Both Bitcoin and Ethereum remain on a sound footing, poised to continue a bullish trend. As long as BTC continues trading above the $105,000 mark, the odds of further growth and a new all-time high are quite high.

Investor sentiment also points toward medium-term optimism for Bitcoin, as shown by data from the BlackRock Bitcoin ETF, which yesterday surpassed 700,000 BTC under management, with a total capitalization of around $75.5 billion. An additional $164.6 million flowed into the fund just yesterday.

This inflow of capital reflects sustained institutional interest in cryptocurrency, despite volatility and regulatory risks. BlackRock, being one of the largest asset managers in the world, has a significant impact on the market. The company's positive outlook on Bitcoin acts as a signal for a broader range of investors, including retail participants. The amount invested in the fund in a single day highlights the scale of capital flows being directed into Bitcoin.

IBIT (BlackRock's ETF) accounts for over 55% of all BTC held by US spot Bitcoin ETFs. Since its launch in January 2024, the fund has delivered a total return of 82.67%. Rumors are already circulating that BlackRock now earns more from its IBIT fund than from its flagship iShares Core S&P 500 ETF.

Meanwhile, according to Galaxy Research, US-based Bitcoin ETFs, combined with Michael Saylor's Strategy, the largest corporate holder of Bitcoin, have been purchasing more Bitcoin each month than miners are producing. In 2025 alone, Strategy and US Bitcoin ETFs together acquired $28.22 billion worth of Bitcoin, while the net new issuance from miners during the same period amounted to only $7.85 billion.

All of this serves as additional confirmation of a bull market in play.

Intraday strategy on the crypto market

Going forward, I will continue to rely on major pullbacks in Bitcoin and Ethereum as buying opportunities, betting on a further bullish trend in the medium term, which hasn't gone anywhere.

Bitcoin

Buy scenarios

Scenario 1: I will buy Bitcoin today upon reaching the entry point around $108,500, targeting a rise toward $109,500. I'll exit the long position near $109,500 and sell immediately on the bounce. Before entering during the breakout, I must ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario 2: Bitcoin can also be bought from the lower border of $107,800, provided there's no strong bearish reaction to its breakout, aiming for $108,500 and $109,500 targets.

Sell scenarios

Scenario 1: I will sell Bitcoin today if it reaches the entry point near $107,800, aiming for a decline toward $107,000. I'll exit the short position near $107,000 and buy immediately on the bounce. Before entering during the breakdown, I must ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario 2: Bitcoin can also be sold from the upper border of $108,500, provided there's no strong bullish reaction to its breakout, targeting $107,800 and $107,000.

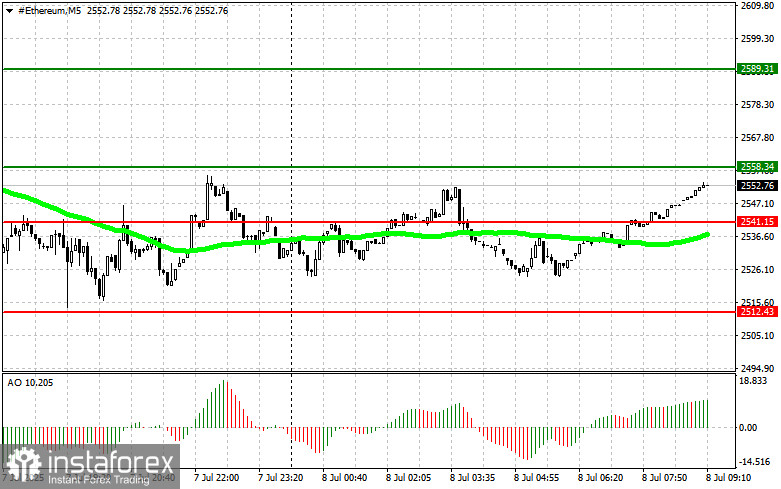

Ethereum

Buy scenarios

Scenario 1: I will buy Ethereum today as soon as the price reaches an entry point around $2,558, targeting a rise toward $2,589. I'll exit the long position near $2,589 and sell immediately at the bounce. Before entering during the breakout, I must check that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario 2: Ethereum can also be bought from the lower boundary of $2,541, provided there's no strong bearish reaction to its breakout, targeting $2,558 and $2,589.

Sell scenarios

Scenario 1: I will sell Ethereum today if it reaches the entry point near $2,541, aiming for a decline toward $2,512. I'll exit the short position near $2,512 and buy immediately at the bounce. Before entering during the breakdown, I must ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario 2: Ethereum can also be sold from the upper border of $2,558, provided there's no strong bullish reaction to its breakout, targeting $2,541 and $2,512.