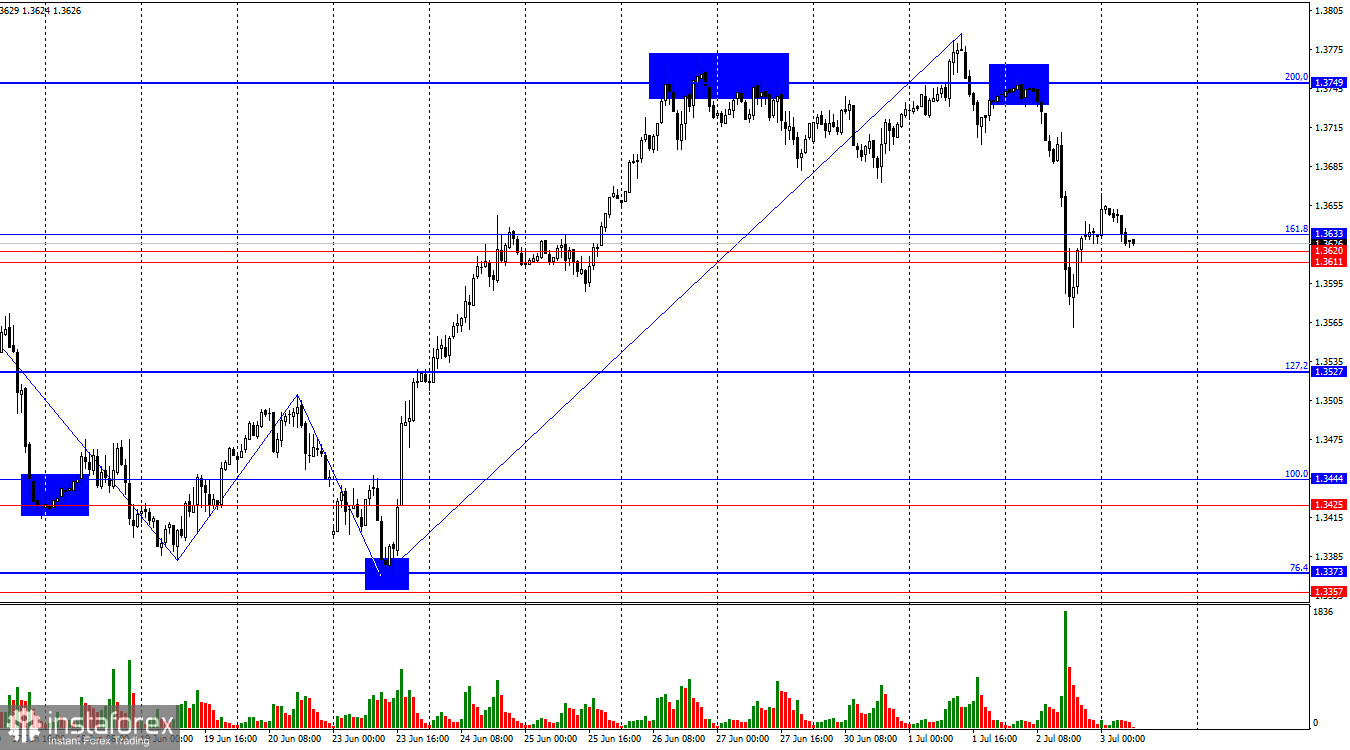

On the hourly chart, the GBP/USD pair on Wednesday rebounded from the 200.0% retracement level at 1.3749, reversed in favor of the U.S. dollar, and fell below the support zone of 1.3611–1.3633. This drop does not appear to be justified, and as of Thursday morning, the pound's quotes are positioned above the 1.3611–1.3633 zone. Thus, a rebound from this zone from above would favor the pound and a renewed rise toward the 1.3749 level. A new consolidation below the 1.3611–1.3633 zone would suggest a stronger decline toward the 127.2% Fibonacci level at 1.3527.

The wave situation still indicates a bullish trend. The last completed upward wave broke above the previous wave's peak, while the new downward wave hasn't approached the previous low. Bearish traders see no reason to establish a downward trend, and the U.S. dollar continues to lack fundamental support. Trump's trade war continues to have a damaging effect on the U.S. currency.

There was virtually no news out of the UK on Wednesday, except for the potential resignation of Finance Minister Rachel Reeves. The UK may face a serious budget deficit, requiring tax hikes, which is unlikely to please taxpayers and voters. Yields on Treasury bonds immediately rose, putting additional pressure on the budget. I don't believe this news alone could have caused the pound to drop by 200 points. Most likely, traders used it as an opportunity to lock in profits on long positions and open new buys at more favorable prices. The pound is supported by the 1.3611–1.3633 level. As long as the pair remains above this zone, a deeper decline is unlikely. Today, important U.S. reports on employment, unemployment, and business activity will be released, which may support the bears. However, for that to happen, the struggling U.S. economy will need to deliver stronger-than-expected figures.

