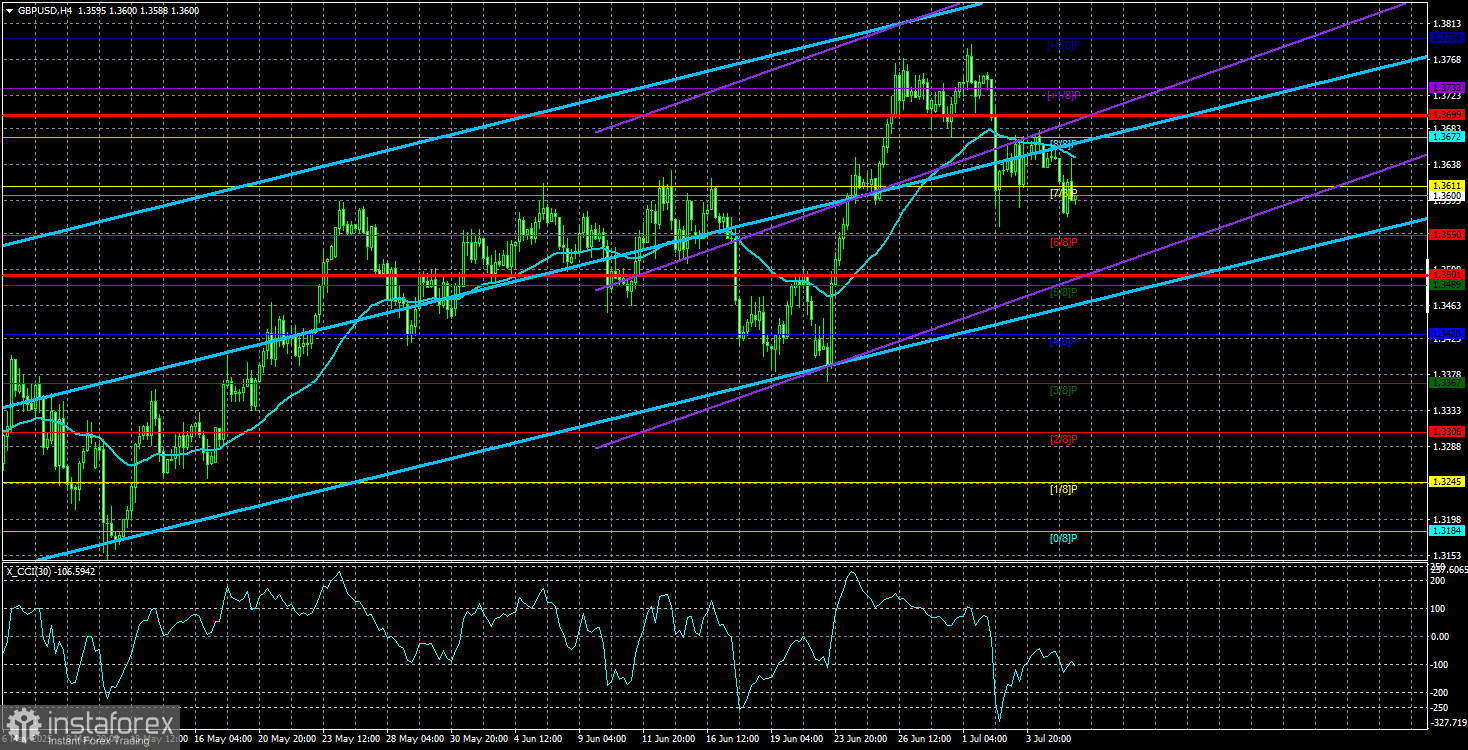

The GBP/USD pair declined slightly on Monday, but it's still premature to speak of a downtrend. From a technical standpoint, the pair remains below the moving average line; however, the CCI indicator entered the oversold zone. There are no fundamental reasons to expect strong growth of the U.S. dollar. Recall that the market continues to freely ignore genuinely solid economic news from the U.S.—for example, labor market data or the Fed's ongoing hawkish policy. This suggests that traders are far more interested in developments surrounding Donald Trump's decisions. And with no positive news on that front, the dollar continues to struggle to strengthen.

On Monday, the U.S. president made headlines again. He plans to restore tariffs to their original levels for all countries that are unwilling to offer him favorable terms, and also intends to raise tariffs on countries he considers to be taking an "anti-American position." The meaning of this term is unclear and not commonly used.

First, BRICS includes such global giants as Russia, China, India, Brazil, South Africa, Iran, and several others. These countries are long-standing rivals of the U.S. At a certain point, a logical question arose: if the U.S. is considered a hostile country, why continue using the dollar for transactions? Rumors that BRICS nations may begin phasing out the use of the dollar for settlements and reserves have circulated for quite some time. Yet the dollar remains the world's primary currency. Abandoning it is neither quick nor simple—but steps in that direction are underway.

Trump, whose actions over the past five months have contributed to a significant decline in the dollar, clearly opposes anything he perceives as contrary to American interests. He wants the world to follow Washington's lead, trade according to American rules, pay what America deems appropriate, and use the currency that benefits the U.S. Just think about it—how can one country dictate to another what currency it should use for reserves or trade? If Russia and India are trading with each other, why must they be obligated to use the U.S. dollar?

