Trade Analysis and Tips for the Japanese Yen

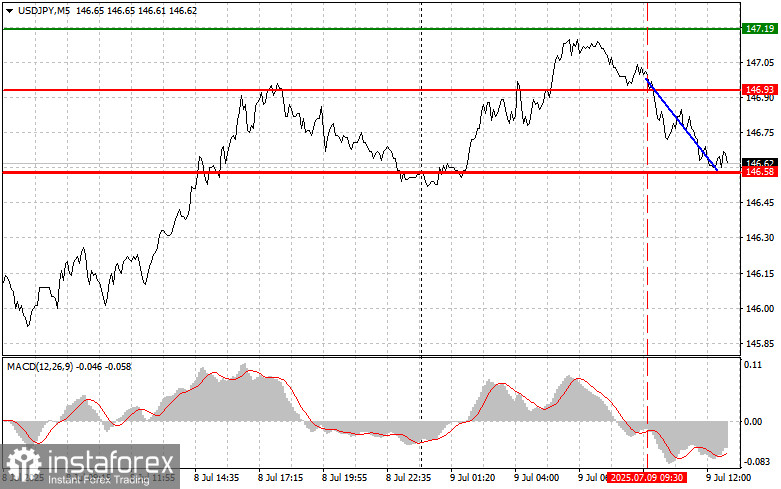

The test of the 146.93 level coincided with the MACD indicator just beginning to move downward from the zero line, which confirmed a valid entry point for buying the U.S. dollar. As a result, the pair declined toward the target level of 146.58.

Demand for the dollar has slightly weakened, while interest in the yen has returned—especially considering how much the pair has risen recently. Given that the Bank of Japan has not yet abandoned its policy of further rate hikes, and considering the potential for a U.S.–Japan trade agreement, sellers are taking advantage of attractive price levels and gradually entering the market amid the current uptrend.

In the second half of the day, the key events will be the release of U.S. wholesale inventory data and the minutes from the latest Federal Reserve meeting. Inventory levels typically have some market impact, but significantly more attention will be paid to the Fed minutes, where market participants hope to find clues about the central bank's future monetary policy strategy. In particular, there will be interest in how committee members assess current inflation levels, economic growth trends, and employment prospects. Any indications of a more decisive move to cut interest rates could trigger dollar weakness. Overall, the second half of the day is expected to remain relatively calm.

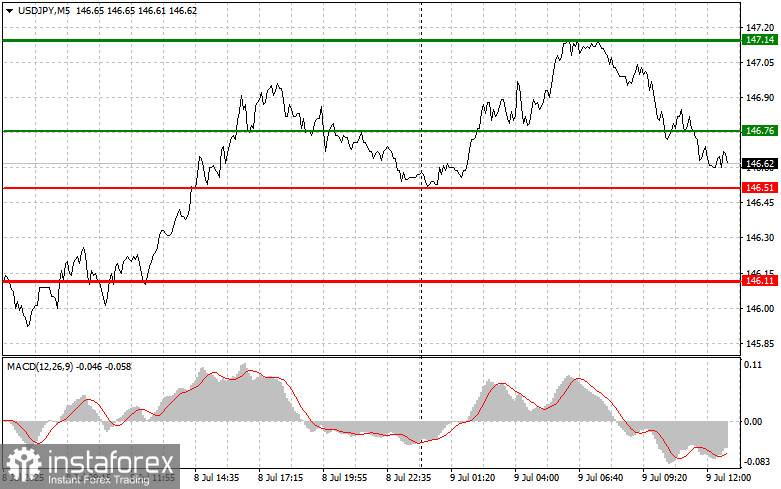

As for the intraday strategy, I will mainly focus on executing Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy USD/JPY at the entry point around 146.76 (green line on the chart), targeting a rise toward 147.14 (thicker green line on the chart). Around 147.14, I will exit long positions and open short positions in the opposite direction, aiming for a reversal move of 30–35 points. A further rise in the pair can be expected as the uptrend continues.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the 146.51 level while the MACD indicator is in the oversold area. This will limit the pair's downward potential and trigger an upward market reversal. A rise toward the opposite levels of 146.76 and 147.14 can be expected.

Sell Signal

Scenario #1: Today, I plan to sell USD/JPY after the price breaks below 146.51 (red line on the chart), which could lead to a rapid decline in the pair. The key target for sellers will be 146.11, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a reversal of 20–25 points from that level). Downward pressure on the pair is unlikely to return in force today.Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 146.76 level while the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 146.51 and 146.11 can be expected.

Chart Notes:

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – suggested level for placing Take Profit or manually closing a position, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – suggested level for placing Take Profit or manually closing a position, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it's important to follow overbought and oversold zones.

Important:Beginner Forex traders must be extremely cautious when making entry decisions. It's best to stay out of the market before the release of important fundamental reports to avoid getting caught in sharp price swings. If you choose to trade during news events, always use stop-loss orders to minimize losses. Trading without stop-losses can quickly lead to a complete loss of your deposit, especially if you don't use proper money management and trade large volumes.

And remember, successful trading requires a clear trading plan—like the one I presented above. Spontaneous decisions based on the current market situation are an inherently losing strategy for intraday traders.