The S&P 500 rose by 0.47%, while the Nasdaq 100 gained 0.94%. The industrial Dow Jones, however, slipped by 0.02%.

Asian stock indices posted modest gains ahead of the upcoming US jobs report, as investors await fresh data following the latest ADP report, which signaled that President Donald Trump's trade war is taking a toll on the US economy. This uncertainty has created a wait-and-see atmosphere, where any sign of weakness in the American economy is viewed as a potential trigger for a global recession.

Weak data could prompt the Federal Reserve to ease monetary policy, which, in turn, may support risk assets. However, optimism remains limited due to fears of an escalating trade war. New tariffs and retaliatory measures could undermine global trade and investment, weighing negatively on worldwide economic growth.

The MSCI Asia Pacific Index edged up by 0.2%. US stock index futures rose 0.1% after the S&P 500 closed at another record high on Wednesday, buoyed by Trump's announcement of a trade deal with Vietnam. Meanwhile, gold fell 0.2%, marking its first decline in four days. US Treasury bonds inched higher on Thursday, following a previous session where yields jumped due to heavy selling in the UK. There, concerns about the future of Chancellor of the Exchequer Rachel Reeves reignited questions about the country's fiscal outlook.

In Japan, investors bought up 30-year government bonds at auction, suggesting that policymakers have had some success in curbing bond market volatility.

Overall, investors remain cautious ahead of today's jobs report. An increasing number of US economic data are pointing to a potential economic slowdown, making it more likely that the Fed will have to act sooner or later.

As for the trade deal with Vietnam, Trump stated that the Asian nation has agreed to eliminate all tariffs on US imports. Meanwhile, Vietnamese exports to the US will face a 20% tariff, and any goods considered as transiting through Vietnam will be subject to a 40% duty. Some analysts believe the deal could provoke retaliatory measures from China, potentially reigniting trade tensions.

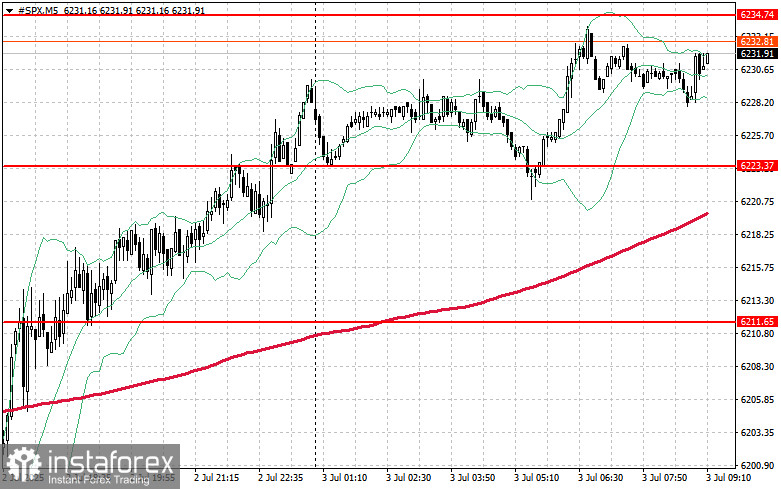

From the technical viewpoint on the S&P 500, the key task for buyers today is to break through the nearest resistance at 6,234. This would signal further upside potential and open the door for a push toward 6,245. Another crucial objective for the bulls will be maintaining control over 6,257, which would further strengthen their position.

In case of downward movement due to fading risk appetite, buyers must defend the 6,223 area. A breakdown below this level would likely send the index back to 6,111, and could pave the way for a move toward 6,200.