Analysis of Macroeconomic Reports:

Very few macroeconomic publications are scheduled for Monday, and none of them are significant. Let us recall that Friday was practically a semi-holiday, as the United States celebrated Independence Day. Monday may not be much more interesting. Germany will release its industrial production report, which in recent years has rarely shown strong figures. However, in 2025, this has no relevance for the euro, which continues to rise amid the dollar's collapse. The eurozone will also publish its retail sales report, which is also unlikely to draw traders' attention under current conditions.

Analysis of Fundamental Events:

There are absolutely no noteworthy fundamental events on Monday. Over the past two weeks, numerous speeches were delivered by key officials from the ECB, the Fed, and even the Bank of England (which is a rarity in itself). However, very few important statements were made, and they had virtually no impact on overall market sentiment. The ECB fears rising inflation, the Fed fears rising inflation, the Bank of England fears rising inflation, and collectively, they all fear economic uncertainty due to Donald Trump's tariffs.

The most significant issue for the market remains the trade war, with no signs of resolution or de-escalation in sight. In the near future, tensions may escalate sharply, as Donald Trump signed 3 out of 75 deals just days before the end of the "grace period." Moreover, the market doesn't understand what there is to celebrate if all the tariffs introduced by Trump remain in place. The situation with China is completely unclear—there were reports of a deal, but no information has been released regarding its content or scope. As for the deal with Vietnam, it's hard to say what effect it might have at all.

General Conclusions:

On the first trading day of the new week, both currency pairs may show very sluggish movement, as no important events or publications are scheduled for the day. As a result, we may see a second consecutive day with low volatility and a lack of trending movement.

Main Rules of the Trading System:

- The strength of a signal is determined by the time it takes to form (bounce or breakout of a level). The less time it takes, the stronger the signal.

- If two or more false trades are opened near a specific level, all subsequent signals from that level should be ignored.

- In a flat market, any pair may produce many false signals or none at all. In any case, it's better to stop trading at the first signs of a flat.

- Trades should be opened during the time window between the start of the European session and the middle of the American session. After that, all trades should be closed manually.

- On the hourly timeframe, it is advisable to trade based on MACD signals only when there is solid volatility and a trend confirmed by a trendline or trend channel.

- If two levels are located too close to each other (within 5 to 20 points), they should be treated as a support or resistance zone.

- After the price moves 15–20 points in the correct direction, a Stop Loss should be set at breakeven.

