Analysis of Macroeconomic Reports:

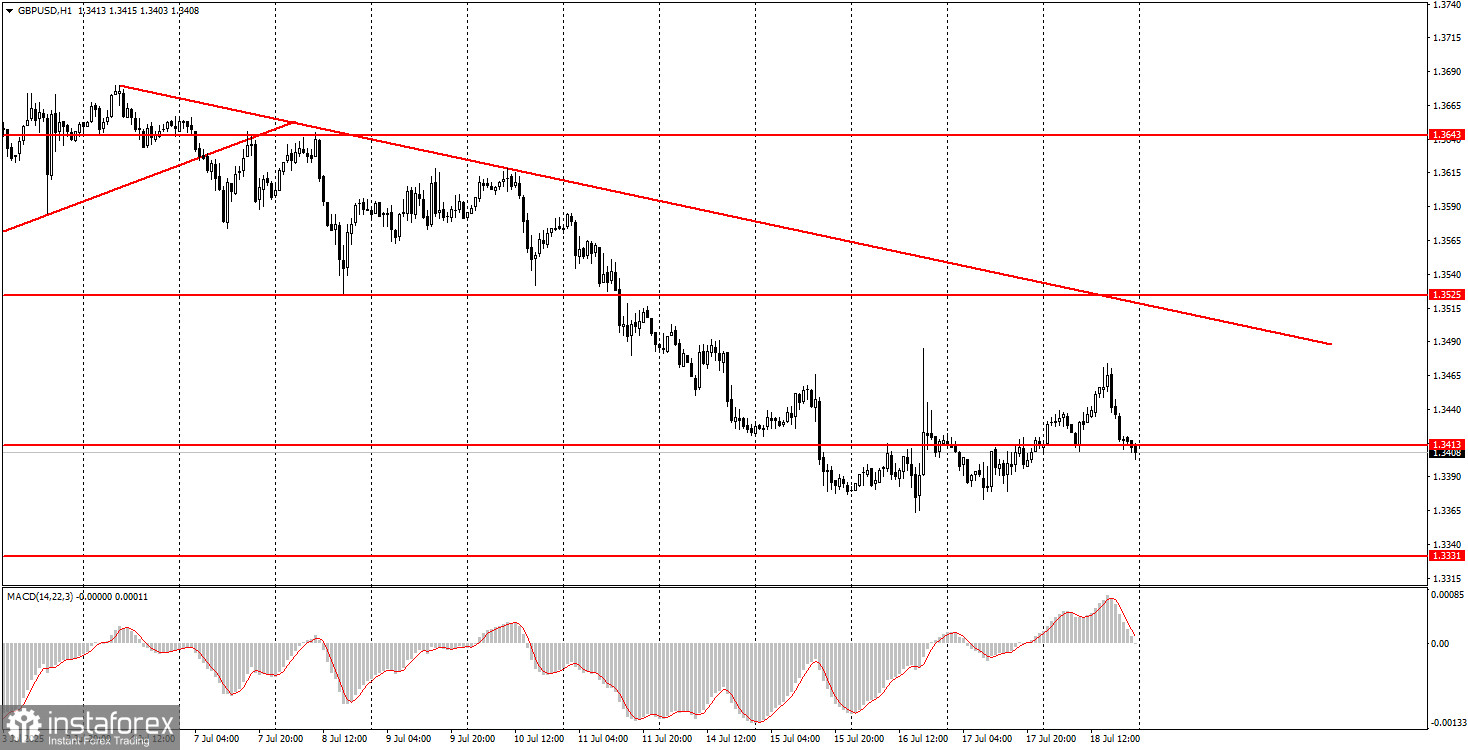

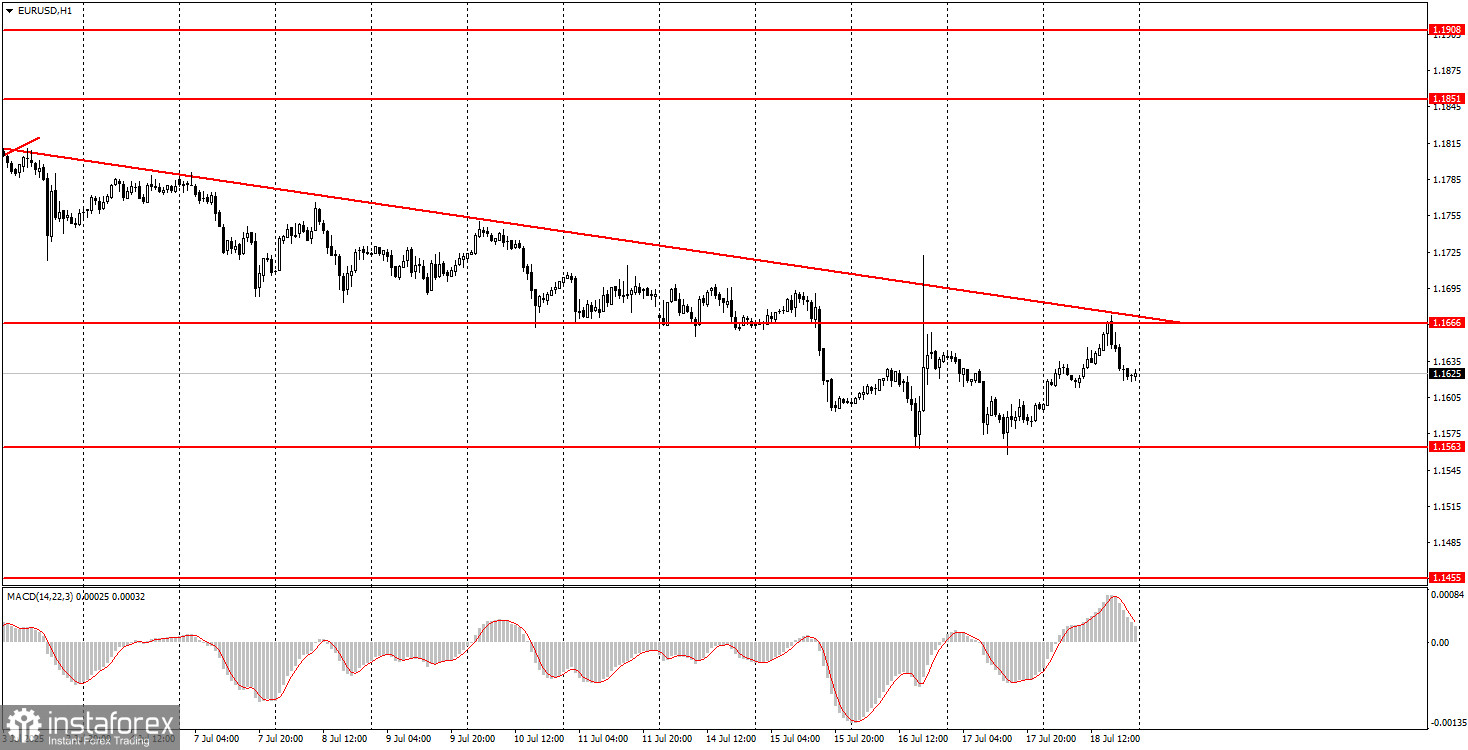

There are no macroeconomic reports scheduled for Monday. Therefore, weak market movements can be expected. Of course, Donald Trump could unexpectedly return to the spotlight at any moment with a new decision on tariffs or yet another "firing of Jerome Powell." However, such events are impossible to predict in advance. Both currency pairs continue to exhibit downward trends.

Analysis of Fundamental Events:

There are also no noteworthy events among fundamentals, as no important speeches by representatives of the Federal Reserve, European Central Bank, or Bank of England are scheduled for Monday. That said, we've repeatedly noted that their comments currently carry little weight. All three central banks are following a clear monetary policy trajectory, and their positions on the matter are fully understood.

The trade war remains the market's top concern, with no signs of resolution in sight. The situation remains rather difficult, as Trump has only managed to conclude three trade deals over more than four months of negotiations, one of which is quite questionable. Three deals out of a possible seventy-five. Over the past two weeks, the U.S. president has decided to raise tariffs again on countries reluctant to negotiate with Washington, while also increasing import duties on copper, pharmaceuticals, and semiconductors. Despite these unfavorable developments, the dollar has grown rather strongly over the past three weeks—something that contradicts the fundamental backdrop. We are preparing for a new leg of the upward trend on the higher timeframes for both currency pairs.

Conclusions:

During the first trading day of the week, both currency pairs may exhibit very sluggish price action, as no significant events are scheduled. Technical corrections are ongoing but may end at any moment. Descending trendlines have formed on both pairs, and a breakout above them would indicate a resumption of the six-month uptrend. The euro has twice bounced off the 1.1563 level, which could be an early warning sign of a possible end to the bearish trend.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.