenario #2:I also plan to sell the euro today if there are two consecutive tests of the 1.1826 level and the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a reversal to the downside. A decline toward 1.1800 and 1.1755 can be expected.

Chart Legend:

- Thin green line – Entry price to buy the trading instrument

- Thick green line – Estimated level for placing Take Profit or manually closing trades, as further growth above this level is unlikely

- Thin red line – Entry price to sell the trading instrument

- Thick red line – Estimated level for placing Take Profit or manually closing trades, as further decline below this level is unlikely

- MACD Indicator – Used to determine overbought and oversold zones for entry decisions

Important Note for Beginner Forex Traders:

Entering the market requires caution. It's best to avoid trading ahead of major fundamental reports to protect against sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-losses can quickly wipe out your account, especially if you disregard money management principles and use large trade volumes.

Remember: successful trading requires a well-defined plan, like the one presented above. Making spontaneous trading decisions based on the current market environment is a losing strategy for intraday traders.