Everyone gets what they want. Supporters of the U.S. dollar are pleased that American inflation accelerated in June, leaving the Federal Reserve with no grounds to cut the federal funds rate in July. Opponents of the greenback, on the other hand, note that the CPI has failed to exceed forecasts for the fifth consecutive month, or at best, has merely met them. This is grounds for Donald Trump to resume his criticism of the Fed. Undermining trust in the U.S. currency is a strong argument in favor of buying EUR/USD.

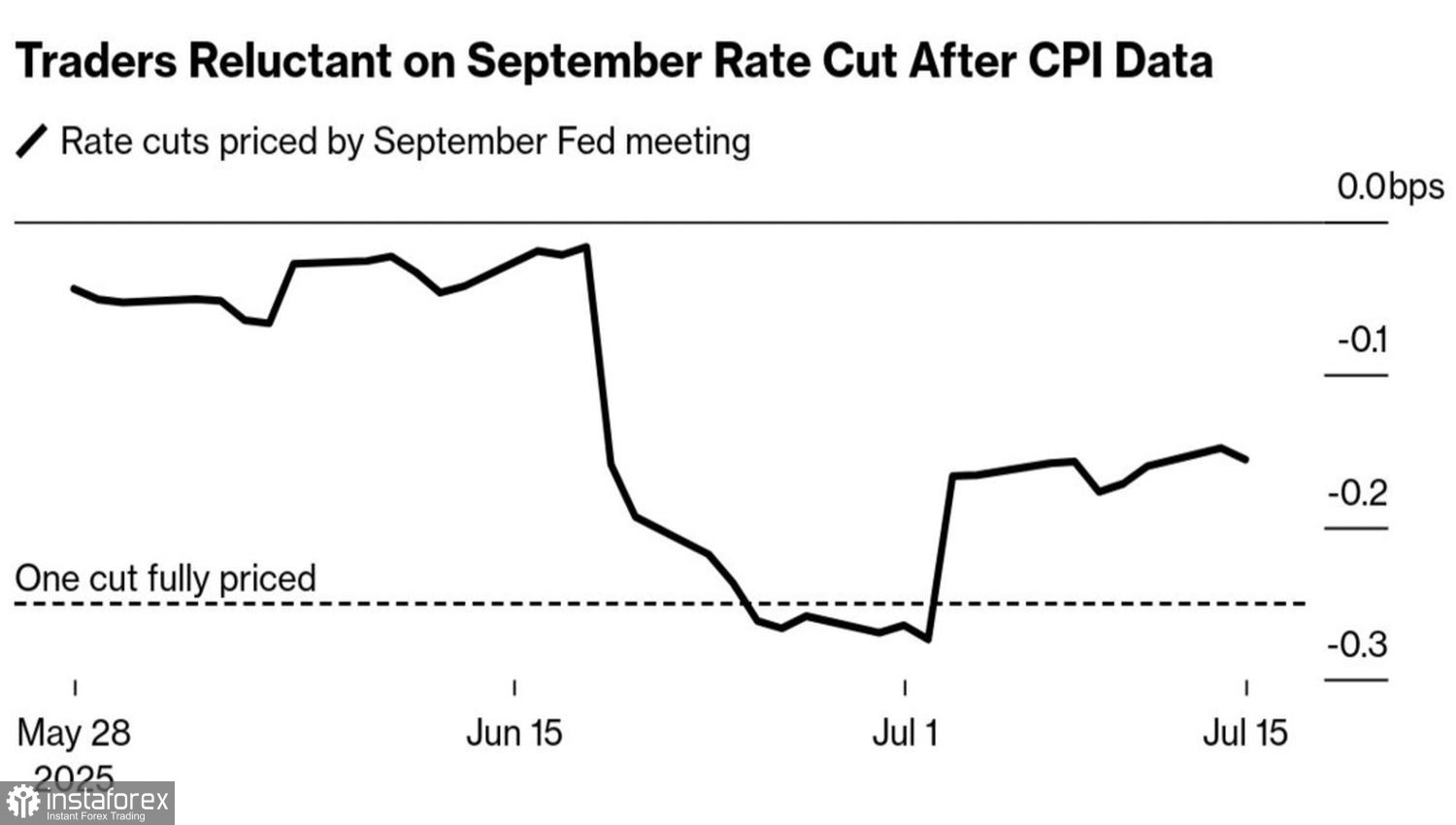

In June, U.S. consumer prices rose from 2.4% to 2.7%, and core inflation from 2.8% to 2.9%. The headline figure matched Bloomberg analysts' forecast, while the core reading fell short. A monthly CPI increase of 0.2–0.3% aligns with the Fed's inflation target. That's good news for the stock market and bad news for the U.S. dollar. However, it's doubtful that the Fed would decide to cut rates at the next FOMC meeting based on this data, especially given the continued strength of the labor market. Unsurprisingly, the market's expectations for monetary easing in September have barely changed.

Expected Scale of Fed Monetary Easing in September

However, the recent slowdown in energy and food prices makes another wave of criticism from Donald Trump toward the Fed all but certain. The U.S. president typically pays close attention to these components of the CPI.

A fresh attack on Jerome Powell equates to another blow to the dollar. The independence of the Fed is at stake, and investors react nervously to the President insulting the central bank chief. Especially considering that Powell is already under investigation for allegedly misleading Congress regarding the renovation of the Fed's headquarters. White House officials are also joining in the witch hunt. Treasury Secretary Scott Bessent stated that Powell should leave the FOMC in May and not stay on as governor until January 2028, citing this as standard practice.

The Treasury chief noted that there are numerous qualified candidates for the role of Fed chair, both within and outside the central bank. Political pressure is making Powell's position increasingly untenable. However, Powell intends to make history, not get caught up in it, unlike Arthur Burns, who once gave in to President Richard Nixon's calls for rate cuts.

History may repeat itself—but not in 2025. The Fed is almost certain to hold rates steady in July and possibly in September as well, despite Bessent calling for a 50-basis-point cut. The central bank's inaction would support the U.S. dollar.

Technically, the daily EUR/USD chart shows a pullback within the broader uptrend. As long as the pair remains below its fair value at 1.1715, the bias remains bearish. It makes sense to sell the euro toward the $1.1615–1.1630 and $1.1530 levels. Conversely, a return above $1.1715 would signal a consideration of long positions.