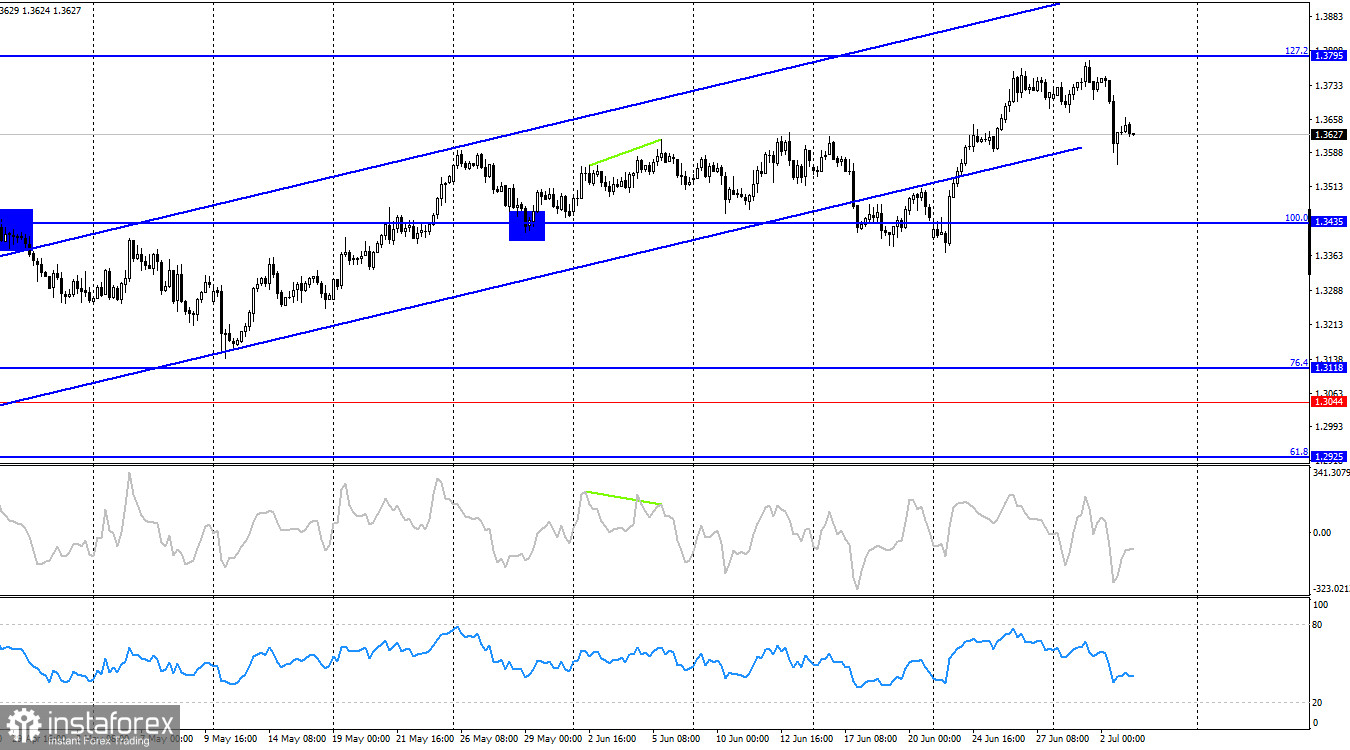

On the 4-hour chart, the pair reversed in favor of the U.S. dollar just a few points shy of the 127.2% retracement level at 1.3795. Since the decline was unexpected and may end quickly, I believe the hourly chart is more relevant for now.

