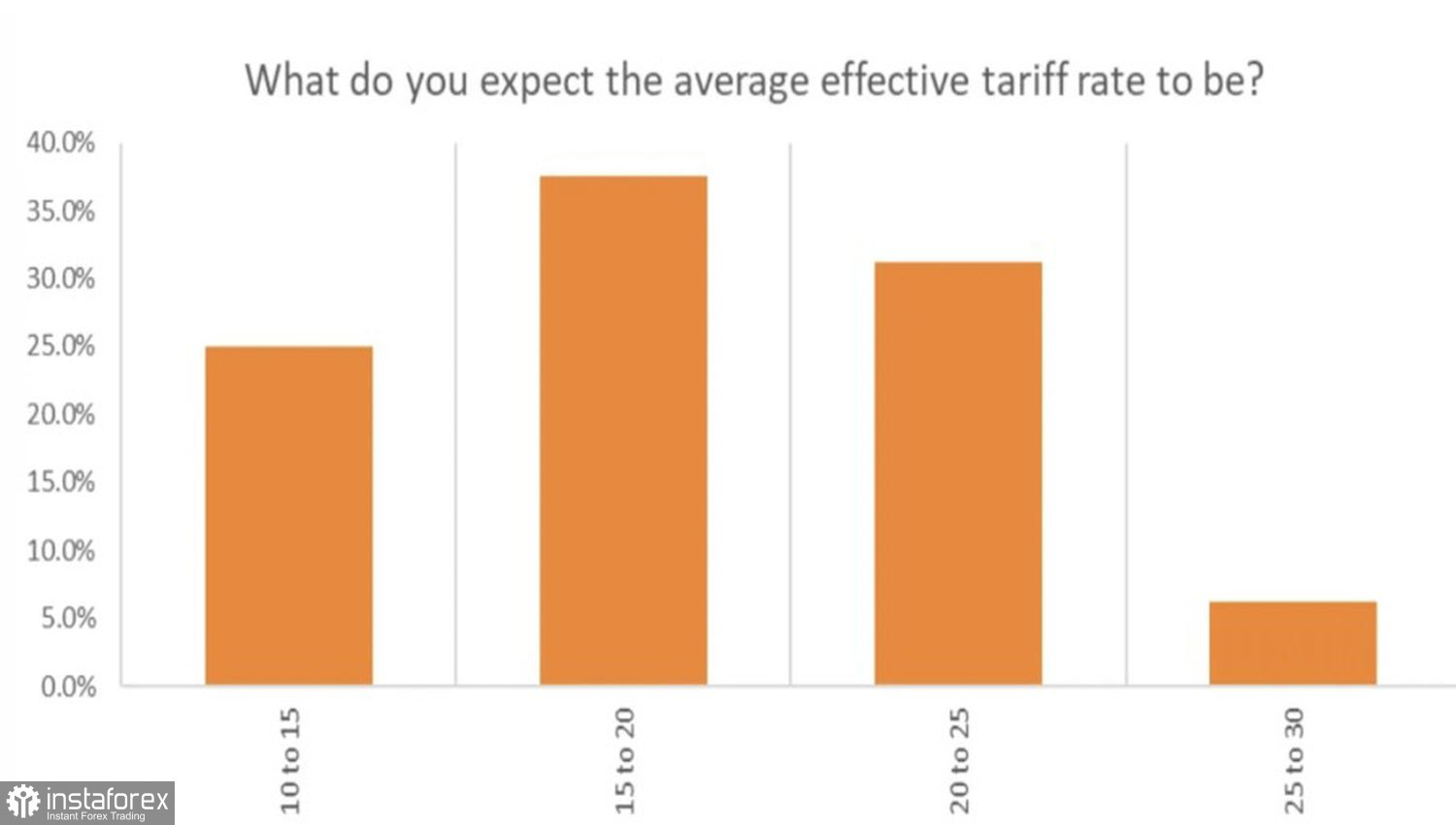

Deep down, markets still believe tariffs could become an inflationary force. However, without confirmation from official data, investors are not ready to sell the S&P 500. They've grown accustomed to tariff-related drama and reached a state of complacency. Yet the combination of high import duties and a weak dollar is a dangerous cocktail. It would accelerate CPI, force the Federal Reserve to maintain elevated rates, negatively affect consumer demand, and reduce profit margins. Still, no one seems to be pricing in this negative outcome just yet.

