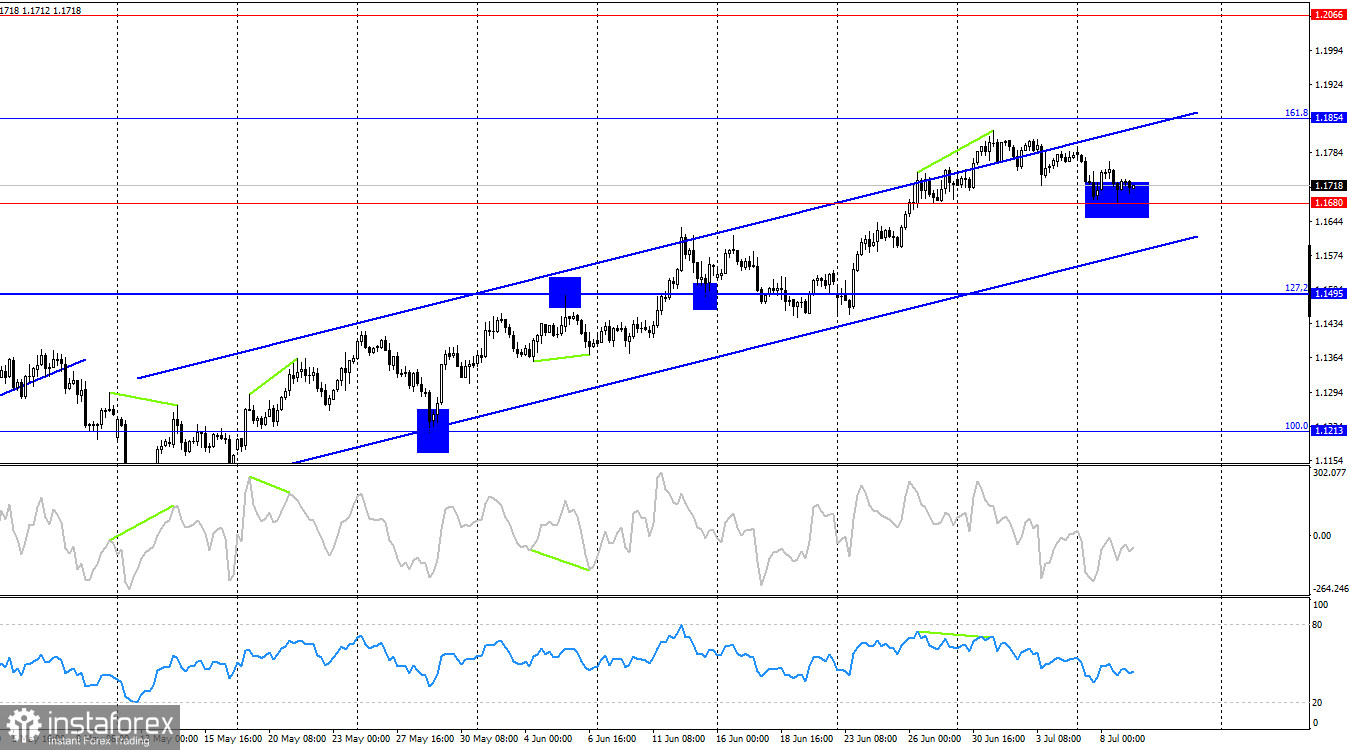

On Tuesday, the EUR/USD pair continued to decline, completely ignoring the 127.2% correction level at 1.1712. This level is currently not suitable for identifying trading signals. The euro's decline should be viewed as a corrective pullback.

The wave structure on the hourly chart remains simple and clear. The last completed upward wave broke above the peak of the previous wave, while the new downward wave did not even come close to the previous low. Therefore, the trend remains bullish. The lack of real progress in U.S. trade negotiations and the low likelihood of reaching agreements with most countries continue to discourage bearish traders from becoming more active.

There were no notable economic reports on Tuesday, but Donald Trump began the new week with another round of tariffs. On Monday, he announced tariff hikes for 15 countries with which the U.S. has a high trade deficit. However, the new tariffs will take effect only on August 1. This gives U.S. trade partners another deadline and a new opportunity to reach agreements. That said, traders were more focused on the EU deal than on countries like Myanmar or Tunisia. Regarding the EU, Trump stated on Tuesday that tariff increases are still on the table if no deal is reached, but their implementation is also delayed until August 1.

It's worth noting that, in addition to country-specific tariffs, there are also sectoral tariffs. Imports of steel, aluminum, and automobiles from any country are subject to tariffs of 50%, 50%, and 25%, respectively—unless a trade agreement is in place. This means that the average tariff rate for the EU is already above 10% and may rise even further starting August 1. In my view, there is still no reason for optimism among traders or for strength in the dollar. I expect the corrective pullback to end and the EUR/USD pair to resume its upward trend.

