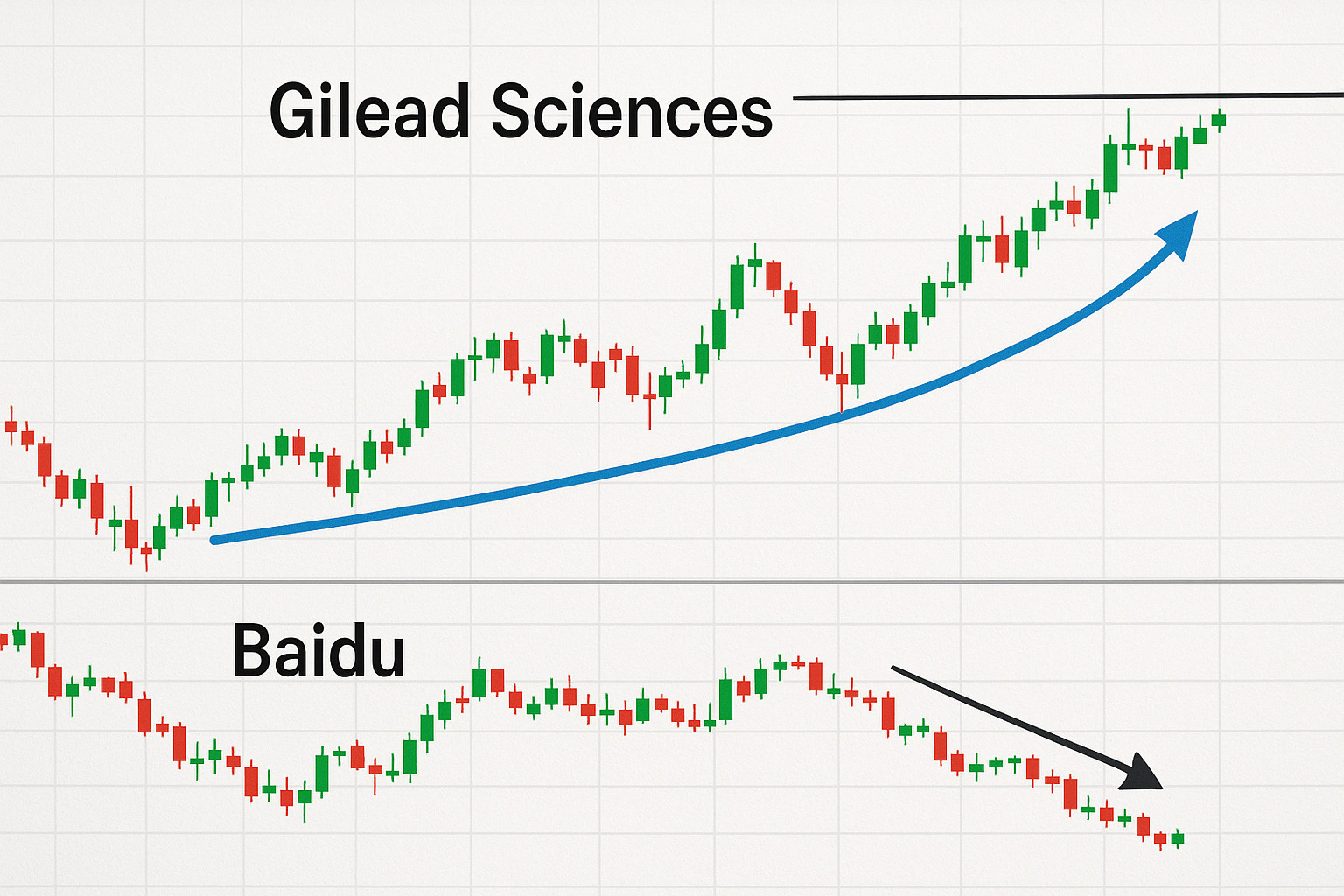

Gilead shares are climbing, while Baidu is falling

Gilead Sciences stock is showing signs of growth after a strong rebound from the support line, with a projected rise toward the March 10 high of 119.89.

Meanwhile, Baidu continues to decline, creating favorable conditions for hedging. Investors are closely watching the evolving dynamics in the pharmaceutical and tech sectors. More at the link.

Nvidia reignites the market

US major stock indices rose thanks to positive news from Nvidia about resuming chip sales to China, raising hopes for a possible easing of the trade war. Investors are awaiting key inflation data, which could influence monetary policy. The high-tech sector remains the main growth driver. More at the link.

Inflation and tariffs keep the market on edge

Markets remain watchful of how tariffs might impact inflation, which could negatively affect corporate profits and consumer demand. Trump continues to pressure Russia with tariff threats, adding to economic uncertainty. The business community is voicing concern about potential disruptions to global trade. More at the link.

Stock indices continue steady growth

On Monday alone, US benchmark stock indices posted modest gains despite reports of new tariffs, with a focus on upcoming corporate earnings and inflation data.

The oil market remains under pressure due to weakening demand and rising tariff concerns. At the same time, investors are seeking safety in reliable assets. More at the link.

The Nasdaq hits record high as Bitcoin surges

The Nasdaq reached an all-time high amid Bitcoin's rise to $120,000, though the outlook remains cautious due to trade-related risks stemming from Trump's tariffs. Cryptocurrencies posted strong gains, signaling a positive outlook for digital assets. So far, markets are reacting cautiously to potential regulatory intervention. More at the link.

Reminder: InstaForex offers the best conditions for trading stocks, indices, and derivatives, helping you earn effectively on market fluctuations.