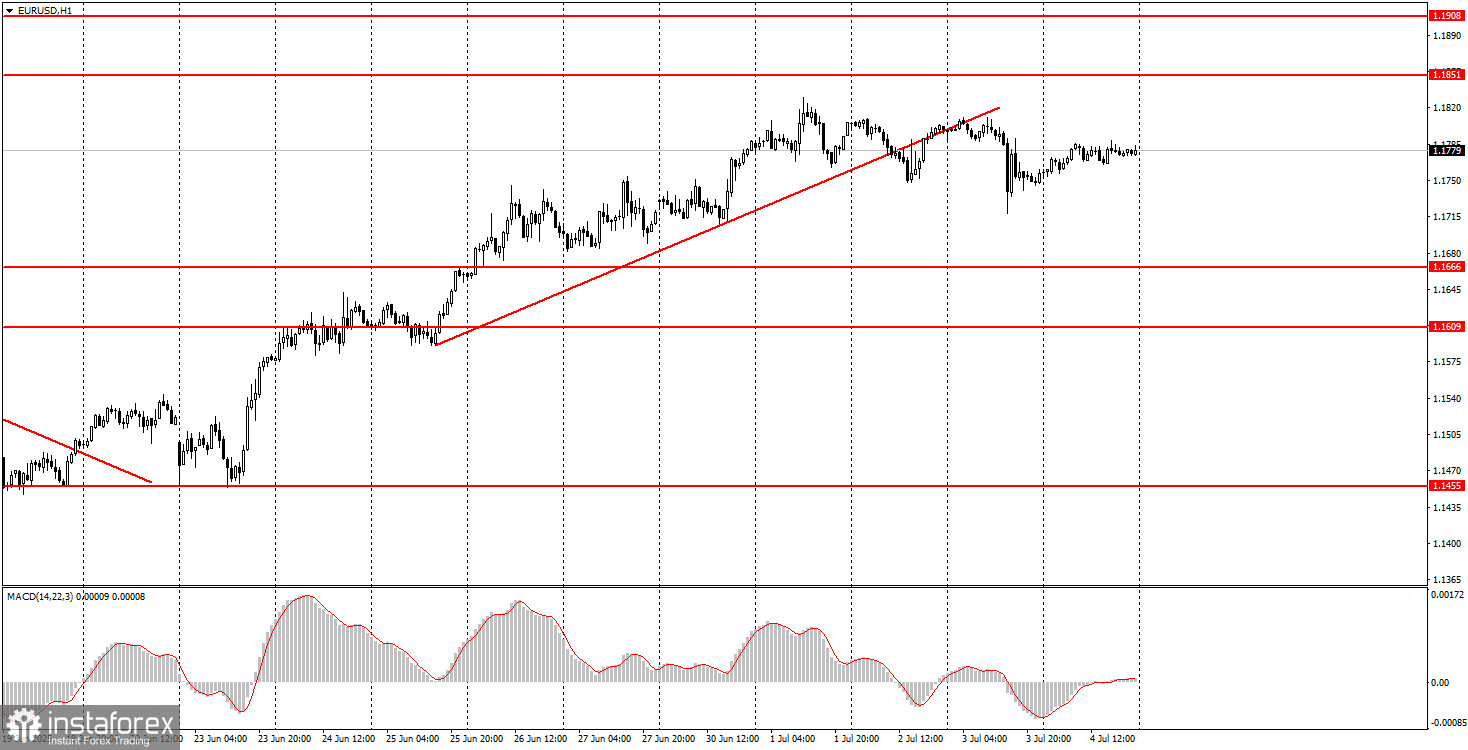

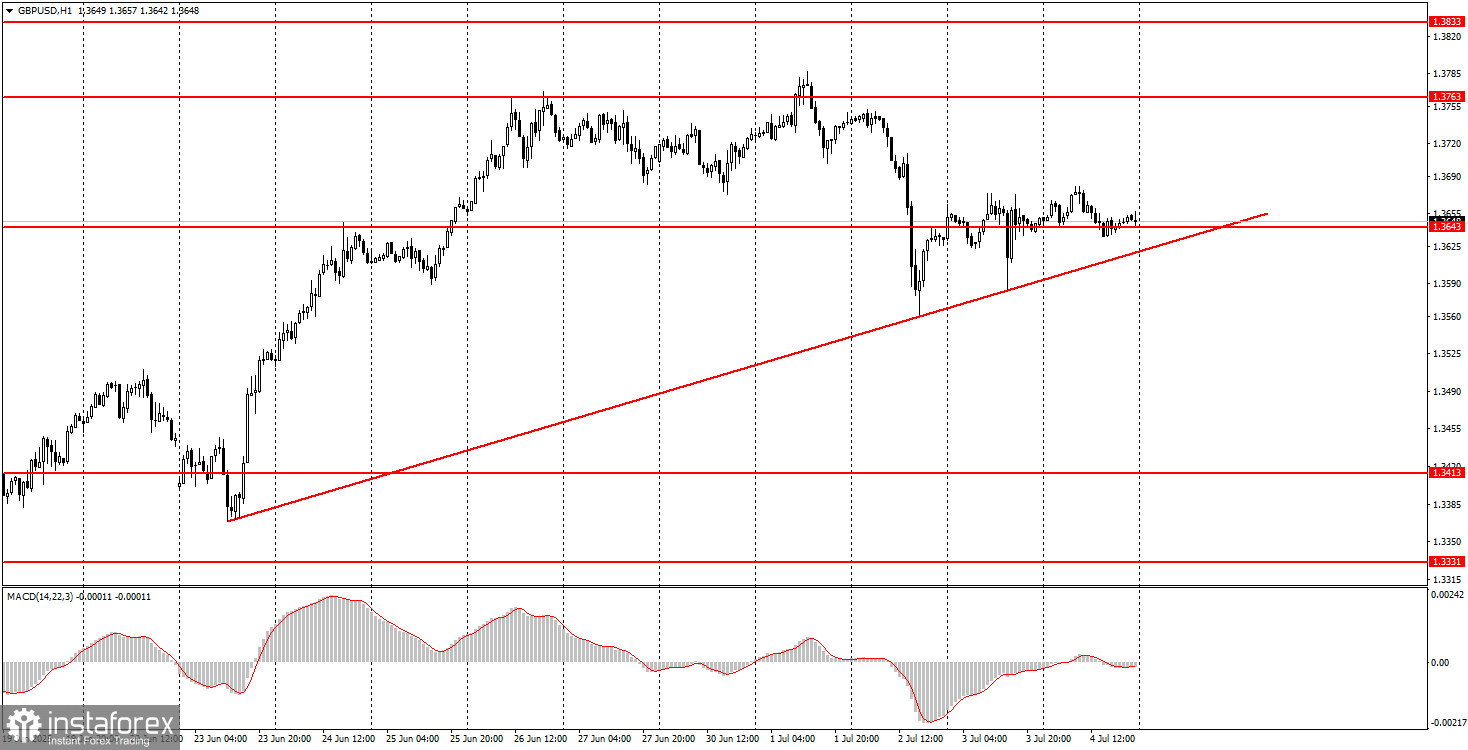

What's on the Charts:

- Support and resistance levels – price levels that serve as targets when opening buy or sell positions. Take Profit levels can be set near them.

- Red lines – channels or trendlines that indicate the current trend and show which direction is preferable for trading at the moment.

- MACD indicator (14,22,3) – the histogram and signal line are auxiliary indicators that can also be used as a source of signals.

Important speeches and reports (always listed in the economic calendar) can significantly impact the movement of a currency pair. Therefore, it is recommended to trade with maximum caution during their release or exit the market to avoid a sharp reversal against the preceding trend.

For beginners trading on the forex market, it's important to remember that not every trade will be profitable. Developing a clear strategy and applying sound money management are key to long-term success in trading.