On the 4-hour chart, the pair returned to the 1.1680 level. A rebound from this level would favor the euro and signal a resumption of growth toward the next corrective level at 161.8% – 1.1851. A firm move below 1.1680 would open the way for a decline toward the lower boundary of the ascending trend channel. No emerging divergences are observed on any indicator at the moment.

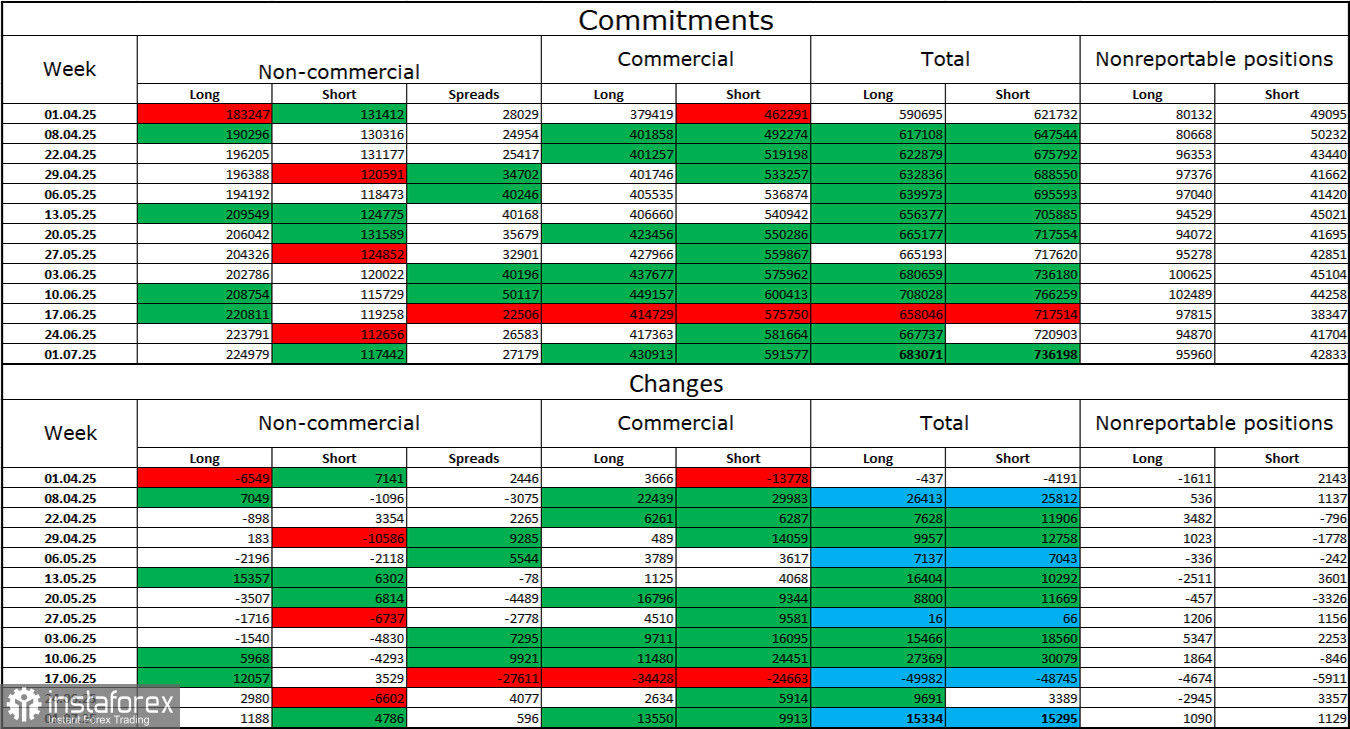

Commitments of Traders (COT) Report:

During the most recent reporting week, professional traders opened 1,188 new Long positions and 4,786 Short positions. The sentiment of the "Non-commercial" group remains bullish—largely thanks to Donald Trump—and continues to strengthen over time. The total number of Long positions held by speculators is now 225,000, while Short positions total 117,000. The gap, with few exceptions, continues to widen. This indicates sustained demand for the euro and a lack of interest in the dollar. The overall situation remains unchanged.

For twenty-two consecutive weeks, large players have been reducing Short positions and increasing Longs. Despite the significant difference in monetary policy between the ECB and the Fed, Donald Trump's policies have become a more influential factor for traders. His actions could lead to a recession in the U.S. and other long-term structural challenges for the American economy.

Economic calendar for the U.S. and the EU:

- U.S. – FOMC Minutes (18:00 UTC)

On July 9, the economic calendar contains no notable entries. As a result, market sentiment on Wednesday will once again not be influenced by economic reports.

EUR/USD Outlook and Trading Recommendations:

I would not consider selling the pair today, as I do not view the 1.1712 level as strong. Buying is possible on a rebound from the 1.1680 level on the 4-hour chart, with a target at 1.1802. Bulls continue to hold the initiative in the market, and the news background remains in their favor.

Fibonacci grids:

- On the hourly chart: from 1.1574 to 1.1066

- On the 4-hour chart: from 1.1214 to 1.0179