Markets are currently focused on Donald Trump's tariff threats, the start of the Q2 corporate earnings season, and the upcoming U.S. inflation data release. The U.S. President has said he does not plan to make any new deals—letters, in his view, already constitute a deal. However, if someone wants to propose a different deal, the U.S. is willing to listen. Trump has threatened Russia with 100% secondary tariffs if the armed conflict in Ukraine is not ended within 50 days.

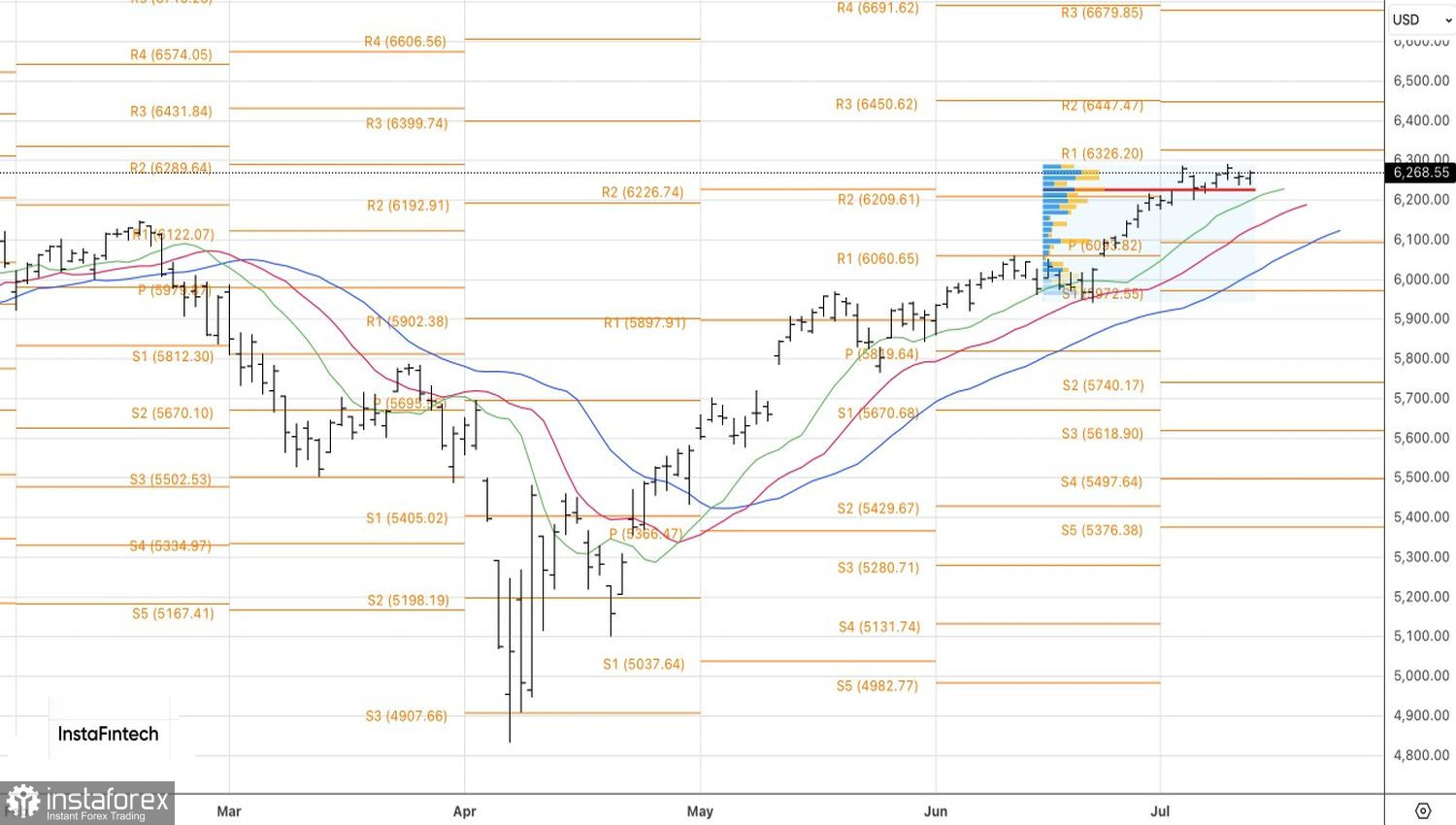

S&P 500 Corporate Earnings: Trends and Forecast

Wall Street analysts expect S&P 500 corporate profit growth to slow to 2.5%, which would mark the slowest pace since mid-2023. The earnings season kicks off with U.S. banks. Since the April low, the KWB Bank Index has risen 37% and is near record highs, outpacing the broader equity index. Yet the potential for a continued rally amid the stunning resilience of the U.S. economy appears to remain untapped.