Trump's stance is difficult to comprehend. If BRICS countries continue their "anti-American policies," they will face an additional 10% tariff. As we can see, tariff warfare remains one of Trump's key instruments. So even if trade agreements are signed with 75 countries, there is no guarantee that in a month Trump won't find another global injustice and impose new tariffs. If something doesn't go according to the White House's plan, then—tariffs.

Therefore, we are almost certain that the global trade war is not going to end anytime soon. Many countries may already realize that pressure will persist as long as Trump remains in office. As a result, some may opt to cease negotiations with the U.S. altogether. If he wants tariffs—so be it. It will hurt America more. The more damage to America, the sooner the Republicans will lose power, and either Musk's party or the Democrats will come to power—partners with whom mutual cooperation is possible.

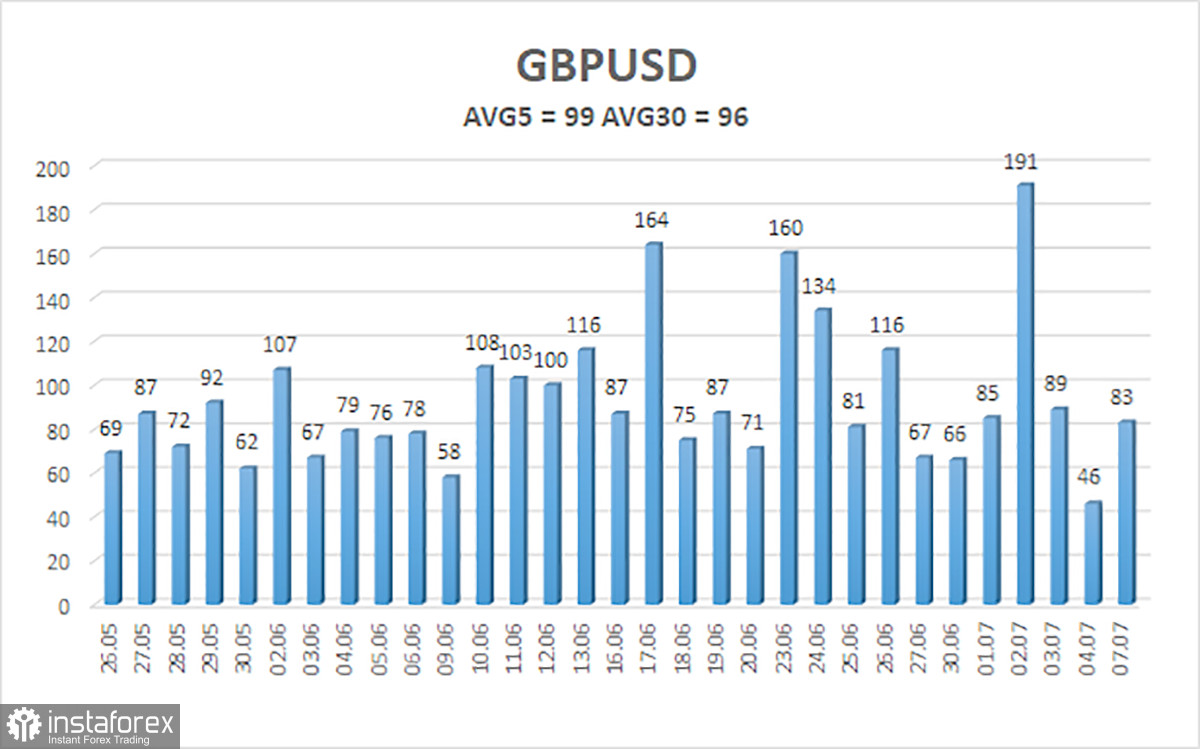

The average volatility for the GBP/USD pair over the last five trading days stands at 99 points, which is considered "average" for the pair. On Tuesday, July 8, we expect movement within a range bounded by 1.3501 and 1.3699. The senior linear regression channel is pointing upward, indicating a clear uptrend. The CCI indicator entered the oversold zone for the second time recently, again suggesting a possible resumption of the upward trend.

Nearest support levels:

- S1 – 1.3550

- S2 – 1.3489

- S3 – 1.3428

Nearest resistance levels:

- R1 – 1.3611

- R2 – 1.3672

- R3 – 1.3733

Trading Recommendations: The GBP/USD pair continues a weak downward correction, which may soon come to an end. In the medium term, Donald Trump's policies will likely continue to put pressure on the dollar. Therefore, long positions with targets at 1.3699 and 1.3733 remain relevant if the price stays above the moving average. If the price remains below the moving average line, short positions with targets at 1.3550 and 1.3501 may be considered—but as before, we do not expect strong dollar growth. Occasionally, the U.S. currency may show corrective movement, but strong growth would require clear signs of an end to the global trade war.

Explanation of Illustrations:

- Linear regression channels help determine the current trend. If both are pointing in the same direction, the trend is considered strong.

- The moving average line (settings: 20.0, smoothed) defines the short-term trend and the direction in which to trade.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) show the likely price range for the pair over the next 24 hours based on current volatility metrics.

- The CCI indicator entering the oversold (below -250) or overbought (above +250) zones signals a potential trend reversal.