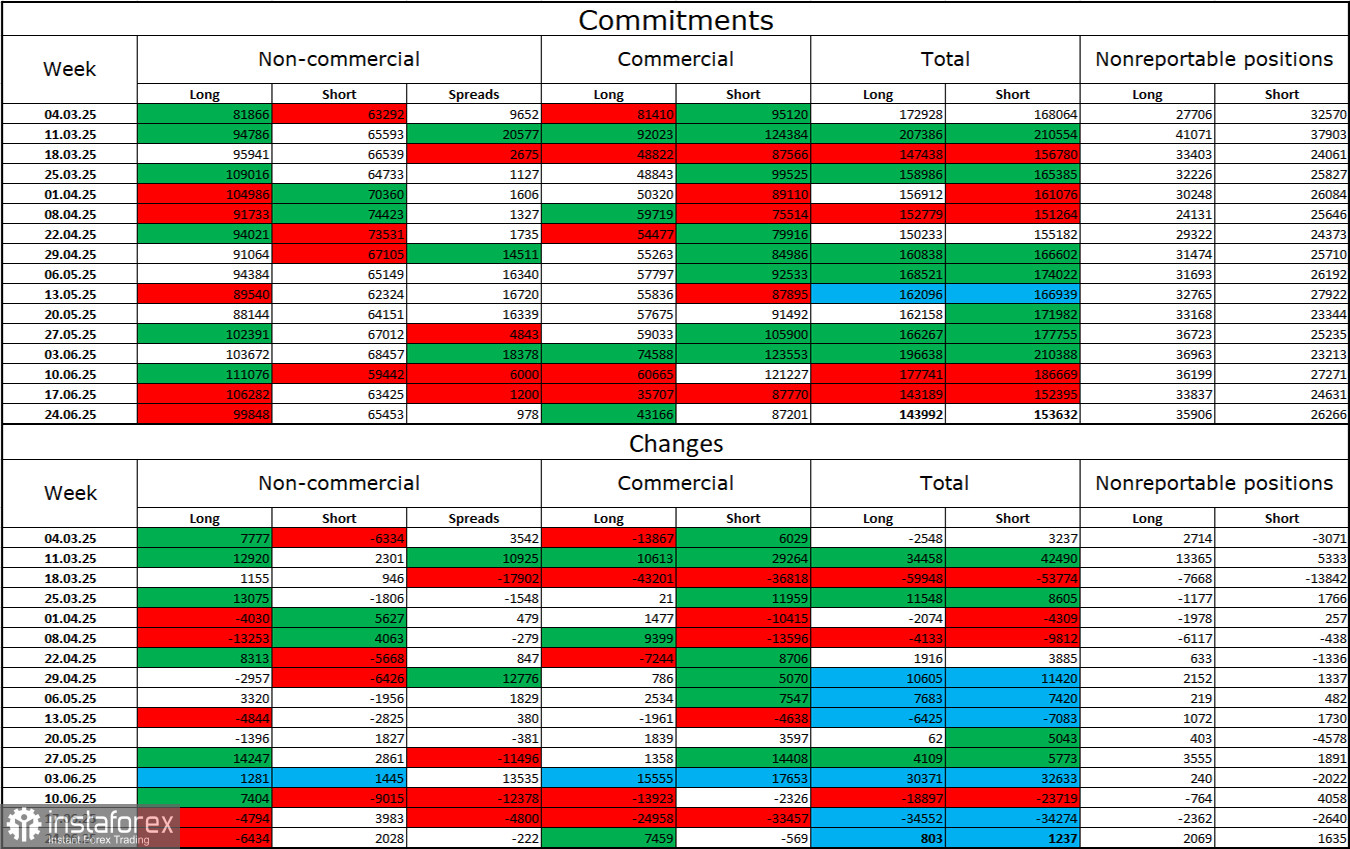

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became less bullish over the latest reporting week. The number of long positions held by speculators decreased by 6,434, while short positions increased by 2,028. However, bears have long lost their advantage in the market and currently have no real chance of success. The gap between long and short positions stands at 35,000 in favor of the bulls: 100,000 versus 65,000.

In my view, the pound still faces downside risks, but the events of 2025 have completely reshaped the market in the long term. Over the past three months, the number of long positions has risen from 65,000 to 100,000, while short positions have fallen from 76,000 to 65,000. Under Donald Trump, confidence in the dollar has been shaken, and COT reports indicate that traders have little interest in buying the U.S. currency. Thus, regardless of the broader news background, the dollar continues to fall amid developments surrounding Trump.

News Calendar for the U.S. and the UK:

- UK – Services PMI (08:30 UTC)

- U.S. – Nonfarm Payrolls (12:30 UTC)

- U.S. – Unemployment Rate (12:30 UTC)

- U.S. – ISM Services PMI (14:00 UTC)

Thursday's economic calendar includes at least three key events. The news background is likely to have a strong influence on trader sentiment in the second half of the day.

GBP/USD Forecast and Trading Recommendations:

Selling the pair was possible following a rebound from the 1.3749 level, targeting 1.3611–1.3633. That target has been reached. New selling opportunities may arise if the pair consolidates below the 1.3611–1.3633 zone, targeting 1.3527. Buying opportunities may be considered if the pair rebounds from the 1.3611–1.3633 zone on the hourly chart, with a target at 1.3749.

The Fibonacci grids are built from 1.3446–1.3139 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.