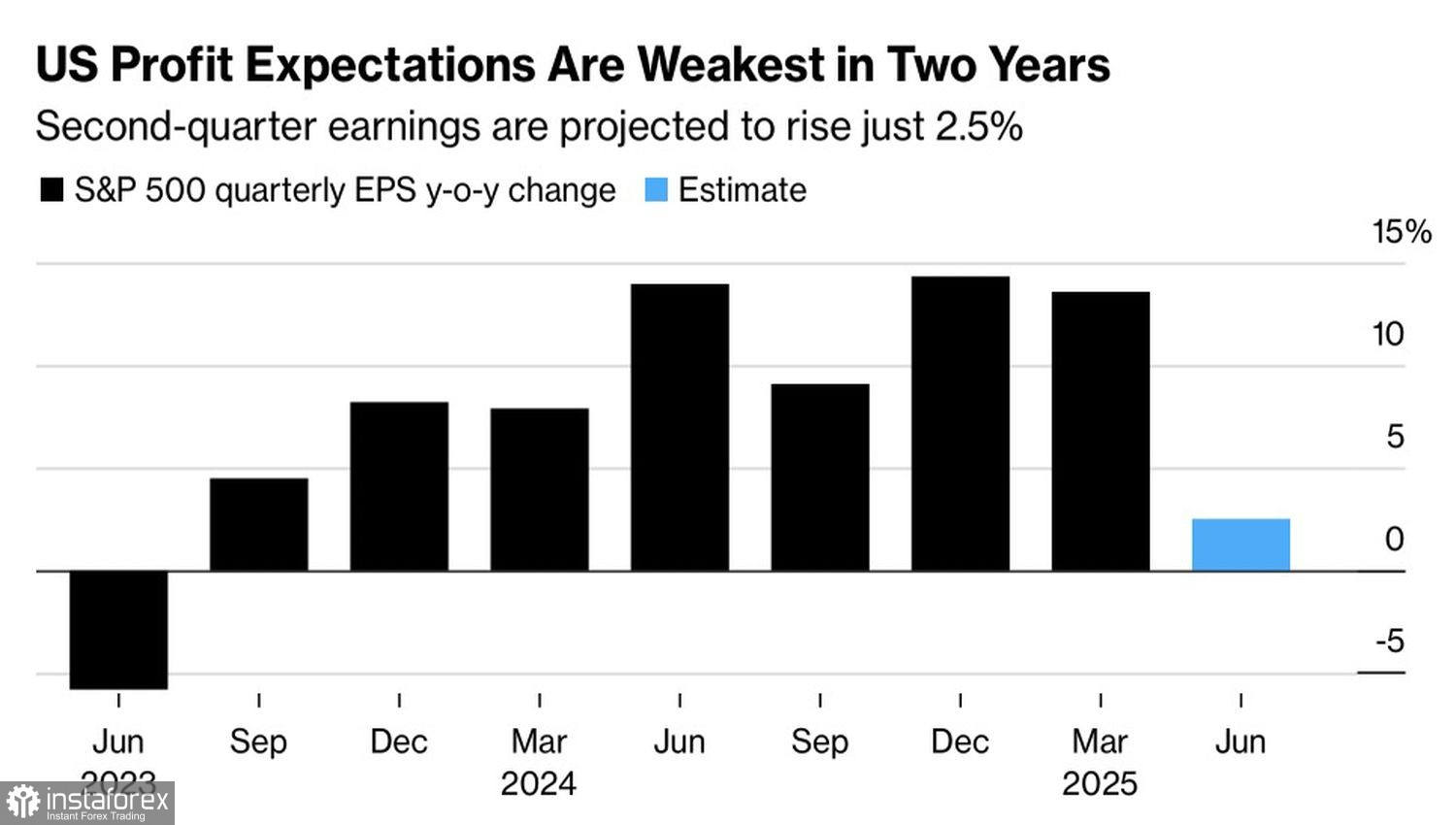

Will this resilience falter due to tariffs? According to a 22V Research survey, investors expect the average U.S. import tariff rate to reach 17%. They estimate that such duties would add 28 basis points to core inflation growth in 2025—almost half the level forecasted in May.

Projected Average U.S. Tariff Rate: Market View

According to Citigroup, the derivatives market is pricing in an S&P 500 move of ±0.6% in response to the upcoming U.S. inflation release for June. This is below the average realized move of 0.9% over the past year. But actual market reaction could differ sharply—consumer price data may offer the first concrete signs of tariff impacts on the U.S. economy.