Bitcoin and Ether have resumed growth, reaching new weekly highs amid favorable macroeconomic conditions. Over the past 24 hours, Bitcoin has risen by 2.5%, trading above $109,000. Ethereum also advanced by 5.58%, reaching $2,564, with XRP, Solana, and Dogecoin also showing notable recoveries.

Yesterday's market surge is largely attributed to the release of macroeconomic data. While such releases don't always trigger immediate price movements, weak U.S. data typically supports risk assets, as many investors and traders anticipate a more dovish stance from the Federal Reserve on rate cuts. A closer examination of the situation reveals several key points.

First, the published figures likely indicate a slowdown in U.S. economic growth, which increases pressure on the Fed to adjust its monetary policy. The market interprets this as a signal for potential easing, which typically stimulates investment and asset growth.

Second, this interpretation is closely tied to investor expectations regarding future Fed actions. Market participants are closely monitoring any shifts in the central bank's tone, and any signs of readiness to cut rates — which Fed officials have hinted at multiple times this week — are immediately reflected in prices.

Despite Bitcoin maintaining support above the $100,000 level for an extended period, the market still requires a sustainable catalyst to help the cryptocurrency break through its historical high.

Regarding intraday strategies in the cryptocurrency market, I will continue to rely on major dips in Bitcoin and Ethereum, anticipating that the medium-term bull market remains intact.

Below are the short-term trading strategies and setups.

Bitcoin

Buy Scenario

Scenario #1: I plan to buy Bitcoin today at the entry point around $109,400, targeting a rise to $110,900. I will exit long positions and sell on the rebound near $110,900.

Before buying on a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: Buy Bitcoin from the lower boundary at $108,600 if there is no bearish reaction to a breakout, aiming for $109,400 and $110,900.

Sell Scenario

Scenario #1: I will sell Bitcoin today at the entry point around $108,600, targeting a drop to $107,300. I will exit short positions and buy on the rebound near $107,300.

Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Sell Bitcoin from the upper boundary at $109,400 if there is no bullish reaction to a breakout, aiming for $108,600 and $107,300.

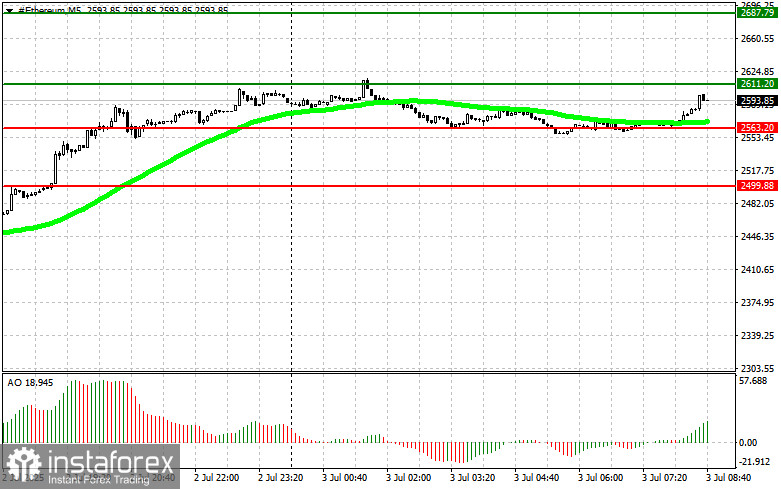

Buy Scenario

Scenario #1: I will buy Ethereum today at the entry point around $2,611, aiming for a rise to $2,687. I will exit long positions and sell on the rebound near $2,687.

Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: Buy Ethereum from the lower boundary at $2,563 if there is no bearish reaction to a breakout, targeting $2,611 and $2,687.

Sell Scenario

Scenario #1: I will sell Ethereum today at the entry point around $2,563, aiming for a decline to $2,499. I will exit short positions and buy on the rebound near $2,499.

Before selling on a breakout, confirm that the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Sell Ethereum from the upper boundary at $2,611 if there is no bullish reaction to a breakout, aiming for $2,563 and $2,499.