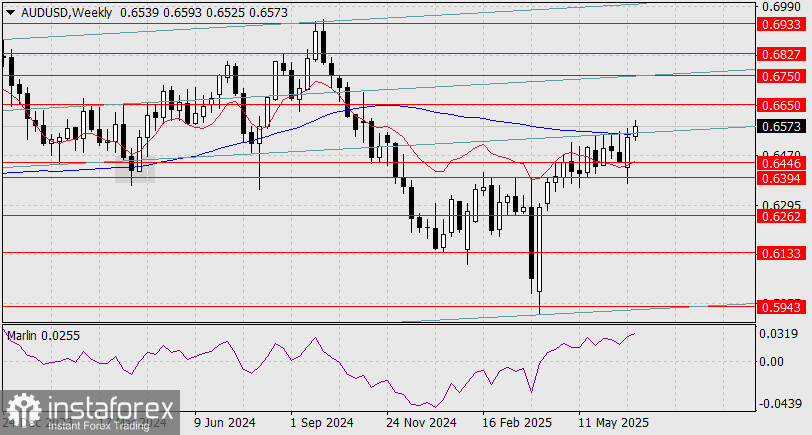

On the weekly chart, the Australian dollar has broken through a very strong resistance formed by the embedded price channel line and the MACD line, notably at the point of their intersection. Formally, this opens up targets at 0.6650 and even 0.6750—the next price channel line. However, everything hinges on tomorrow's U.S. employment data.

The Nonfarm Payrolls forecast stands at 120,000, down from 139,000 in May, and the unemployment rate is expected to rise from 4.2% to 4.3%. We do not expect better figures, as the number of unemployed has been increasing week over week. But there is a huge caveat—the data could easily be "adjusted" to appear more favorable.

We haven't seen falsifications of Nonfarm data for some time, but during Biden's presidency, they weren't necessary. Typically, such manipulations occur during difficult economic times and under strong leadership. We recall data manipulations during Barack Obama's first term (the second term would require a deeper historical review, but it's unnecessary here), and now we are witnessing a similar political and economic backdrop.

From a technical perspective, the recent two-day rise in AUD/USD could turn out to be a false breakout of strong resistance. The price may return to the 0.6394–0.6446 range and eventually work its way down to 0.6262. A similar false move—this time downward—occurred in April 2024 (marked by a gray rectangle), when the target level, the MACD line, and the price channel line were all breached.

On the daily chart, the price has consolidated above the price channel line, while the Marlin oscillator is turning back toward the zero line. Most likely, both the price and the oscillator will meet tomorrow's U.S. Bureau of Labor data release on these neutral technical lines.

On the H4 chart, the price is already contemplating breaking below yesterday's low of 0.6557, which would prepare the ground for an attack on the MACD line at 0.6522. Notably, this line aligns with its value on the daily chart, further reinforcing its significance. This support is also strong, and tomorrow will determine the winner.